This article was co-produced with James Marino Sr. of Portfolio Insight.

We monitor dividend increases for stocks using [Dividend Radar], a weekly automatically generated spreadsheet listing stocks with dividend streaks of five years or more. The Dividend Radar spreadsheet separates stocks into categories based on the length of the streak: Champions (25+ years), Contenders (10- 24 years), and Challengers (5-9 years).

Recently, two companies in Dividend Radar announced dividend increases and one company announced a dividend cut.

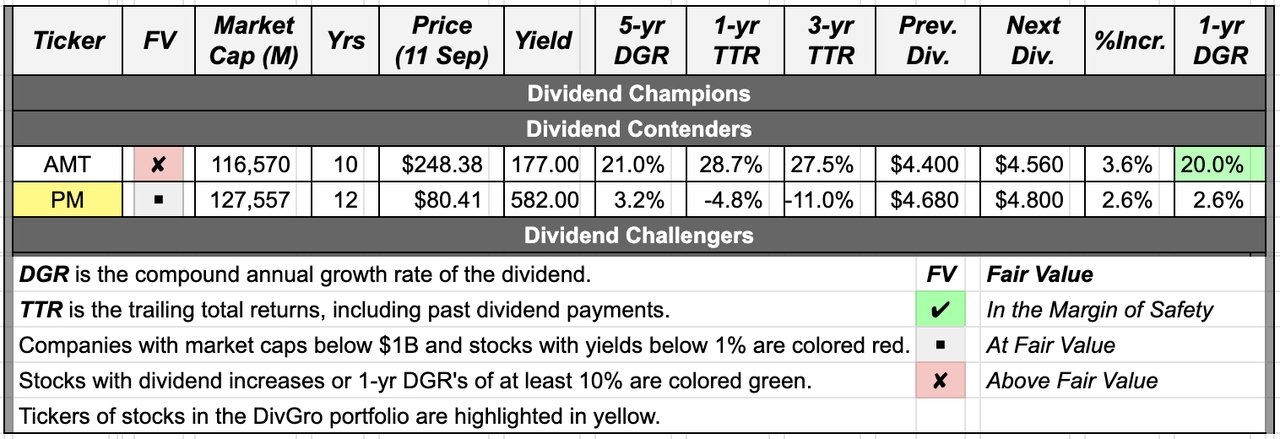

The following table presents a summary of the dividend increases.

The table is sorted into sections for Champions, Contenders, and Challengers, and then by the percentage increase, %Incr. Dividends are annualized and in US$, unless otherwise indicated. Yield is the new dividend yield for the market close Price on the date listed. Yrs are years of consecutive dividend increases, while 5-yr DGR is the compound annual growth rate of the dividend over a 5-year period.

Some companies increase their dividends more than once a year, so the last column (1-yr DGR) indicates the percentage increase from the year-ago dividend.

Summary of Dividend Increases: September 5-11, 2020 |

Previous Post: Dividend Changes: August 29-September 4, 2020 |

Source: Created by the authors from data in Dividend Radar. The following dividend increase data are sorted alphabetically by ticker.

Company descriptions are the author's summary of company descriptions sourced from Finviz.

American Tower Corporation (REIT) (AMT)

AMT is a real estate investment trust that owns, develops, and operates multi-tenant communications sites across the globe. Customers include wireless service providers, radio and television broadcast companies, wireless data and data providers, government agencies, and municipalities. AMT was founded in 1995 and is headquartered in Boston, Massachusetts.

- On Sep. 10, AMT declared a quarterly dividend of $1.14 per share.

- This is an increase of 3.64% from the prior