I mentioned in a recent monthly update that I was thinking about bringing back the style of analysis I used when I was first assembling my dividend growth portfolio. Currently, the portfolio is very underweight in the communications services sector, and I finally decided to address that.

I published an article of this style a little over three years ago when I was looking for a stock from the industrial sector and ended up selecting 3M Co. (MMM). That worked out pretty well for a while, as MMM climbed from my purchase price of around $200/share to almost $260/per share a few months later. Since then, however, while the dividend has been nice... let's just say I have had ample opportunity to average my cost basis down.

Dividend growth stocks in the communications services sector are few and far between. I always start my search for new companies at the Dividend Investing Resource Center, where I can search for stocks with a history of raising their dividends. I feel dividend growth investing is the best way to safely and steadily build wealth. And by wealth, I mean a healthy and growing stream of income that will eventually allow the fetching Mrs. Soule and I to live the life we want to live without worrying about pesky things like working or... well, like working.

Communications Services Sector

There are only 13 companies in this sector to choose from, three of which I already own. Three of the remaining ten stocks have a dividend yield of less than 1.0%, so I am immediately turned off to them. One of the stocks that I initially included in my research (and really liked) has only a three-year history of hiking its dividend, so I decided not to look further at the stock. There are a few stocks that I left off that I might need to take a closer look at now that I'm looking at this list again, but at this time, I did not include them in my screen.

At any rate, I decided to take a fresh look at the three companies I already own and to add in a new competitor, namely Omnicom Group Inc. (OMC). The three companies whose stock I already own are Interpublic Group of Companies Inc. (NYSE:IPG), AT&T Inc. (T), and Verizon Communications (VZ).

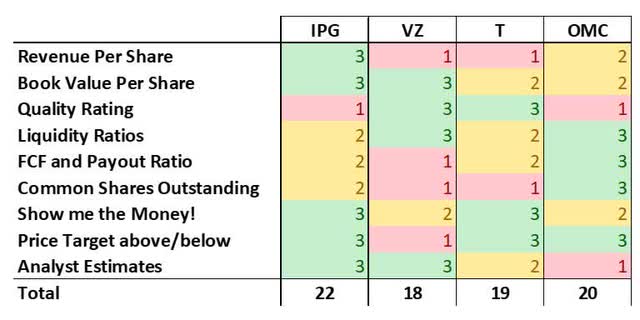

So, let me briefly explain the ratings system. I will rate the companies on nine different metrics based on the guidelines I established when I first started selecting stocks to purchase in this portfolio. I'm analyzing annual numbers, and all four of these companies have fiscal year ends in December, so obviously I'm doing a bit of a "pre-COVID-19" analysis. If it makes sense, I will pull TTM or quarterly numbers. Unless otherwise specified, I pulled my data from MarketWatch and manipulated the numbers in a spreadsheet of my own design.

For each metric, the company will receive either a Good, Neutral, or Bad rating. I will color code them with green (for good), yellow, and red. The ratings are completely subjective, and I will be the final judge. At the end of the article, I will assemble the results and see which stock comes out on top. So, let's get to the first metric.

Guideline #1 - Revenue Per Share Increasing

OMC has had fairly steady revenue growth per share, but its revenue has actually been pretty flat. The company's share repurchase program has kept this looking good. And unfortunately, the TTM revenues are back to 2011 levels. But still, for the pre-COVID-19 performance, the company gets a Neutral rating.

IPG has had excellent and consistent growth in revenue per share for the past five years. Looking at the TTM figure, the company's revenue is back down to 2018 levels. However, IPG has also continued repurchasing shares and is deserving of this Good rating.

Guideline #2 - Book Value Per Share Increasing

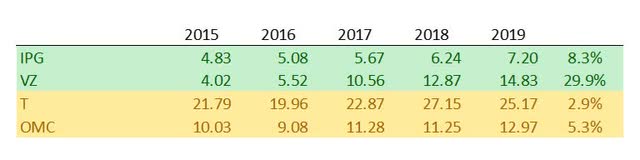

All four have increasing BV per share figures. But VZ is clearly the huge winner here. Still, at an 8.3% average annual growth rate, I can't give IPG a Neutral rating. Both T and OMC are growing their BV per share, but not near as impressively as VZ has and not quite as impressively as IPG. I did have to draw the line somewhere, so both of them get a Neutral rating.

