CHX's Short-Term Outlook Is Not Constrained

Since combining with Ecolab's (ECL) upstream servicing business in June, ChampionX Corporation's (CHX) focus has been on chemistry sales because of the resilience in energy production. The second most important driver has been its international operation extension. As a result, Australia and the Middle East have been its robust growth drivers in recent times, offsetting some of the slowdowns in North America. However, it will not shake off the adverse effects of the deterioration in the artificial lift business following the capex fall and production shut-in.

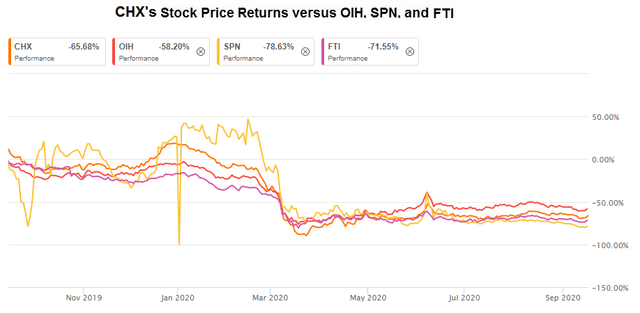

At the operational level, the additional synergies from the merger can partially mitigate the impact on margin following to the top-line decline. In the short to medium term, I think the company's top line and operating margin will remain steady. CHX's other key advantages include a robust balance sheet and positive free cash flows. I do not think the stock price can potentially produce higher returns in the short term. Investors looking for medium- to long-term growth might want to wait for dips in the stock price before investing.

Business Strategies Have Changed After The Merger

In June 2020, Apergy became ChampionX after combining with Ecolab's upstream energy business. Apart from the benefits of geographic diversification, the merger added a stable and global production chemical product line to the company's portfolio.

As the upstream energy faces persistent challenges from oversupply, ChampionX's production chemicals, critical for maintaining production from flowing wells, can become an important driver. Some of the areas where it claims to be an industry leader in production chemicals are corrosion and bacterial management and control, oil and water separation, water shut-off and control, wax and asphaltene management, and automated chemical control. Investors may note that production chemical is a consumable item, which typically experiences smaller declines in a downturn because the