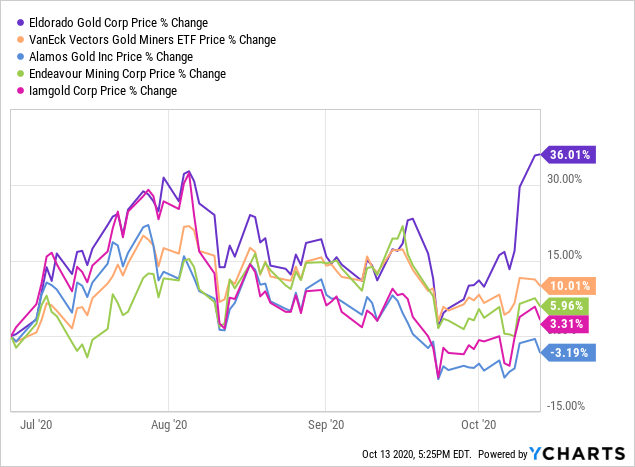

Eldorado Gold (NYSE:EGO) finally appears to be turning the corner after years of underperformance amid permitting delays and operational issues at its core projects in Turkey and Greece. The share price has risen 36% versus a 10% increase in the gold miners index (GDX) since we first highlighted the company as an undervalued opportunity back on July 1st.

Eldorado has recently broken out from its peer group of mid-tier gold miners amid media reports and speculation that a resolution with the Greek government over the development of its large scale gold-copper Skouries project might finally be coming.

Share price performance since July 1st

(Source: YCharts)

Preliminary Q3 Numbers Largely Meet Expectations, with the Best Performance Coming from Lamaque

For the third quarter of 2020, preliminary production numbers released on Tuesday show output of 136,672 ounces of gold across Eldorado's four core operations. This total represents an annualized rate of 547,000 ounces, which aligns with management's 2020 full-year guidance of 520,000 to 550,000 ounces at an all-in sustaining cost of $850 to $950 per ounce. Management did not suspend guidance like many other gold producers during the COVID-19 pandemic, with only a brief shutdown affecting its Lamaque operations.

This quarter's results translate to a 35% increase over the same period last year, although this jump was from a low base and largely expected. In the third quarter of 2019, production was materially lower at their flagship Kisladag mine in Turkey as they ramped operations back up after halting mining in 2018. After issues with heap leach recoveries, the company looked to transition to CIL processing with a new mill before changing their mind and sticking with heap leach due to the high capital costs of a mill expansion and higher than expected heap leach recoveries in the current pit area.

While