Actinium Pharmaceuticals (NYSE:NYSE:ATNM) is a clinical stage biotech developing treatments in the growing field of targeted radiotherapies. All except one of their candidates are in phase 2 or below, and their platform is focused on the highly-unmet need areas of both targeted conditioning (i.e. improving success rates in Bone Marrow Transplant (“BMT”)) as well as cancer therapeutics (i.e. acute myeloid leukemia (“AML”), colon cancer, prostate cancer, etc.).

Lead candidate Iomab-B is in the phase 3 SIERRA trial for BMT, with more data expected during 4Q20. While we think it’s too early to bet big on this name, early data readouts (most recently on April 16) have been very promising.

ATNM’s platform revolves around Antibody Warhead Enabling (“AWE”) technology, with the aim to create specific Antibody Radiation-Conjugates (“ARC”) for multiple indications.

Conditioning is the process of depleting stem cells in a patient’s bone marrow, and is essential in order to facilitate the engraftment of new cells. Conditioning is currently done with non-targeted chemotherapies and external radiation, but the downsides of a non-targeted approach are many: limited patient access, toxicities, and a high risk of failure/mortality. In the US (in 2017), about 174,000 patients were diagnosed with cancers treatable with BMT, but only 21,000 BMTs were performed. This means that over 150,000 patients that would benefit from a BMT did not receive one (September 2020 presentation, slide 6).

ATNM’s hope is that their targeted therapeutic approach will be less toxic and thus lead to better transplant, and ultimately survival, outcomes. So far, the data looks very promising, with 100% of patients in the treatment arm undergoing successful engraftment compared with only 18% in the control arm. This should leave to better survival outcomes.

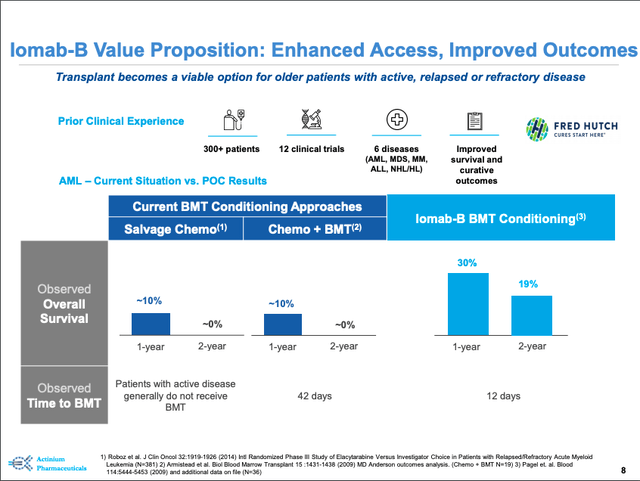

Iomab-B Value Proposition

Source: September 2020 presentation (slide 8)

As of June 30, ATNM had $53M in cash, and management expects this amount to be sufficient to make it through the SIERRA data readout during 4Q20 as well as other pre-clinical results in 2021. They did file a prospectus for a $500M shelf offering on August 7, and there have been several rounds of dilutive financing in the past year, so investors should be mindful of more dilution going forward. But we think the potential commercial reward relative to the market cap of under $150M gives this investment an attractive risk/reward profile.

Again, the SIERRA data is still too early to bet big on. But if the results hold up, the stock should see a nice increase, as this targeted ARC approach can be applied to many other therapeutic areas. We think this deserves a small bet, and that ATNM is a Buy.