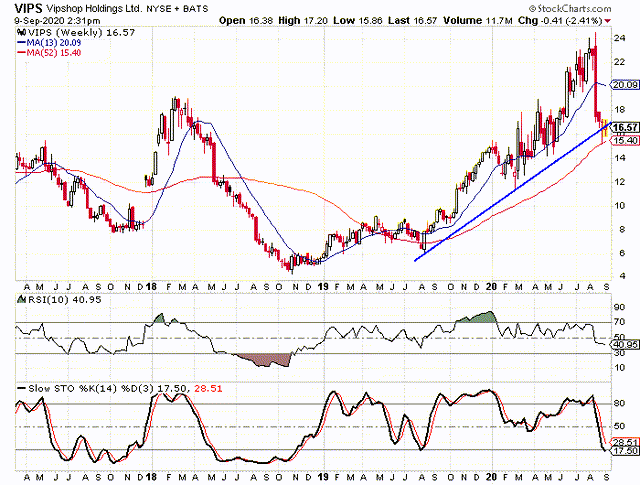

When Vipshop Holdings (NYSE:VIPS) reported earnings on August 19, it missed on both the EPS and revenue estimates. This caused a violent drop in the stock price and then it continued lower for another two weeks. The decline would ultimately come to an end when the stock found support at its 52-week moving average.

The sharp drop erased a great deal of the gains the stock experienced from late February through the earnings date. The stock doubled during this stretch and investor enthusiasm may have gotten to be too much. With investor expectations running high, the smallest misstep was bound to send the stock lower. I’m not talking about analysts and their EPS and revenue estimates, I am talking about what investors were expecting. When those expectations get too high, it becomes very difficult for companies to exceed expectations by a wide enough margin for the stock to move higher. I think that is what we saw with Vipshop Holdings. The fact that the company missed its estimates only made the selloff worse.

Sentiment Indicators are Shifting in Different Directions

I first wrote about Vipshop Holdings back in May 2019. At that point in time, there were 19 analysts covering the stock with only six “buy” ratings. There were nine “hold” ratings and four “sell” ratings. When the company reported earnings last month, there were 26 analysts covering the stock with 17 “buy” ratings and nine “hold” ratings. This gives you an idea of how much sentiment had shifted in just over a year.

I also wrote about Vipshop Holdings back in March and in that article, I talked about how the earnings were expected to jump sharply compared to the previous year. Despite the huge expectations in March, the company was able to beat by a wide margin. The report in May was

If you would like to learn more about protecting and growing your portfolio in all market environments, please consider joining The Hedged Alpha Strategy.

One new intermediate to long-term stock or ETF recommendation per week.

One or two option recommendations per month.

Bullish and bearish recommendations to help you weather different market conditions.

A weekly update with my views on the market, events to keep an eye on, and updates on active recommendations.