Quick Take

American Well Corporation (NYSE:AMWL) has filed to raise $525 million in an IPO of its Class A common stock, according to an S-1 registration statement.

Amwell provides a telehealth services delivery platform for healthcare service providers in the United States.

AMWL is growing rapidly and will have industry tailwinds in its favor in the coming years, so the IPO is worth a close look.

Company & Technology

Boston, Massachusetts-based Amwell was founded to develop the Amwell Platform, a telehealth system that enables a wide variety of healthcare services to be delivered remotely.

Management is headed by Chairman and Co-CEO Ido Schoenberg, MD and president and Co-CEO Roy Schoenberg, MD, MPH.

Ido was previously co-founder of iMDSoft and Roy was previously the founder of CareKey, an electronic health management software vendor.

Below is a brief overview video of the firm's approach:

Source: Amwell

The firm has clients among health systems, health insurance plans, employers, and partners & retailers.

The company’s primary offerings include:

Telehealth

Telestroke

Telepsychiatry

On-demand consultations

Scheduled consultations

Pre-packaged care modules & programs

EHR Integration

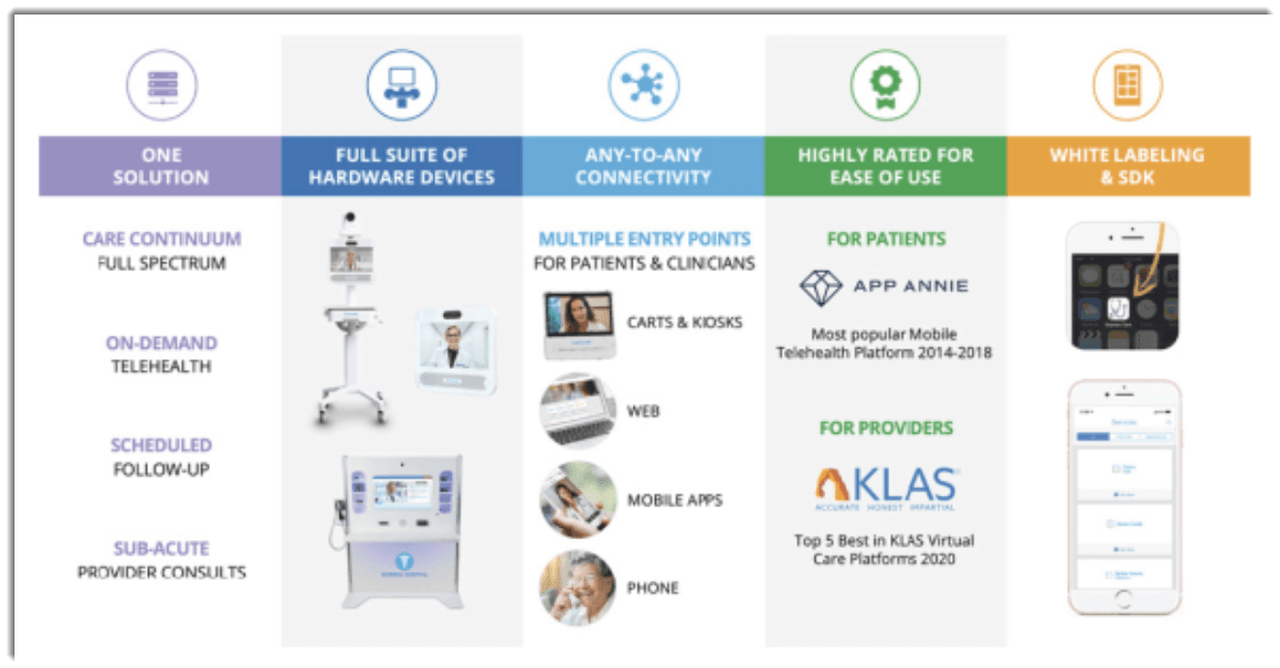

Below is a chart visualizing the firm's platform capabilities:

Amwell has received at least $801 million from investors including Allianz Digital Corporate Ventures and Teva Pharmaceutical Industries (TEVA).

