It's been a tough couple of months for the precious metals sector, and the silver producers (SIL) have been the hardest-hit within the group. Despite an impressive Q2 report, Hecla Mining (NYSE:HL) has not been able to sidestep the sector-wide carnage, with the stock sliding more than 30% from its August highs. Fortunately, this correction has done minimal technical damage, and the valuation is becoming much more reasonable after the drop. This is helped by the fact that earnings estimates continue to climb, with FY2021 estimates sitting at almost double the level they were just three months ago, given the higher silver (SLV) price. While I still believe there are better opportunities elsewhere in the sector, I see Hecla as a Speculative Buy below $4.55.

(Source: Hecla Mining Company Presentation)

(Source: Hecla Mining Company Presentation)

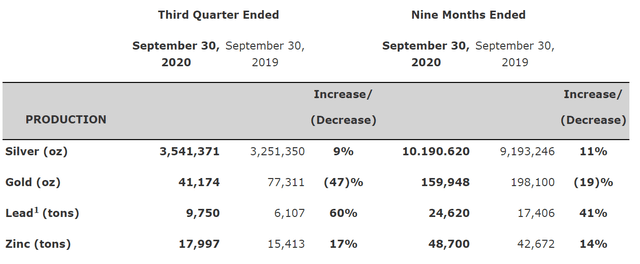

Just over two months ago, I wrote on Hecla Mining and warned that it was a terrible time to be chasing the stock. This is because the stock was trading at more than 40x forward earnings, it was up over 375% in less than 100 trading days, and bullish sentiment was through the roof for silver miners. The stock has since pulled back over 25%, but analysts have been busy pulling earnings estimates higher at the same time as this correction has occurred. Meanwhile, the company just reported another strong quarter for silver production, though gold production came in a little shy of my estimates. Let's take a closer look at the company's Q3 production results below:

(Source: Company News Release)

(Source: Company News Release)

As we can see in the table below, Hecla produced over 3.54 million ounces of silver in Q3, a 9% increase from the same period last year. Year-to-date, silver production is tracking at 11% above last year's levels, and the increased silver production combined with the significant rally we've seen since Q2 should bolster Q3 and