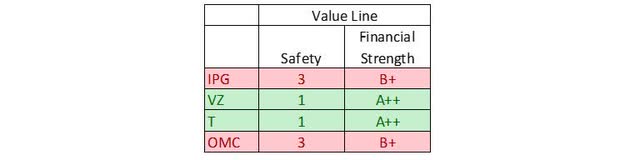

Guideline #3 - Quality Rating

This one is pretty cut and dried. These are the safety and financial strength ratings from Value Line. Both VZ and T have the highest ratings possible for both safety and financial strength, so, of course, they get Green here. Both IPG and OMC are smack in the center of these rankings with safety being ranked from 1 (best) to 5 (worst) and a B+ being the fifth best out of nine possible rankings. The rankings are based on the safety and financial strength of each stock compared to the other 1,700 stocks that Value Line covers. So, perhaps I should assign a Neutral rating to IPG and OMC, since by Value Line's definition, they are very average stocks in this respect. However, I prefer to have stocks I purchase to have better rankings than this, so they both are assigned a Bad rating here.

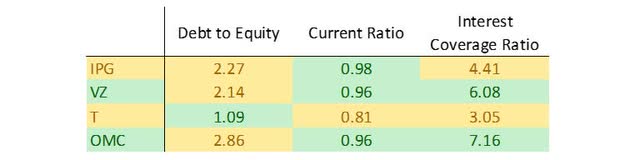

Guideline #4 - Financial Health Measures

I want to buy companies that are financially healthy, and for these measures, I am going to rely on Morningstar. I pulled each of the twelve numbers you are going to see below straight from their website.

Debt-to-equity ratio is just what it sounds like - total debt/shareholders' equity. This ratio tells us how leveraged a company is, and the higher the number, the more risky a company's stock may be. So, while people talk all the time about how much debt AT&T has - and my God yes, it has a lot of debt at $191 billion - you also need to consider that T has gobs and gobs of equity, including $17 billion in cash. That gives the company a D/E ratio of 1.09, which sticks out and earns it the lone Good rating for this metric.

The current ratio is intended to give an idea about a company's ability to survive in the immediate term, and only considers short-term assets and short-term liabilities. A ratio around 1.0 indicates that the company can meet all of its liabilities due within one year with just the assets that are cash or are expected to be turned into cash within one year, meaning the company is very solvent in the immediate future. Three of the companies have ratios very close to 1, earning them good ratings, while T's ratio is an outlier at 0.81, earning it a Neutral for this one.

Interest coverage ratio is simply EBIT/interest expense. It measures how many times a company can cover the interest payments on its debt with available earnings. It is important for the interest coverage ratio to be at least 1.0, and many people consider 1.5 to be the bare minimum. The higher the number the better, and OMC is the champ here with an interest coverage ratio above 7. Honestly, all of these ratings are good, but I chose to draw the line at around 5 just to have some differentiation.

The color that the ticker symbol is in is what I will call the company's final rating with regard to financial health measures. VZ and OMC earned two Good ratings and one Neutral each, so they rated Good overall. IPG and T were the reverse, so they earned Neutral overall.

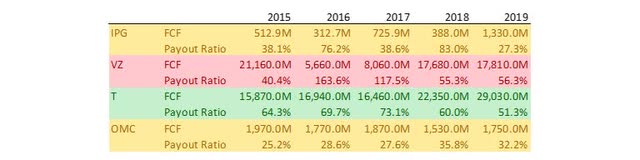

Guideline #5 - FCF and Payout Ratio

This is my favorite metric, and I do place a lot of emphasis on this when I'm looking at the final score. The thing I love to see most about a company is that it generates a ton of cash and it gives a fair amount of that cash back to shareholders.

