German carrier Lufthansa (OTCQX:DLAKF) is preparing a major cut to its fleet, one that will bring the fleet more in line with industry trends. The airline is expecting flights by the end of the year to be down by 75%, while it earlier anticipated flights to reach 50% of the normal schedule. In this analysis, we will look at the Lufthansa fleet to figure out which jet maker, Boeing (NYSE:BA) or Airbus (OTCPK:EADSF), will be facing the steeper cuts.

Source: Luchtvaartnieuws

Deeper cuts

As lockdowns came to an end in many countries, airlines started rebuilding their networks gradually. Among airlines there's the realization that recovery is not a matter of months but years, where the first steps are to partially recover the network. That network recovery initially looked very promising, but even in that scenario it would take a long time. Various readers threw TSA screening numbers at me and extrapolated that arriving at a conclusion that passenger numbers would be back to normal somewhere by the end of the year. However, as I noted, extrapolating existing data might not provide an appreciable degree of accuracy on future recoveries even when considering passenger numbers a measure of recovery.

That's because lockdowns choked passenger flows, and once those lockdowns were eased the networks were partially rebuild, but easing lockdowns also led to an increase in new COVID-19 cases. While it's not a huge second wave, it has stalled the network recovery of airlines and that has sparked deeper cuts… also for Lufthansa.

Quads set to go

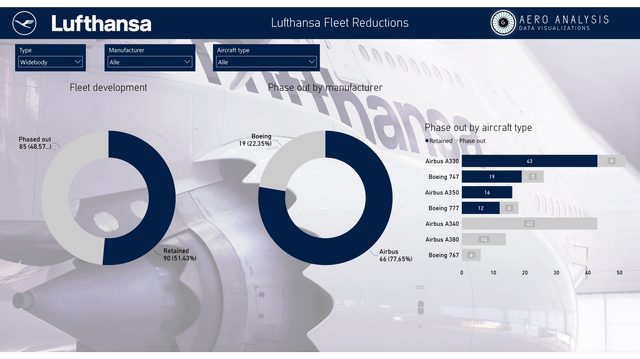

Source: Envisioned fleet reductions Lufthansa (Source: The Aerospace Forum)

Source: Envisioned fleet reductions Lufthansa (Source: The Aerospace Forum)

During the virtual annual general meeting Lufthansa CEO Carsten Spohr said that the airline would cut the fleet by 100 aircraft confirming that the airline would be a smaller airline after the crisis. The company, however, now expects to

*Join The Aerospace Forum today and get a 15% discount* The Aerospace Forum is the most subscribed-to service focusing on investments in the aerospace sphere, but we also share our holdings and trades outside of the aerospace industry. As a member, you will receive high-grade analysis to gain better understanding of the industry and make more rewarding investment decisions.

The Aerospace Forum is the most subscribed-to service focusing on investments in the aerospace sphere, but we also share our holdings and trades outside of the aerospace industry. As a member, you will receive high-grade analysis to gain better understanding of the industry and make more rewarding investment decisions.