Welcome to the September edition of the graphite miners news. September saw graphite prices essentially flat and lots of news from the graphite miners.

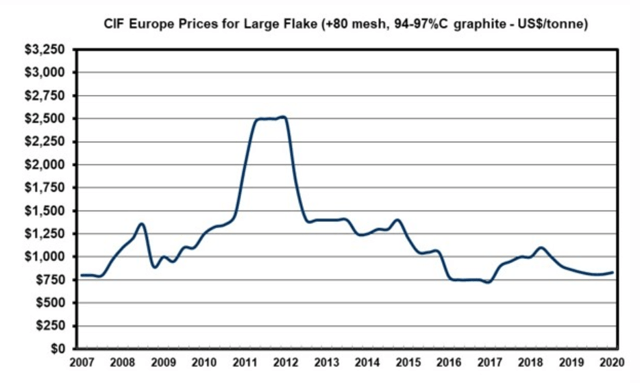

Graphite price news

During September China graphite flake-195 EXW spot prices were up 0.16%, and are up 6.5% over the past year. Note that 94-97% is considered best suited for use in batteries; it is then upgraded to 99.9% purity to make "spherical" graphite used in Li-ion batteries.

Graphite price chart - Large flake graphite price is ~USD 830/t (slightly out of date now, but an ok rough guide still)

Source: Northern Graphite

A reminder of a 2016 Elon Musk quote:

Our cells should be called Nickel-Graphite, because primarily the cathode is nickel and the anode side is graphite with silicon oxide.

In my January 30, 2018 Trend Investing Interview with Benchmark Minerals Simon Moores said about graphite:

Spherical graphite anode plants, predominately based in China, were traditionally 5-10,000 tpa but now we are tacking four megafactories are looking to produce 60,000 to 100,000 tpa from 2020 onwards.

2019 to 2030 demand increase forecast for EV metals as the EV boom takes off - 'Battery' graphite demand forecast to grow 10x.

Source: Courtesy BloombergNEF

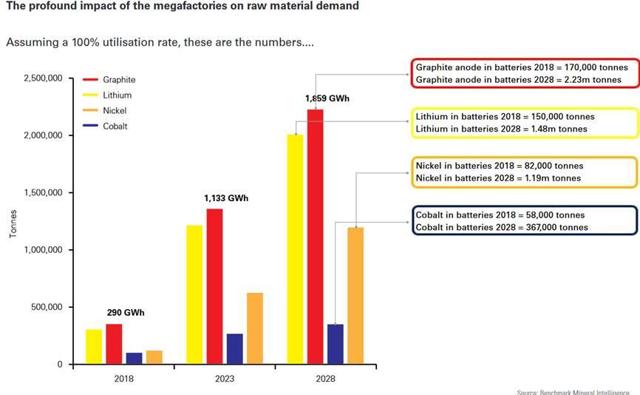

The impact of the proposed megafactories on raw material demand (graphite in red)

Source: Benchmark Mineral Intelligence

Benchmark Mineral Intelligence - Simon Moores's - forecasts (total demand)

Source: Benchmark Mineral Intelligence Twitter

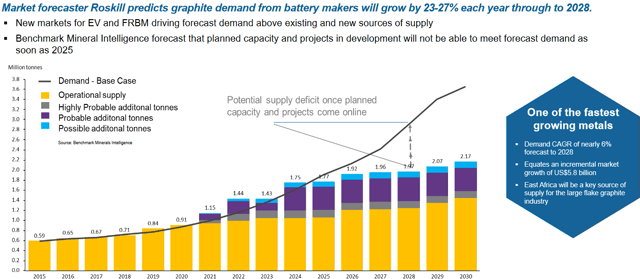

Graphite demand versus supply forecast

Source: Triton Minerals courtesy Roskill

Graphite market news

On August 28 The Driven reported:

"Wild times:" Tesla value hits $US420 billion as Musk dampens Battery Day speculation... Adding silicon to carbon anode makes sense. We already do," said Musk, who also pointed out that the use of silicon in batteries has challenges that reduces battery life. "Question is just what ratio of silicon to carbon & what shape?

Trend Investing

Thanks for reading the article. If you want to sign up for Trend Investing for my best investing ideas, latest trends, exclusive CEO interviews, chat room access to me, and to other sophisticated investors with a focus on renewable energy & the EV and EV metals sector. You can learn more by reading "The Trend Investing Difference", "Subscriber Feedback On Trend Investing", or sign up here.