Introduction

I do like investing in exchange operators as the base revenue and cash flows tend to be steady while operators benefit from increased volatility levels where it doesn’t matter if the markets are going up or down. In a previous article on Euronext (OTCPK:EUXTF), I noticed I missed out on the exchange operator breaking through the 100 EUR barrier, and as I obviously like the business model, I started to have a look at how other exchange operators are performing. Cboe Global Markets (BATS:CBOE) is one of the larger operators of exchanges in the USA with a specific focus on equities and options.

Both the net income and free cash flow exceeded expectations, thanks to the volatility

When CBOE announced its Q2 results, the market didn’t seem to care too much as the excellent performance was already widely expected. After reaching a low of $72 during the initial COVID-19 panic, the share price was trading at over $106/share again just two months later. Now, after seeing the confirmation of the good second quarter, CBOE’s share price has fallen over 15% again to less than $90/share.

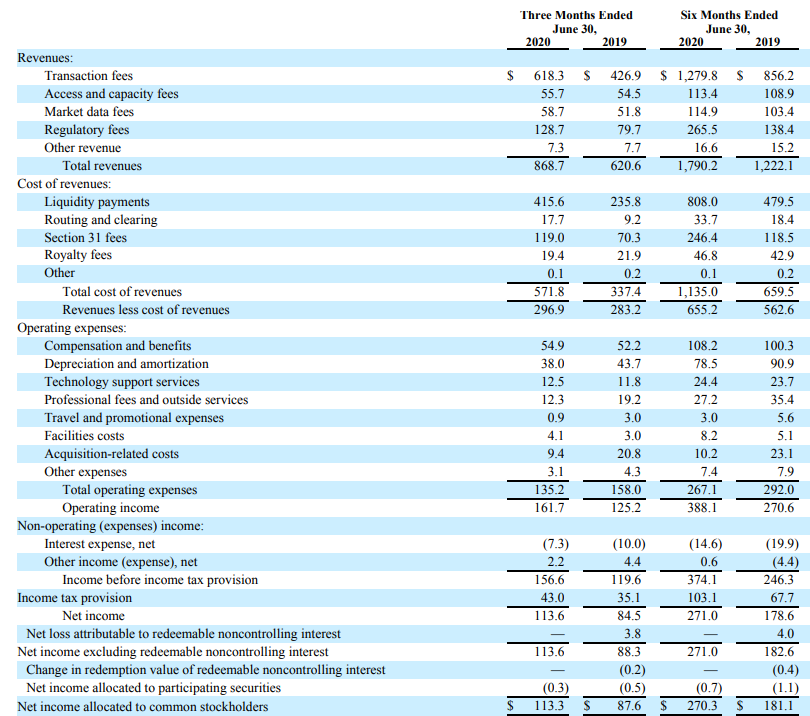

In the second quarter of the year, CBOE reported a total revenue of $869M thanks to an improved performance across the board. However, the expenses also increased and the company reported a gross income (revenue minus cost of revenues) of $297M, just 5% higher than the $283M generated in the second quarter of 2019.

The other operating expenses did decrease, predominantly thanks to lower fees for outside services and a lower amount of acquisition-related expenses, and this resulted in a substantial increase of the operating income, which cruised more than 25% higher to almost $162M.

Source: SEC filings

The bottom line shows a net income of almost $114M in the second quarter, about 30% higher than the

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

NEW at ESCI: A dedicated EUROPEAN REIT PORTFOLIO!