But the best thing about free cash flow is that it's free. Meaning a company can do whatever it likes with its free cash. Sure, I like to see dividends pouring into my brokerage account. But I also like to see companies buying back their own stock. I like to see them having buckets of cash to dump into R&D, for example (like MMM does). I like to see companies that have dipped their toe in the M&A pool generating the cash needed to aggressively reduce the debt they recently took on.

But most importantly, if they are paying a nice dividend and they have a history of raising that dividend, I want to make sure they are cranking out the cash needed to continue to hike that dividend in the manner I've gotten used to. So, in the chart below, "payout ratio" is the annual dividend paid out (from the statement of cash flows) as a percentage of free cash flow:

AT&T gets the gold star here, as its FCF has gone up tremendously and the company's payout ratio has come down from 70%+ in 2017 to just a hair over 50% in 2019. VZ had a few years there of scary payout ratios, otherwise it would be right there with T. IPG and OMC both had very low payout ratios in 2019, but their FCF has been too unpredictable to give them a Good rating. OMC almost squeaked into the Good category because the company's payout ratio indicates to me that its dividend is very safe (based solely on these numbers).

Guideline #6 - Common Shares Outstanding

As mentioned above, I like to see a company that buys back its own stock. While I begin my search for a company based on its dividend history, a lot of investors look specifically for companies that return cash to shareholders through share buybacks. It is more tax-friendly, but to me it is less substantial, so I prefer dividends. Still, I like companies that return cash to their owners using both methods.

Neither AT&T nor Verizon appear to have share buyback programs in place at this time. I know that T suspended its buyback program after the huge acquisition it made to concentrate on reducing its debt, so it is not a surprise, but the company still gets a Bad rating.

OMC has steadily and somewhat rapidly been reducing their share count which earns them a good rating. IPG saw their share count tick up in 2019 as they are also focusing on debt reduction instead of repurchasing shares at the moment.

Guideline #7 - Show Me the Money!

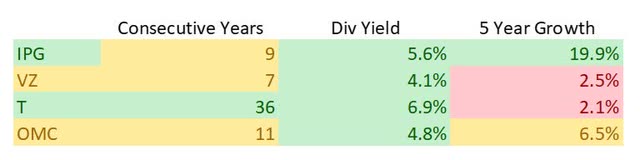

I have already talked about share buybacks as one way a company returns its profits to shareholders, but here, I will rank the dividend policy of the companies. These numbers were pulled from Seeking Alpha's website a week or two ago. The yield is almost certainly different as you're reading this.

One of the problems that a lot of dividend growth investors have with the two telecom giants is they are not growing their dividend very quickly. In fact, T and VZ have 10-year growth rates of 2.2% and 2.7%, respectively, just a bit higher than their 5-year growth rates, which are slow. That's bad. IPG, on the other hand, has very aggressively raised its dividend from $0.24/share annually in 2012 to $1.02 at present. The company's dividend has more than quadrupled since 2012. However, that is only eight years, which is decent but not awesome. OMC seems like a Goldilocks situation, with a fat dividend yield, a decent growth rate, and an eleven-year streak, but nothing screams out "wow!" like T's 36-year streak or 6.9% yield or IPG's 19.9% 5-year growth rate. So, it gets a Neutral rating (again, in comparison to the other stocks). That's just how it fell out.

Guideline #8 - Price Targets

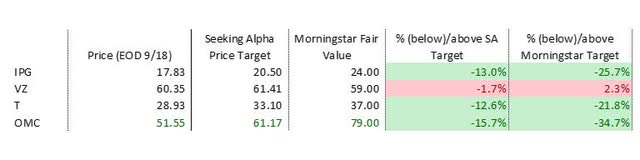

For this section, which is new for me, I took a look at the price targets for each stock from both Seeking Alpha and Morningstar and compared it to the current price.

As of close of business on Friday, the 18th, only VZ is trading close to the price targets from Seeking Alpha and Morningstar, which means there's not a lot of room for growth, so they get a Bad rating. The other three stocks are at least 12% below their targets, and that earns them all a Good rating.

