In this world nothing can be said to be certain, except death and taxes. - Benjamin Franklin

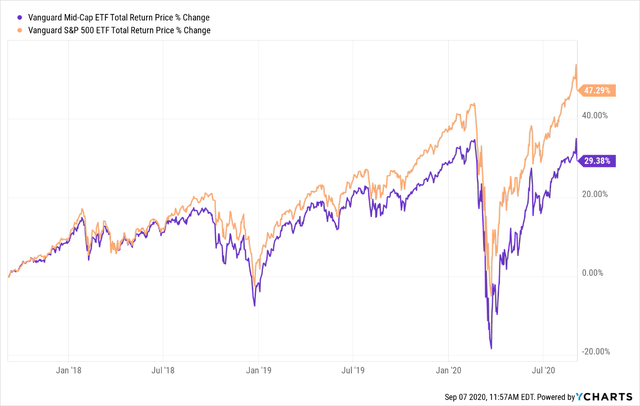

The Vanguard Mid Cap ETF (NYSEARCA:VO), a fund that is focused on mid-cap US stocks, has not been loved in recent years. It has had an impressive Covid-recovery, finally turning positive for the year, but remains below all-time highs made in February. Of course, this is not new for mid-cap investors. In the last three years, despite overwhelmingly positive equity markets and a risk-on sentiment, mid-caps have outperformed large caps, as measured by the Vanguard S&P 500 ETF (VOO). And by a significant amount, with a gain of 47.29% for the latter in the last 3 years to a gain of only 29.38% for the former.

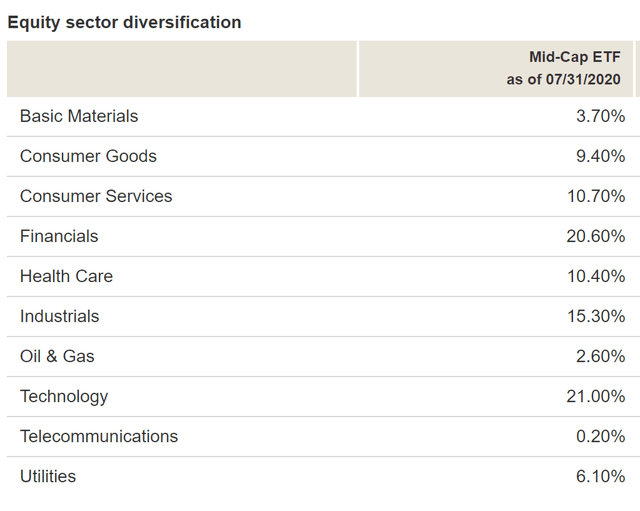

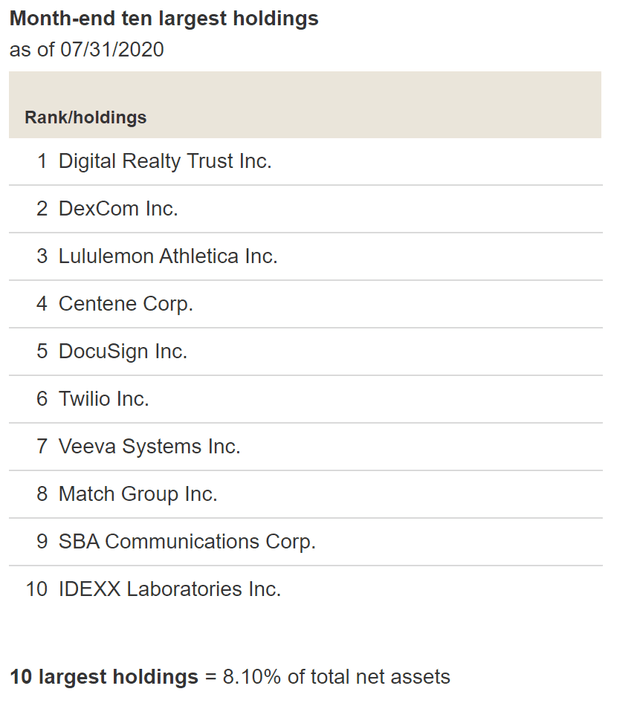

Looking at the holdings of the ETF, the top 10 holdings account for only 8.1% of the portfolio, as much of the company-specific risk has been diversified away. Sector-wise, the holdings are balanced, with the top 3 sectors being Technology (21%) Financials (20.6%), and Industrials (15.3%). That gives a nice balance to the ETF in growth industries and value industries, which lets you hedge out the bet on which strategy will win out over the long term after more than a decade of growth stocks flourishing. Eventually, value investing can return, and you will have exposure to those types of companies with this holding.

Source: Vanguard

Thoughtful Selections

While the Covid crisis has many challenges for the mid-cap space, the portfolio has some excellent picks. For example, Lululemon Athletica Inc (LULU) is in a unique position, as their demand has likely increased with more consumers looking for comfort while working from home, a trend that the athleisurewear company has been excellent at capitalizing on. DexCom Inc. (DXCM) recently smashed earnings expectations in late July, with

Subscribers told of melt-up March 31. Now what?

Subscribers told of melt-up March 31. Now what?

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you'll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.