Introduction

I have written a few articles on various REITs in recent weeks, such as Chartwell Retirement Residences (OTC:CWSRF) and Boardwalk REIT (OTCPK:BOWFF). I have always had an interest in the sector for the simple the joys of being a landlord and the steady income stream without having many of the drawbacks, such as dealing with careless tenants or repairs and maintenance. My interest has been further awakened in the depths of the current crisis with the flooding of liquidity into financial markets, in which I believe REITs will be a large beneficiary. The consequence of this quantitative easing is that yields on all government securities have fallen drastically, with the 10-year U.S. government bond yield falling from 1.8% in January 2020 to 0.58% as of July 2020. Investing at meagre yields like this is not enough to even offset inflation expectations going forward, which could even be modest at best. Although not all REITs are created equal, many have the ability to provide a stable distribution as a result of stable cash flows through implementation of long-term leases.

The Vanguard Real Estate ETF (NYSEARCA:VNQ) provides a means to hedge inflation with a 4% yield at present and provides a strongly diversified basket of REITs to protect your wealth versus pinning your hopes on one or a few. I liken it to sticking a bowl of popcorn kernels in the microwave and betting that kernels will pop versus making bets on which particular kernels will pop.

Investment Thesis

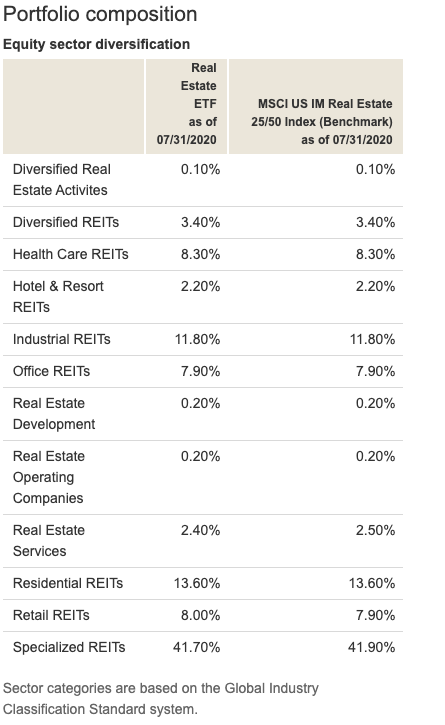

Almost the majority of holdings are specialized REITs, which are REITs that own properties that don’t fit within the other REIT sectors. Examples of properties owned by specialty REITs include movie theatres, casinos, farmland and outdoor advertising sites.

(Source: Vanguard)

As you can see below, the largest holdings are actually data centres, such as