Guideline #9 - Analyst Estimates

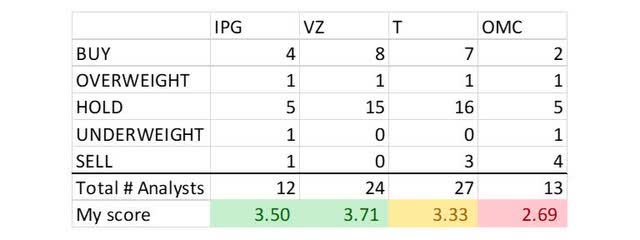

And finally, I have added a ninth guideline in this article, and that is to gather the ratings of all of the analysts and try to come up with a "score" for each stock based on those. These are analysts' rankings from MarketWatch.

I arrived at my score by assigning a value of 5 to a buy, decreasing by 1 to value of 1 for a sell. So, if there were ten analysts and all ten rated the stock as a Hold, the calculated score would be a 3. It would also be a 3 if there were five buys and five sells: (5 x 5) + (5 x 1) = 30, 30 divided by 10 analysts = 3. You get the idea.

So, you can see that OMC has a rating below a hold, which makes sense when you look at the individual ratings and see that nearly a third of the analysts covering OMC rate the stock a sell.

More than half of the analysts covering both VZ and T rate those stocks a hold. Quite a few (33% and 26% respectively) also rate those stocks a buy. That gives VZ the best rating of the bunch, very close to an average of overweight. If not for the three analysts ranking T as a sell, it would be right there with VZ. Not sure which analysts think T is a sell, but that's not the idea of these exercises. Just crunching numbers here.

I'm also giving IPG a Green here, as it has four buy ratings and only one sell. In general, the stock is well above the midpoint here, and with just the one sell rating, I draw the line between IPG and T there.

Final Ratings

And the winner is Interpublic Group of Companies Inc. Based on my analysis, the company looks slightly more attractive than its larger competitor, OMC. Both are part of the "Big Five" advertising companies, and I would feel comfortable purchasing either of them at these levels, though I do worry why so many analysts have a sell rating on OMC.

The only Bad rating IPG got was in the Value Line ratings, which take into account things like balance sheet leverage, cash flow, business risk, corporate size, and cash on hand. I mentioned the company had paused the stock buyback program. It seems that was primarily due to an acquisition in 2018, and as a result, the balance sheet does not look as nice as it did pre-acquisition. Long-term debt climbed from $1.3 billion at the end of 2017 to $4.8 billion as of the end of June. This might be a reason for the very average ratings for safety and financial strength, but the company's interest coverage ratio allays some of my fear there.

If IPG is focusing on paying down debt, then I would expect the dividend increases may not be as robust for the next couple of years. However, with a yield close to 6%, I am willing to get paid to wait until the company has the debt situation back to where it wants it.

Since the pandemic began, IPG has done some cost-cutting, particularly of SG&A expenses, and should emerge from the current situation a more lean company, which should further hasten debt repayment as revenues return (eventually) to pre-pandemic levels. Revenue for Q2 was down almost $500 million compared to Q2 2019. I would expect that will improve for Q3, and we don't have that long to wait to find out, as the end of the third quarter is almost upon us.

So, I think I will add some more capital to IPG. I also leave this analysis feeling pretty good about VZ and T as well. I am more or less resigned to just collecting a big fat dividend from those two stocks and don't expect a ton of growth from either. We will see. The 5G possibilities are mind-blowing, based on several articles I've read on the subject, but we will have to see if that translates to massive revenue and profit increases. We also have yet to see if AT&T's acquisition of Time Warner was a phenomenal move or another blunder. Either way, it is tough to ignore that 7% yield of AT&T.

Congratulations on making it this far! This has definitely turned out to be one of my longer articles, and thank you so much for reading it. I would be interested to hear if anyone owns any of these four and your thoughts on them at this time. Please let me know, and if you enjoyed my analysis, please remember to hit that big orange "Follow" button. Best of luck to all in your investing goals.