Introduction

If you're familiar with our previous articles, you're probably expecting this to be a precisely detailed short thesis garnished with sarcastic humor attacking management. Not this time. The media has worked pretty incredulously to layout the bear case on Palantir (NYSE:PLTR). Most stories written about Palantir have been a recount of these 4 facts, occasionally seasoned with a few new minor details:

- Palantir has never made a profit in 17 years

- Palantir's valuation is below its peak in the private market

- Palantir's insiders have tight control of the company

- Palantir controversially helps ICE and works with the CIA/military

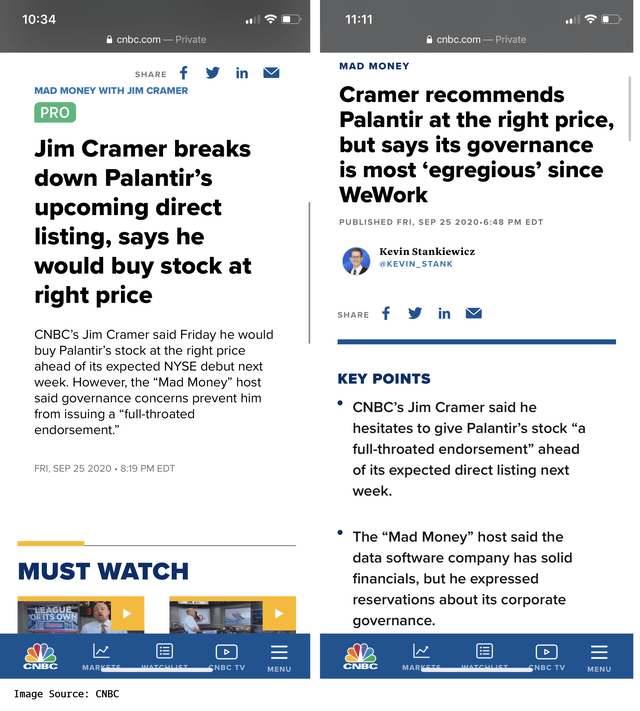

The attack on Palantir has been thinly veiled and relentless. CNBC ran a story on Palantir then quickly edited the link so that it redirected to a more menacing version. Scott Galloway, a marketing professor at NYU who had a previous stint in tech serving on the board of the now-bankrupt Gateway Computer, bashed Palantir with his typical use of foul language. United States Representative and finance guru Alexandria Ocasio-Cortez wrote a letter to the SEC, essentially informing them that Palantir's SEC filings detailed 'risky risks' and furthermore, her general displeasure with the company.

This biased and politically motivated coverage has rarely focused on the positive developments, such as Palantir's 42% FY20 revenue growth guidance or the recent announcement of a $91M U.S. Army contract followed shortly after with a $36M contract from NCATS. That's $127M in new contracts over the span of one week, mostly ignored by the media. At 80% margins, the "world's best software", and a strong revenue ramp, we believe Palantir could be profitable within 24 months.

Cold War 2.0 & The Google "Rebellion"

In spite of the controversy, Palantir's CEO has made repeated media appearances, unfazed and unapologetically confident. One thing you will find, even in the most detailed and fair articles written about the company (such as this well-researched piece by New York Magazine) is that they focus almost exclusively on the history of Palantir, particularly its early history, and rarely about Palantir's future.

The consumer Internet companies-this is not Apple but the other ones-have basically decided we're living on an island. And the island is so far removed from what's called the United States in every way, culturally, linguistically, in the normative ways, that we'd rather be regulated as a foreign island then be part of the United States proper.

And that's the core problem. You are part of the United States proper. Regulation is part of the problem. Part of the problem is, there are, you are part of a larger whole that made your company possible. That is protecting you against tariffs. That's protecting you against regulation. That is allowing you to build your company.

You cannot create an island called Palo Alto Island that is only subject to [certain] regulation, much like a Canton system. But Silicon Valley really wants is the canton of Palo Alto. We don't have a cantonal system in America. We're United States of America not the United States Canton, one of which is Palo Alto. That must change.

- Palantir CEO Alex Karp, Davos 2020

To understand Palantir's future, let's take a step back to Davos in January 2020. Roughly the same time that Sundar Pichai (CEO of Google (GOOG) (GOOGL)) was telling a crowd of influential world leaders that AI will be "more profound than fire", Alex Karp (CEO of Palantir) was close by delivering a shot across Google's bow. A year earlier, Palantir announced it had secured a spot in an $800M US Army contract, larger than a previous $222M SOCOM contract.

Karp's comments at Davos and subsequent letter to shareholders has stoked rising mistrust of Google within the US Government. It's not hard to see why they might be suspicious.

