Homebuilder Rankings

(Hoya Capital Real Estate, Co-Produced with Brad Thomas)

Homebuilders: A V-Shaped Vendetta

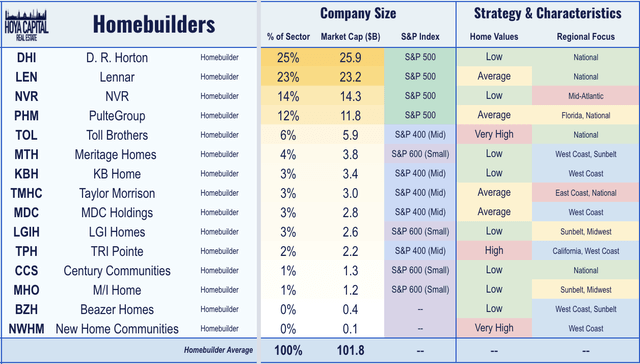

An antihero of the prior financial crisis, publicly-traded homebuilders have seemingly been on a vendetta over the last six months, asserting themselves as the unexpected leader of the early post-pandemic recovery. After being slammed at the outset of the pandemic on fears that a coronavirus-induced recession could inflame a repeat of the Great Financial Crisis for the critical U.S. housing sector, homebuilders have roared back to life in recent months, leading the early stages of the post-pandemic recovery. In the Hoya Capital Homebuilder Index, we track the 15 largest homebuilders, which account for roughly $100 billion in market value. Together, these 15 firms constructed approximately a quarter of total single-family homes built last year.

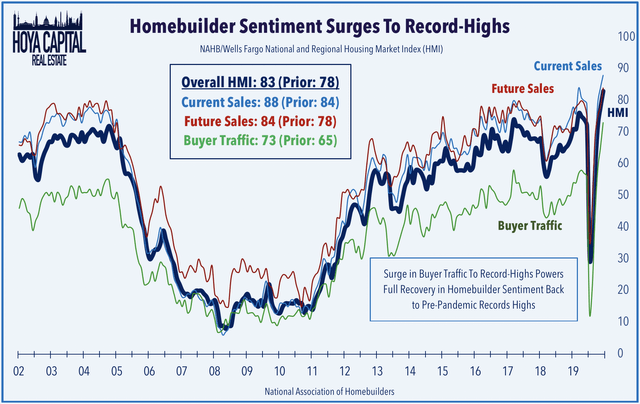

As we discussed since the dark days of mid-March, while the "Housing Crash 2.0" narrative was certainly a clickable headline, macroeconomic fundamentals indicated that the U.S. housing industry was likely to be an unexpected leader of the post-pandemic recovery, a far cry from their role as a primary provocateur during the prior financial crisis. The U.S. housing sector foretold an emerging consumer-led rebound, which continues to catch analysts and economists by surprise, underscored by record-high readings on the Citi Economic Surprise Index. Perhaps the sharpest "V" of all economic data points has been seen in Homebuilder Sentiment itself, which jumped to the strongest levels on record in September, driven by a record surge in Home Buyer Traffic.

Even before we began to see the rebound in Homebuilder Sentiment, the early signs of the unexpected rebound in housing market activity were seen prominently in the Mortgage Bankers Association's weekly mortgage data as well as in Redfin's (RDFN) homebuying demand index, which formed the contours of a sharp V-shaped bounce amid the

Subscribe to iREIT on Alpha For the Full Analysis

Hoya Capital is excited to announce that we’ve teamed up with iREIT to cultivate the premier institutional-quality real estate research service on Seeking Alpha! This idea was discussed in more depth with iREIT on Alpha members. Exclusive articles contain 2-3x more research content including access to iREIT on Alpha's REIT Ratings and live trackers. Sign-up for the 2-week free trial today! iREIT on Alpha is your one-stop source for unmatched Equity and Mortgage REIT coverage, Dividend ETF Analysis, High-Yield REIT Preferred Stocks & Bonds, real estate macroeconomic research, REIT and property-level analytics, and real-time market commentary.