![]()

Science Applications International (NASDAQ:SAIC) provides engineering, technical, and enterprise IT solutions to the U.S. government. The company has over 25,000 employees, about half of which have security clearances (slide 5). That's because almost 50% of revenue comes from the Department of Defense ("DoD"), and several recent large-scale contract wins are exhibits #1 and #2 (see below). The company is significantly undervalued in comparison with the S&P 500, and could be a prime beneficiary of a rotation out of high-flying tech stocks into more boring undervalued companies.

Earnings

SAIC's fiscal year is one full year ahead of the calendar year. As a result, SAIC released its Q2FY21 earnings report on September 2nd:

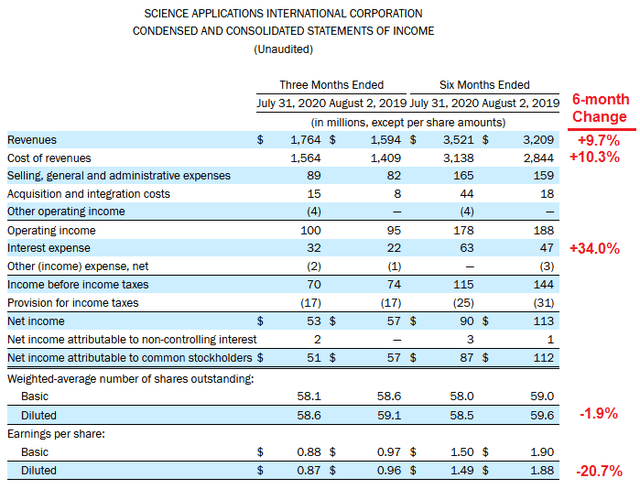

Source: Q2 EPS report

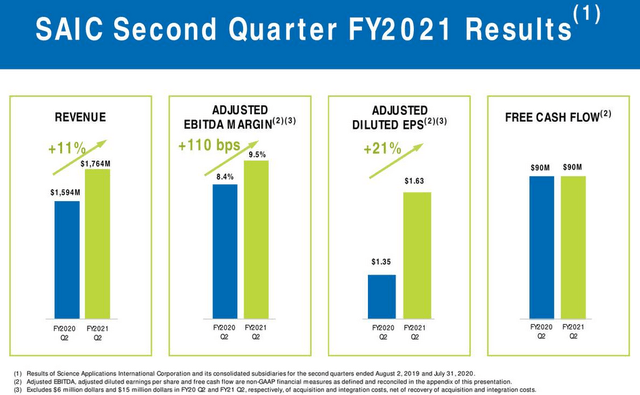

Source: Q2 EPS report

In spite of top-line revenue growth of nearly 10% over the first six months of the year versus the year earlier period, cost-of-revenues increased at a faster pace and combined with higher SG&A, expenses related to the Unisys (UIS) Federal acquisition, and higher interest expense (+34%) EPS fell 20.7% as compared to the first six months of 2019.

During the quarter, SAIC voluntarily paid down $125 million of debt. Subsequent to the end of the quarter, SAIC has made another $100 million in voluntary debt repayment and continues to de-lever, which should lead to a meaningful lowering of the $63 million of interest expense during Q2. Long-term debt of $2.7 billion was up ~$800 million over the prior year quarter. Net debt of ~$2.5 on annualized 6-month trailing EBITDA (~520 million) gives a net debt to EBITDA ratio of an estimated 4.8x.

Source: Q2 Presentation

Source: Q2 Presentation

As shown in the graphic above, SAIC delivered $90 million in FCF, or an estimated $1.54/share. Considering the quarterly dividend is only $0.37/share, there appears to be a big disconnect in the company's FCF generation and the amount it chooses to allocate to shareholders. But the disconnect is