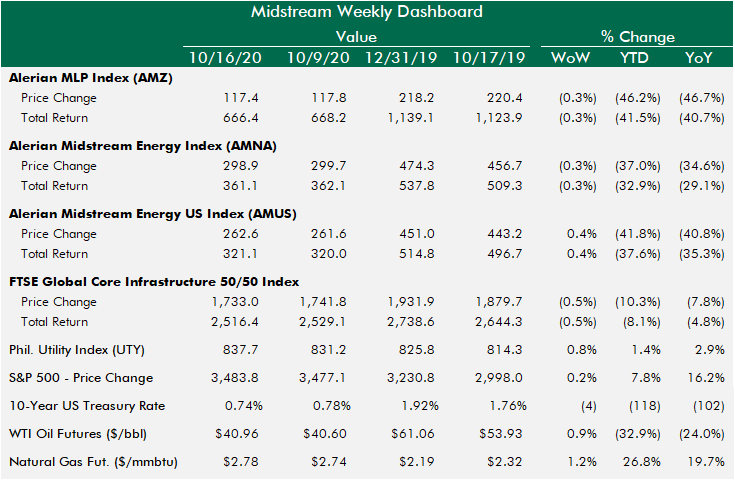

Midstream and MLPs looked to be coasting to a third straight week of solid gains, but a sharp selloff across energy stocks Friday erased the gains for the week. There was little volatility in the market generally this week. In the summary dashboard below, only natural gas prices moved more than 1% vs. last week. In the absence of material catalysts, the market is in a holding pattern ahead of the election.

Earnings season for midstream kicks off this week with KMI on Wednesday. Expect earnings to bring some catalysts for individual stocks, including opportunities for management teams to discuss fundamental outlooks, free cash flow plans, cost-cutting initiatives, and capital allocation. Even with that opportunity, midstream and the energy market overall has the election and tax loss-selling looming in the next few months, so it will be interesting to see how much impact earnings will have.

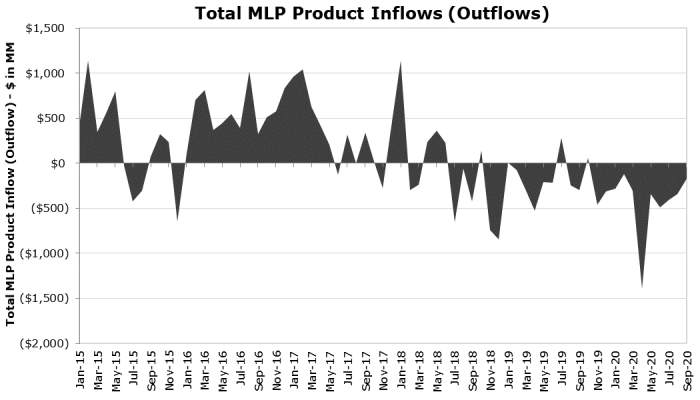

Fund Flows: Structurally Challenged

There seems to be a pause in the ongoing fund outflows from midstream fund products. That reprieve in selling pressure, combined with the lack of volatility and news this week, affords me a chance to call back to old posts to help explain fund flow dynamics at play in midstream.

Based on Wells Fargo data, in just the last 21 months through 9/30/20, there have been $6.2bn of total net outflows from midstream ETFs and open-end mutual funds, $8.5bn from February 2018. This is in addition to more than $3bn of institutional outflows from reported mandate terminations. The overall amount of institutional "money-in-motion" out of midstream is much larger when considering those that do not report publicly. This money is moving into listed infrastructure, listed real assets, broader equity mandates, and into private equity.

The reasons for the outflows are many, and they've been discussed at length here at MLPguy for