In 2017, Google announced it would build an AI lab in China amidst rising US-China tensions, then a year later abandoned a secretive defense project using AI to analyze images from drones. By late 2019, it surfaced that engineers at Google refused to even work on cloud infrastructure for the government, nine key engineers threatened to resign. As Bloomberg put it: "Portions of the company's employee base are in a state approaching rebellion".

This all comes at the same time that government and military spending on AI, data, and software is skyrocketing. There is a cold war brewing between the US and China, and an arms race for dominance in various technologies. The Department of Defense is spending $4B on AI and ML R&D activities during FY2020 alone. NIST, NIH, and NSF are spending $850M, and the Trump administration has proposed an additional $1.5B boost to AI funding. DARPA is back in the semiconductor business, partnering with SoftBank's (OTCPK:SFTBY) ARM (which will soon be acquired by Nvidia (NVDA)).

We view Palantir as a prime beneficiary of this tech arms race and the increased government spending associated with such.

The Media is clueless on TikTok, ignores MiningLamp

Amidst these rising geopolitical tensions comes the Trump administration's battle with TikTok. Despite the fact that popular US web portals such as Facebook, Twitter, Instagram, and Google are all banned in China, this saga recently reached a stalemate with a lone federal judge overturning a national security decision made by the President. A recent data leak has revealed that China has been building a global mass surveillance database targeting US citizens and US military personnel. This database included data from TikTok.

TikTok illustrates the dangers of the 21st century. It's possible and likely that TikTok is sharing sensitive personal data on US citizens with the Chinese government. Australia was sounding the alarm back in February. This data could be used to create tomorrow's weapons of war; imagine a tool that is able to identify an individual who had strong anti-US sentiments as a kid, in the future when they are an adult working on a sensitive project. Imagine being able to simply blackmail someone by digging up a private post 10 or 20 years after they've deleted the app.

If the US is able to examine the algorithms used by TikTok today, it might even reveal that TikTok is being used to influence US politics. TikTok is popular with young service members, so imagine if upon examination, the US discovered the algorithms are being used to identify which users are in the military. TikTok users themselves believe the app favors pro-China content. The Chinese Communist Party took quick action to ensure that TikTok's algorithms would never be opened up for examination while clueless journalists speculated that this is because these algorithms are somehow irreplaceably valuable IP.

The media seems happy to parrot CCP propaganda on TikTok (after all, it's the same media that refuses to give Palantir a fair shake), and it has totally ignored the broader story. TikTok is backed by Chinese tech giant Tencent (OTCPK:TCEHY), via its stake in ByteDance (BDNCE). Tencent is also a key backer of company called MiningLamp, which is a critical Palantir competitor. MiningLamp's data integration and visualization software tools are used by more than 200 of the Fortune 500 companies. While Google refuses to work with the US government, over 200 US companies are using software backed by Tencent, which has contributed large amounts of data to a Chinese global spying operation via TikTok.

If Tencent's TikTok is dangerous and inappropriate for our kids, potentially spying on them, certainly MiningLamp is unfit for our companies. This presents a clear and robust catalyst for Palantir to grow its corporate revenue base in the very near term.

The World: 5 Years From Now

What's interesting about our client list, people ask how can you have this super valuable company there are only 125 customers. To which I respond, yeah, but they're the 125 most interesting institutions in the world. These aren't just any institutions...

- CEO Alex Karp, shortly after the IPO on CNBC

We believe that it would be a mistake to think of Palantir as simply a data visualization and management tool, like Tableau (DATA). In the company's own words, they're building software that companies will need 5 years from now. What exactly does this mean?

Over the next 5 years, a massive evolution will take place in the telecom sector. The rollout of 5G technologies such as MIMO (massive-in massive-out) will enable billions of connected devices. This will enable the long-discussed "Internet of Things" to become a reality. The focus of the internet will shift from iPhones and laptops to a blanket of connected sensors and devices, all producing data that will need to be analyzed in order to be useful. This will be the next era in telecommunications and computing.

To get the most use out of this data, it will not only need to be highly secure but also shared and combined with data from various companies and sources. This is why China is developing a framework for industrial data sharing, what it calls "industrial data trading market". Tencent is a key backer of the project, constructing what appears to be an underground "bomb shelter" data center in Guizhou. This comes as part of a $70B digital infrastructure push, funded by Beijing. China has embraced the idea of an open data sharing/data mining platform from American author, Jeremy Rifkin. Additionally, the Chinese government has laid out a policy framework for what "industrial data" should be shared and what should not.