Customer/User Acquisition

The firm works with large entities to embed its telehealth capabilities within their workflows and pursues new business via a direct sales force.

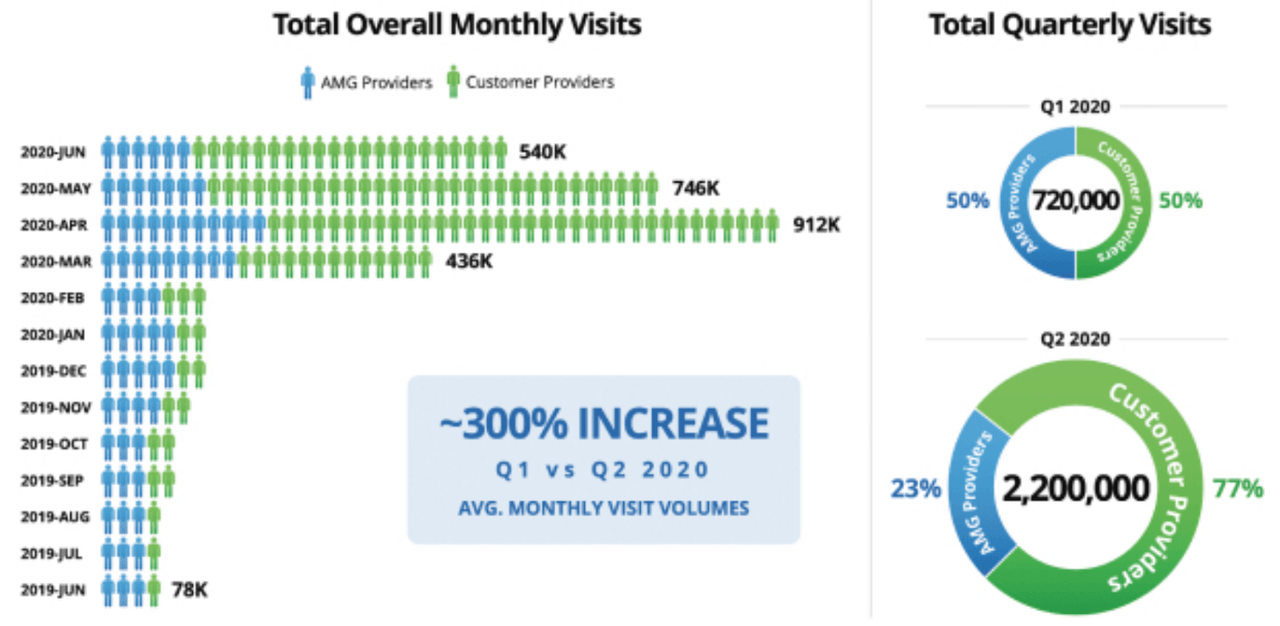

The onset of the Covid-19 pandemic has been extremely positive for demand for the firm's system, with a 300% increase in total monthly telehealth visits in Q2 2020 versus Q1, as shown in the graphic below:

Sales and Marketing expenses as a percentage of total revenue have been trending lower as revenues have increased, as the figures below indicate:

Sales and Marketing | Expenses vs. Revenue |

Period | Percentage |

Six Mos. Ended June 30, 2020 | 21.4% |

2019 | 32.0% |

2018 | 27.8% |

Source: Company registration statement

The Sales and Marketing efficiency rate, defined as how many dollars of additional new revenue are generated by each dollar of Sales and Marketing spend, rose sharply to 2.0x in the most recent reporting period, as shown in the table below:

Sales and Marketing | Efficiency Rate |

Period | Multiple |

Six Mos. Ended June 30, 2020 | 2.0 |

2019 | 0.7 |

Source: Company registration statement

Market & Competition

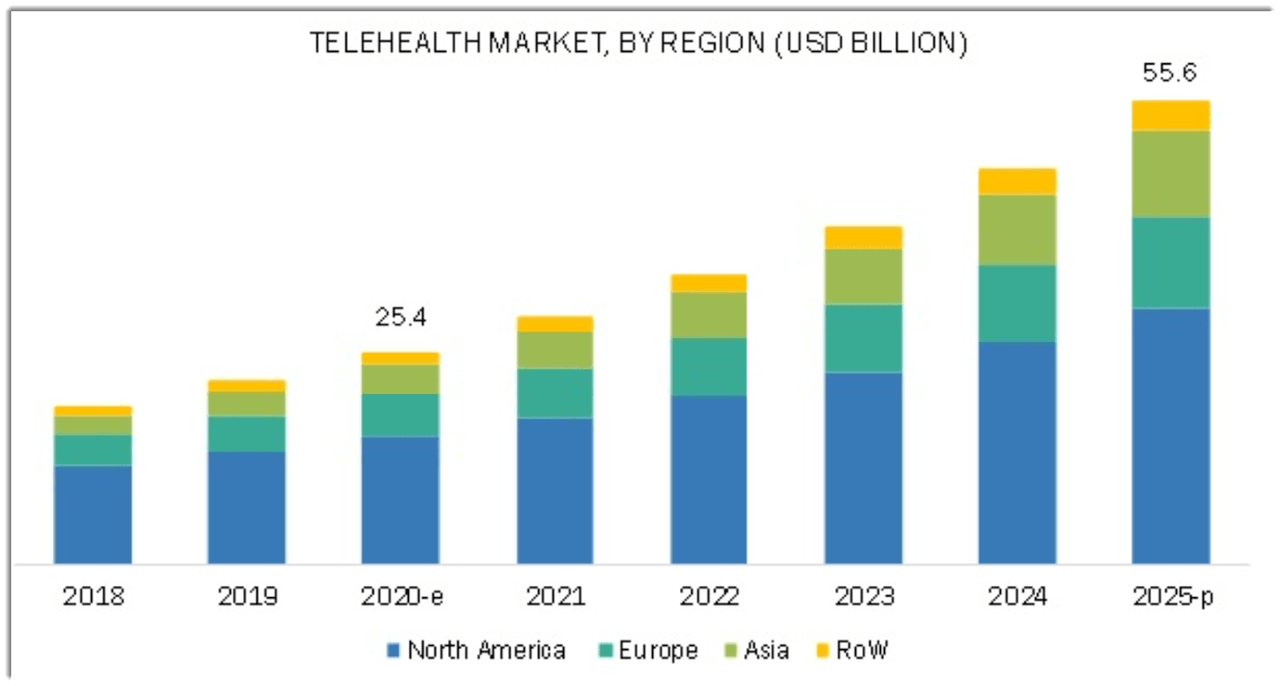

According to a 2020 market research report by MarketsAndMarkets, the global market for telehealth software and services is expected to reach $55.6 billion by 2025, up from a forecast $25.4 billion in 2020.

This represents a strong CAGR of 16.9% from 2020 to 2025.

The main drivers for this expected growth are a sharp increase in monitoring of chronically ill and elderly patients and improved telehealth monitoring devices and connectivity.

Also, providers continue to offer an increased number of specialty services via remote means as they seek to improve care quality while increasing productivity and reducing costs.Below is a chart showing the historical and projected growth rates in telehealth usage by global region:

Major competitive or other industry participants include:

Doctor On Demand

Teladoc Health (TDOC)

MDLive

Philips

Medtronic (MDT)

GE Healthcare (GE)

Cerner (CERN)

Siemens Healthineers (OTCPK:SIEGY)

GlobalMed

Chiron Health

Financial Performance

Amwell’s recent financial results can be summarized as follows:

Growing topline revenue, at an accelerating rate

Increasing gross profit, but decreased gross margin

High and growing operating losses

Sharply increased cash used in operations

Below are relevant financial results derived from the firm’s registration statement:

