Back in May, I noted that Galiano Gold’s (NYSE:GAU) analyst estimates were too conservative and that the company was set for upside as its valuation looked cheap. Since then, the stock managed to get to a high of $2.12 and then declined closer to $1.40. In my opinion, Galiano Gold shares are looking attractive once again.

Galiano Gold had a great second quarter. Asanko Gold Mine, in which Galiano Gold has 45% ownership, produced 69,026 ounces of gold at all-in sustaining costs (AISC) of $1067 per ounce, generating operating cash flow of $48.8 million.

Due to the mine plan, the company’s production will be lower in the second half of the year while its costs will increase. Galiano Gold reiterated full-year production guidance of 225,000 – 245,000 ounces at AISC of $1000 - $1100 per ounce. In the first half of 2020, the company reported AISC of $929 per ounce so costs are set to increase materially in the remaining two quarters of the year.

Perhaps, traders and investors have sold the stock in recent months because they wanted to take their profits after a major run in anticipation of weaker quarters. However, Galiano Gold never made a mystery out of its mining plan so the upcoming decline in quarterly production and the increase in costs is not news for anyone who follows the company.

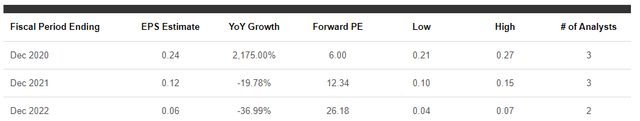

Source: Seeking Alpha Premium

Analysts became more optimistic about Galiano Gold compared to the estimates we’ve seen back in May. Currently, they expect that Galiano Gold will report earnings of $0.24 per share in 2020, a visible improvement compared to the May estimate of $0.14 per share.

That said, analysts still call for a major decline in earnings for 2021. This is surprising since the mine plan calls for an average production of 242,000 ounces