The last time I wrote about Kinross Gold (NYSE:KGC), the company managed to avoid any serious coronavirus-related disruptions and looked attractively valued on a forward P/E basis. Kinross Gold has recently provided updated guidance and announced its plan to pay a quarterly dividend of $0.03 per share so it’s high time to take a look at the thesis.

Source: Kinross Gold presentation

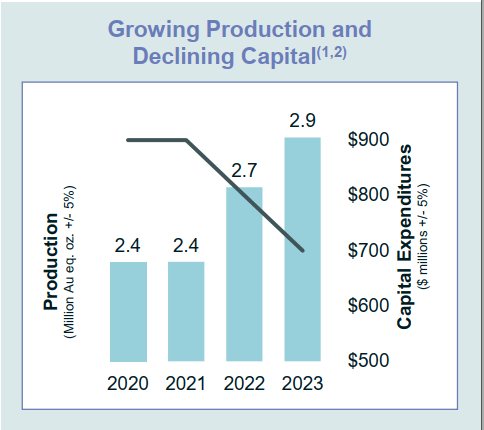

Kinross Gold expects that its production will grow from 2.4 million gold equivalent ounces (GEO) in 2020 to 2.9 million ounces. The sources of this growth are internal. Kinross Gold expects higher production at Kupol (Russia), Bald Mountain (USA), Paracatu (Brazil) and plans to benefit from mine extension at Chirano (Ghana) and enhancements to Fort Knox (USA) mine plan.

At the same time, Kinross Gold expects that its capex will decrease from $900 million in 2021 to $700 million in 2023. Rising production and falling capex spending at a time of higher gold prices set the stage for significant cash flow production.

Not surprisingly, Kinross Gold has finally decided to start paying a dividend of $0.03/share per quarter, or $0.12/share annually. At current share count, Kinross Gold will spend roughly $150 million annually on the dividend. The yield is not big (~1.3%) but miners are not known for big dividends. In addition, Kinross Gold has a bloated share count so any additional penny of the dividend should be distributed to 1.25 billion shares. In the first half of this year, Kinross Gold generated $732.4 million of operating cash flow so its dividend certainly has a margin of safety.

Interestingly, Kinross Gold stated that its priorities included repaying debt upon maturity, including $500 million in senior notes in September 2021. For now, the company decided to repay the remaining $500 million out of the $750 million that it drawn from its $1.5 billion revolving credit facility back