Now all the economic data is gonna be open to everyone, not just a few government secrets. But in a network neutral world you're gonna be able to go up on this platform and have a completely transparent picture of all the data. You can go up on the platform and cut your big data on your value chain out from the noise. Then, you can mine your big data with analytics. Then you can create your own algorithms and apps. They'll allow you to dramatically increase your aggregate efficiency at every step of conversion on your value chain.

And, as you do that, dramatically increase your productivity, dramatically reduce your ecological footprint, and dramatically plunge your marginal cost. Some of those marginal costs are gonna get so low-they head to zero marginal cost. And when they hit near zero marginal cost, it gives rise to a completely new economic system.

In our view, it seems likely that Palantir will play a critical role in building out such a platform in the US, perhaps extending to US allies, integrating supply chain data as a cohesive trade bloc. It will take highly specialized software that is capable of sharing some details but not others - exactly the kind of software Palantir has developed. This is our hunch, but it is certainly emboldened by the company's confidence. After all, the Chairman of Palantir, Peter Thiel, is a close advisor to the President.

So, finally, this brings us to corporate governance. The geniuses over at Forbes are saying this is one of their '2 rEaSoNs tO aVoId PaLaNtIR StOcK'. If you were going to trust a company with your most sensitive information, would you not prefer a company with an entrenched management team that could not be easily removed at the whim of shareholders? Let alone if you were going to trust such a company to build a critical platform for sharing data amongst many different companies.

The media has attempted to paint Palantir's corporate governance as comparable to WeWork... yet, while WeWork's CEO was smoking weed on private jets, doing tequila shots, and buying wave pools... Palantir's CEO is handling sensitive data for the CIA. The fact that no one in the media has raised that point tells you everything you need to know.

A Cyberpunk Conclusion

This year's most hotly anticipated video game is Cyberpunk 2077, expected to be the next great brand in gaming. With themes such as corporate espionage/warfare and a wild and dangerous unsecure internet filled with hackable devices, it's not hard to see why such themes are resonating with a young audience. They're increasingly fathomable, even if it's science fiction fantasy.

Despite all the hoopla surrounding Amazon, Bezos has not really revolutionized the book industry at all. In essence, he is a middleman, and he will likely be outflanked by companies that sell their wares directly to consumers. To begin with, publishing houses themselves could sell their books online. And new technologies promise to cut costs even further by allowing consumers to download books via the Internet. Books can be printed out on traditional computer printers or put into a new notebook-sized computer device that displays books on its screen a page at a time.

-Amazon Dot Bomb, Barron's - May 31, 1999

So, Palantir may be facing its Amazon Dot Bomb moment... the moment where we underestimate the future. At this moment, we may have already failed to realize that cyber attacks (the weapons of Cold War 2.0) have already destroyed key industries such as domestic production of solar panels (which we have written about extensively), and in the future, the potential for such attacks will increase in both scope and consequence.

The challenges that we face, and the crises that we have and will continue to confront, expose the systemic weaknesses of the institutions on which we depend. Our industrial infrastructure and manufacturing supply chains were conceived of and constructed in a different century. Government agencies have faltered in fulfilling their mandates and serving the public. Some institutions will struggle to survive. Others will collapse.

Our customers come to us because their technological infrastructure has failed them. The enterprise software industry's focus on custom software tools and applications is misplaced. Those approaches often only work briefly, if at all. The problems and needs of an organization often change before the software can even be deployed.

Our partners require something more. They need generalizable platforms for modeling the world and making decisions. And that is what we have built.

- Letter from CEO Alex Karp, Palantir S-1

We may be failing to realize that the future of the internet is not buying more things off of Amazon (AMZN) with our iPhones, it's billions of connected IoT devices that will churn out massive amounts of industrial data. We may be failing to realize that AI isn't a futuristic prospect, it's being embedded into the software stack in meaningful ways today. It may be difficult to foresee the impact that breakthroughs in AI acceleration hardware will have, perhaps they will be profound. It may be hard to imagine that many of today's managerial decisions or operational challenges can be reduced to solvable data science problems. We may be underestimating the knowledge gained from 17 years of data integration, much of which was carefully customized by "forward deployed engineers" at great expense.

(Satya Nadella, Eric Schmidt, Alex Karp arrive at the 2019 Bilderberg conference in Montreux, Switzerland. Presumably, the themes discussed in this article were top of mind. Image Source: Newsweek)

So, what will the world look like 17 years from now? Certainly, there will be many connected devices, and the world will need technology to both integrate and secure them. To reap the efficiencies and benefits of a data-driven economy, companies will need to collaborate and share data on a mass scale. Perhaps this technology, like so many others, will be adapted from military origins. The future is going to be a bizarre place. We are long PLTR.