Total Revenue | ||

Period | Total Revenue | % Variance vs. Prior |

Six Mos. Ended June 30, 2020 | $ 122,282,000 | 77.0% |

2019 | $ 148,857,000 | 30.6% |

2018 | $ 113,955,000 | |

Gross Profit (Loss) | ||

Period | Gross Profit (Loss) | % Variance vs. Prior |

Six Mos. Ended June 30, 2020 | $ 45,429,000 | 37.3% |

2019 | $ 68,881,000 | 24.5% |

2018 | $ 55,343,000 | |

Gross Margin | ||

Period | Gross Margin | |

Six Mos. Ended June 30, 2020 | 37.15% | |

2019 | 46.27% | |

2018 | 48.57% | |

Operating Profit (Loss) | ||

Period | Operating Profit (Loss) | Operating Margin |

Six Mos. Ended June 30, 2020 | $ (113,583,000) | -92.9% |

2019 | $ (94,704,000) | -63.6% |

2018 | $ (55,106,000) | -48.4% |

Net Income (Loss) | ||

Period | Net Income (Loss) | |

Six Mos. Ended June 30, 2020 | $ (113,444,000) | |

2019 | $ (88,366,000) | |

2018 | $ (52,312,000) | |

Cash Flow From Operations | ||

Period | Cash Flow From Operations | |

Six Mos. Ended June 30, 2020 | $ (57,822,000) | |

2019 | $ (81,892,000) | |

2018 | $ (74,006,000) | |

Source: Company registration statement

As of June 30, 2020, Amwell had $262.7 million in cash and investments and $114.7 million in total liabilities.

Free cash flow during the twelve months ended June 30, 2020, was negative ($101.8 million)

IPO Details

Amwell intends to raise $525 million in gross proceeds from an IPO of its Class A common stock, selling 35 million shares at a midpoint price of $15.00 per share.

Class A common stockholders will include public investors and existing company investors.

Class B shareholders will be the two co-founders and will always hold 51% of the voting power as long as there are outstanding Class B shares.

The Class C shareholder will be Google, which will acquire the shares in a concurrent private placement of up to $100 million.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $3.8 billion, excluding the effects of underwriter over-allotment options.

Excluding effects of underwriter options and private placement shares or restricted stock, if any, the float to outstanding shares ratio will be approximately 15.9%.

Management says it will use the net proceeds from the IPO as follows:

increasing engineering and development to expand the functionality and value of our core technology platform;

reducing operational and support costs through increased investment in automation, self-help and artificial intelligence;expanding our sales force and account management team;

developing new verticals, including investment in market-specific functionality along with sales and operational support; and

potential acquisitions (both U.S. and international) to acquire new products, services, clients and member lives, although we have no commitments with respect to any such acquisitions at this time.

Management’s presentation of the company roadshow is available here.

Listed bookrunners of the IPO are Morgan Stanley, Goldman Sachs, Piper Sandler, UBS Investment Bank, Credit Suisse, Cowen and Berenberg.

Commentary

Amwell is seeking public investment to fund its growth plans as the firm sees sharply increased usage of its telehealth platform during the Covid-19 pandemic.

ANWL’s financials show strong revenue growth but also even higher operating loss growth and use of cash in operations.

Sales and Marketing expenses as a percentage of total revenue have been uneven but trended downward more recently; its Sales and Marketing efficiency rate has increased sharply as a function of the recent revenue growth.

The market opportunity for telehealth services has undergone a shift as a result of the Covid-19 pandemic forcing healthcare service providers to increase their usage.

Although it is hard to predict the future given current uncertainties, I suspect that a significant part of the recent growth trajectory will remain even after the Covid-19 pandemic recedes, as the situation has proved to be a forcing event for normally slow-to-adopt healthcare institutions to use all means to safely provide patient services.

As to valuation, compared to competitor Teladoc Health (TDOC), the AMWL IPO is reasonably priced, especially given the firm’s higher revenue growth trajectory, so the IPO is worth a close look.

Expected IPO Pricing Date: September 16, 2020

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis. Get started with a free trial!