The Global X Super Dividend REIT ETF (NASDAQ:SRET) is composed of about thirty of the highest yielding REITs, mostly in the US. The ETF makes distributions on a monthly basis, providing a regular source of income shareholders.

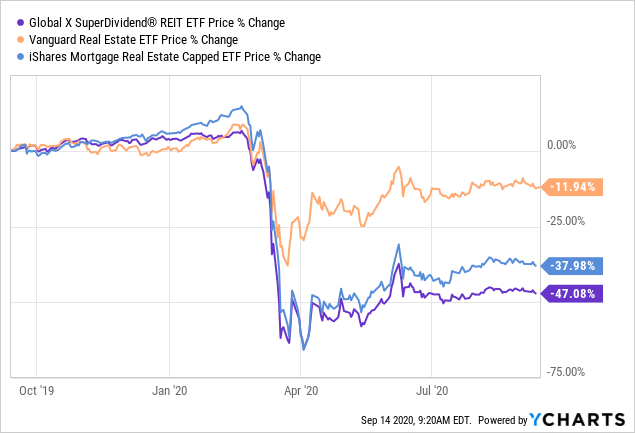

Figure 1: Share price and total return evolution

While the Vanguard Real Estate ETF (VNQ) which I covered last week has recovered to a large extent from the end-of-February market crash and is now only at 12% below its one-year high, this is far from being the case with SRET.

However, with past underperformance not always being an indicator for future underperformance and considering the fact that the asset allocation for the underlying fund is dynamic, I take a fresh look at SRET.

First, I consider the very reason why people invest in an ETF, that is for diversification purposes and also what this means in terms of concentration risks.

Diversification

SRET's strategy is to screen REITs at a global level and make a shortlist of the 60 paying the highest dividend yield. Then, out of these, it selects 30 of the least-volatile ones.

This means that the underlying fund regularly updates asset allocation.

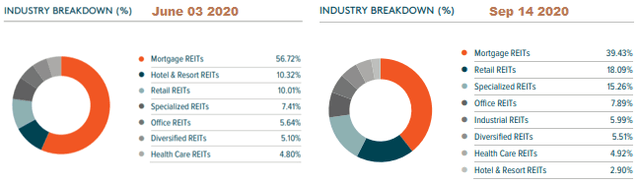

Now exploring the September 14 industry breakdown, the concentration of mortgage REITs which was at a staggering 57% in early June has now been significantly reduced to just under 40%. Also, Hotel and Resorts, which made up 10.32% of the portfolio previously now make up for just under 3%.

Figure 2: SRET by industry breakdown for June 03 and September 14.

Source: Industry breakdown for June 03 and September 14.

Also, the percentage allocation to specialized properties is now 15% from 7% only three months back. Some of the specialized REITs include big names like Iron Mountain (IRM) and Gaming and Leisure Properties (GLPI) which through