About six months ago, I explored why small-cap value stocks had been underperforming the broad market not only during the COVID-19 crisis but also for the past many years. Since then, the Vanguard Small-Cap Value ETF (NYSEARCA:VBR) climbed about 15%, about five percentage points short of the S&P 500 (SPY).

Back in April, I was reticent about small-cap value, choosing not to make too bullish a statement about this group of stocks in the earlier innings of a global pandemic and recession. But today, I am feeling more confident about a revival in this corner of the market.

History, at least, seems to support my optimism.

Credit: Investor Place

A quick word on VBR

First, let me recap what the Vanguard Small-Cap Value ETF is. The fund tracks a benchmark of nearly 900 stocks with average market cap of about $3.9 billion that pass the "value" criteria: high book to price, forward earnings to price, historic earnings to price, dividend-to-price ratio, and sales-to-price ratios.

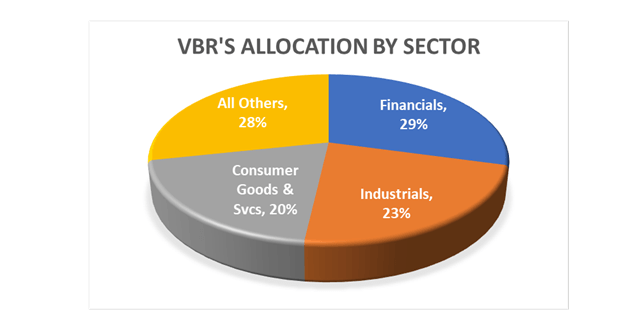

Currently, VBR holds nearly one-third of its assets in the financials and almost one-fourth in the industrials sectors (see pie chart below). Among the top ten holdings, Peloton (PTON) at 80 bps and Booz Allen Hamilton (BAH) at 60 bps of the total portfolio are perhaps the two best-known stocks.

The highly-diversified, $28.5 billion ETF charges a small management fee of 0.07% per year and is very liquid, trading nearly $50 million worth of shares per day in the market.

Source: DM Martins Research, data from Vanguard

What history says

Generally speaking, both the value and small-cap factors tend to perform better during periods of economic recovery and stability. This is probably true because smaller, procyclical companies valued more cheaply (think of specialty consumer banks, regional airlines or small manufacturers) benefit the most from the systematic boost of a thriving economy.

Think differently, reap the rewards

"Thinking outside the box" is what I try to do everyday alongside my Storm-Resistant Growth (or SRG) premium community on Seeking Alpha. Since 2017, I have been working diligently to generate market-like returns with lower risk through multi-asset class diversification. To become a member of this community and further explore the investment opportunities, click here to take advantage of the 14-day free trial today.