Image: DHIRUBHAI DEEPWATER KG1 Source: MarineTraffic

Investment Thesis

Transocean (NYSE:RIG) released its fleet status on October 14, 2020. It was a non-event with a backlog addition of $23 million. It was the best the company could come up to in those circumstances. However, we should wait for more details with the release of the third-quarter results. The risk of some contracts renegotiation and eventual termination is high.

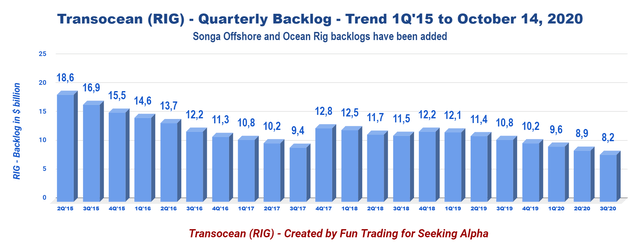

Transocean owns a large backlog of $8.2 billion but could eventually be raised by $250 million, assuming that the contract decision for Deepwater Atlas is expected to be made on or before March 31, 2021.

Transocean is the only offshore drilling company I am following that has avoided a debt restructuring under chapter 11 until now. However, the situation is quite concerning.

The investment thesis is now pretty simple. I recommend avoiding RIG as an investment period. The company is struggling financially and may eventually declare bankruptcy within 12 to 18 months. Worse, it could eventually be forced into bankruptcy in a few weeks under special circumstances that I will talk about in my conclusion.

However, for traders who know how to deal with such situations and control their emotions, I recommend trading the stock short term.

Complete Fleet Status as of October 14, 2020

The company's fleet status was released on October 14, 2020.

- Dhirubhai Deepwater KG1: Customer exercised a 180-day option in India. The initial day rate was $127K/d, which means an additional backlog of $23 million.

- The Corcovado drillship and the Mykonos drillship experienced 21 days at a zero-day rate in Q4.

- The drillship Discoverer India is now cold-stacked.

- The drillship Discoverer Inspiration is now Idle.

- The Drillship Asgard will work until November.

Fleet Status/Revenues in Graphs

As said in my preceding article about the July fleet status, the

Join my "Gold and Oil Corner" today, and discuss ideas and strategies freely in my private chat room. Click here to subscribe now.

You will have access to 57+ stocks at your fingertips with my exclusive Fun Trading's stock tracker. Do not be alone and enjoy an honest exchange with a veteran trader with more than thirty years of experience.

"It's not only moving that creates new starting points. Sometimes all it takes is a subtle shift in perspective," Kristin Armstrong.

Fun Trading has been writing since 2014, and you will have total access to his 1,988 articles and counting.