-

Sign up for Let's Talk ETFs on your favorite podcast platform:

-

Listen and subscribe to the Marketplace Roundtable on these podcast platforms:

As Head of Macro Research at Pervalle Global, a discretionary hedge fund specializing in global macro-driven trades across all major asset classes, Eric Basmajian spends much of his day poring over macroeconomic data from across the globe. The NY-based hedge fund then makes bets based largely on Eric's reading of the macro tea leaves.

In addition to his role at Pervalle, Eric runs his own Seeking Alpha Marketplace service, EPB Macro Research. Subscribers to EPB Macro Research gain access to EPB’s Model Tactical Asset Allocation and Long-Only Asset Allocation portfolios - two low-cost, all-ETF portfolios overseen directly by Eric. By combining an asset class mix that includes stocks, bonds, gold and commodities - tilting based on underlying macroeconomic conditions - Eric has created an all-weather portfolio which tamps down risk and volatility while attaining impressive longer-term appreciation of capital.

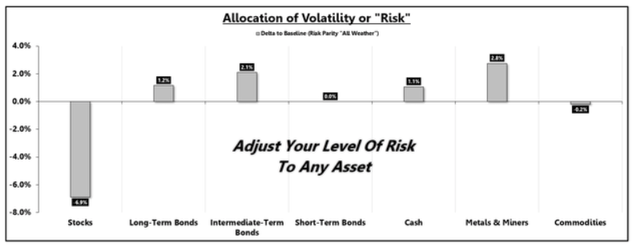

It is this portfolio construction process which we focus on during today's conversation. A student of both Ray Dalio's approach to risk-parity and modern portfolio theory more broadly, Eric's goal is to help investors achieve their long-term investing goals - but with levels of risk that allows them to sleep well at night and avoid panic selling at the worst possible time.

Believing no two investors are exactly alike in terms of their tolerance for risk, Eric's system allows investors to make adjustments and customize their exact level of risk - by either changing up the recommended asset class allocations or by substituting higher beta ETFs within a given asset class (i.e. swapping in NASDAQ:QQQ for NYSEARCA:SPY or NASDAQ:TLT for NASDAQ:IEF.

You will not want to miss Eric's perspectives and practical portfolio advice in the latest joint episode of Let's Talk ETFs and The Marketplace Roundtable.

Show Notes

- 4:00 - 2020 has been a crazy year for markets - and it's not even over

- 7:30 - What is Modern Portfolio Theory - and why does it work?

- 12:30 - Balancing risk through mean variance analysis

- 17:30 - Eric's approach to portfolio construction within EPB Macro Research

- 23:00 - Frequency of portfolio rebalancing

- 29:45 - Current valuations and future expected returns in asset class allocations and position sizing

- 33:30 - How overvalued are equities right now?

- 37:30 - Valuations continued: U.S. vs. Foreign equities

- 42:30 - Expected bond returns in a flat yield curve environment

- 56:00 - Disconnect between Wall Street and Main Street: How efficient are markets?

- 62:00 - Too much debt is bad for future growth

- 72:00 - Labor force vs. productivity growth

- 76:00 - Given the current interest rate environment, how does one get a real rate of return in bonds?