Lincoln National Corporation (NYSE:LNC) continues to be a beaten-down financial stock. Since the start of the year, the shares have traded down by 43%, as fears and concerns over the pandemic still linger. However, I believe that the stock has fallen too far, and that the risks are more than priced in. In this article, I evaluate what makes this stock an attractive investment at the current valuation; so let’s get started.

A Look Into Lincoln National Corporation

Lincoln National Corporation is a financial services company that provides life insurance, annuities, and retirement plan services. It was founded over a century ago, in 1905, with the endorsement of Abraham Lincoln’s son, Robert Todd Lincoln. Today, it is ranked #188 on the Fortune 500 list by revenue and #22 by assets, and serves over 17 million customers. In 2019, the company generated over $17B in total revenue.

COVID-19 has undoubtedly been challenging for the company, as claims related to the pandemic reduced earnings by $0.65 to $0.75 per share in the latest quarter. EPS in the latest quarter was $0.97, which represents a 59% YoY decline. Management estimates that for every 10,000 COVID-19 deaths, the company should expect a $10 million hit to earnings.

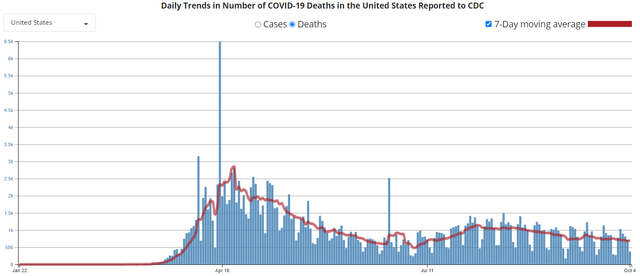

Looking into this morbid financial statistic, I wanted to calculate what LNC’s EPS hit may look like for the third quarter that just ended. Using the red line in the CDC graph below, I estimate the average number of daily COVID-19-related deaths to be 850 for the months July through September.

(Source: CDC)

When multiplied by the 92 days in the quarter, I arrive at an estimated 78,200 COVID-19-related deaths during Q3 alone. Applying management’s $10M per 10K deaths estimate, this comes out to an earnings hit of $78.2M. Then, dividing the $78.2M by the 193.2M total current shares outstanding, I arrive at a $0.40 YoY hit