V.F. Corporation (NYSE:VFC), an apparel company that owns a portfolio of iconic brands including Vans and Timberland, has recently presented its FQ2 (ended September 26) results, and though the quarterly sales slump was catastrophic, influenced by persisting effects of lockdowns and hibernated economic activity, investors have a plethora of reasons to be happy about them.

First and foremost, VFC topped Wall Street’s expectations on both adjusted and GAAP EPS and on sales. Also, it shared upbeat FY21 guidance, expecting at least $9 billion in revenues, while pundits' consensus estimate was $130 million lower.

Additionally, as liquidity remained ample, VFC increased its DPS, thus securing the status of dividend aristocrat. The corollary here is that as even amid the calamitous 2020, VFC did not slim down the payout, and during the economic recovery phase, it will likely continue increasing the DPS and extending its dividend growth story even further.

The top line

While the ripple effects of the recession reverberated through the consumer discretionary sector, the apparel industry bore the brunt of the coronavirus-related lockdowns across the globe, and it is not a mere coincidence that V.F. Corporation did not emerge unscathed.

Source: Unsplash

Source: Unsplash

But the FQ2 results were not entirely weak, as an investor might guess upon a cursory examination of the income statement, because, apart from terrible quarterly revenue figures and margin compression, there were clear signs of a sharp recovery and building momentum in a few regions that will likely bolster sales going forward. But let us begin with the income statement.

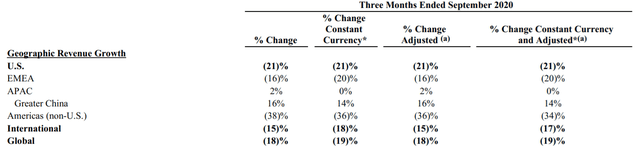

First, due to mandatory apparel store closures, the reported revenue from continuing operations dropped by 18%, while the currency-adjusted decline was 19%. Here it is worth clarifying that with Q2 FY19 originally reported revenues taken into account, the contraction was much deeper, over 23%.

The revenue plunge was mostly precipitated by the weakness of Outdoor, the flagship segment that was the most afflicted, as its result was down by 24%. The poor performance of the division was, in turn, partly a consequence of a 25% contraction in The North Face brand revenue (page 17). Timberland, another heavyweight brand name in VFC's portfolio that is included in Outdoor, posted similarly weak figures, as its reported revenues were down 24% and 26% in constant currency. Active fared substantially better, as its GAAP net sales were down by only 15%. Vans brand revenue was 10% weaker than in Q2 FY19.

But not all the segments were on a shaky footing. Work appeared to be an outperformer as its revenues rose by 14%, partly thanks to a sharp increase in Dickies brand sales. But as the division has only a marginal contribution to the company’s top line (only 9.7% in FQ2) if compared to the flagship brands and product lines, its buoyant performance did little to offset the steep decline in the consolidated sales.

One of the adverse side effects of the sales slump was the compression of margins. For example, the adjusted gross margin from continuing operations was down 3.5% to 50.9% (page 15). Adjusted operating margin retreated lower to 13.1%, while a year ago, it was 18.2%. So, the company covered FQ2 costs, interest, and taxes fully and delivered diluted EPS of $0.66, while in FH1, it switched to a net loss.

Combined, these figures make an eerily somber impression, but it would be a mistake to label the quarter as totally dreadful. So, let us discuss a few positives not to be overlooked.

The silver lining

First, bleak revenues by no means indicate the desirability of VFC's brands faded, and the robust momentum in digital sales quite vividly illustrates that. In FQ2, precisely like in the case of Levi Strauss (LEVI), a prominent apparel heavyweight I have covered recently, VFC's e-commerce performance was on a tear, as direct-to-consumer digital reported revenue rose 44% and 42% in constant dollars. A corollary here is that lackluster total sales were one-off in nature, and if store closures do not return (at least, I hope so, but the Covid-19 statistics is worrisome), the similar contraction is not about to repeat.

Next, the geographic revenue mix shows that sales performance was asymmetric, as it reflected the scope and timing of the coronavirus containment measures implemented by the authorities. And while results in some regions were dreadful, others ended the quarter on an up note. While the Americas' revenues virtually cratered, going down by 38%, the U.S. segment, which was much stronger, reported a 21% decline. The EMEA fared better: revenues in the region fell only by 16%. And, finally, the Asia Pacific impressed with a 2% growth (constant-currency sales were flat), as resilient momentum emerged in both Greater and Mainland China where sales rose propped up by the rapid economic recovery.

Delving slightly deeper, the demand for Vans in the region was especially robust, as the GAAP sales rose 5% and adjusted sales inched 4% up. That, unfortunately, was offset by single-digit declines in both The North Face and Timberland brand revenues.

Ultimately, VFC shared upbeat guidance, as it is clearly confident that the worst had already passed. For example, the full-fiscal-year revenues are expected to add up to "at least $9 billion." And even as VFC is bearish on EPS, it is still forecasting over $600 million in annual adjusted FCF (page 6), which is enough to cover the dividend almost fully (LTM dividends paid added up to $748.7 million).

Since the earnings presentation, Wall Street has become a bit more bullish on sales performance in FY21, and now it is anticipating a $9.07 billion to be delivered in sales, which specifies a 13.5% decline YoY. At the same time, the Street is forecasting revenues to bounce back sharply in FY22 and continue growing at least until FY26.

Cash flows

In the first half of FY21, VFC generated $82.8 million in net operating cash flow and was unable to fully cover capex of $112.5 million. That is clearly not an inspiring fact, but if we extend the time frame a bit, we will notice that VFC remains FCF positive with ~$967.8 million cash surplus in the trailing four quarters.

Capital efficiency

When analyzing the financial performance of a dividend aristocrat, an investor should take into account a few indicators that can help to assess if the management allocates capital proficiently and competently or not. For example, it is worth taking a look at Cash Return on Total Capital. As of my calculations, its CROTC stands at ~16.7%; though the result is adversely impacted by the debt that surged in FQ1, it still remains on a decent level.

The liabilities side of the balance sheet looks bloated, but the financial position is not in peril

An investor should not be spooked by an over 193% Debt/Equity ratio, as it does not imply that the company is financially distressed. Thanks to a massive cash pile, net debt/net CFFO stands at only ~2.3x, which means there are no reasons to worry about both liquidity and solvency.

Final thoughts

The FQ2 sales were depressed, no doubt. But investors should not focus too much on lackluster revenues that were battered by one-off effects, as sales are already recovering. Also, despite the detrimental effects of the lockdowns, VFC secured its dividend aristocrat status thanks to ample liquidity.

Anyway, I am neutral on VFC, as its D+ Value Grade implies multiples are overstretched, and the upside potential is questionable.