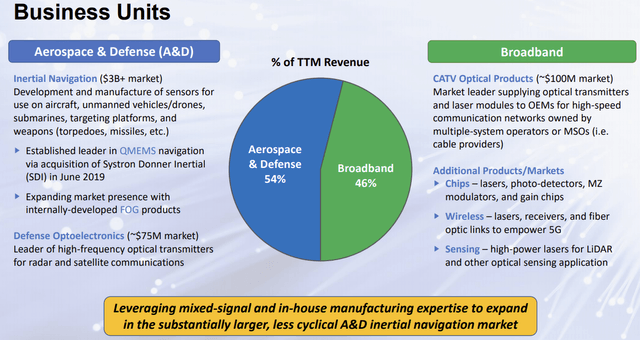

EMCORE Corporation (EMKR) or "EMCORE" is a small, under-the-radar provider of advanced mixed-signal optics solutions. The company operates in two segments:

1) Aerospace and Defense

2) Broadband

Source: Company Presentation

Over the past couple of quarters, results have been mixed mostly due to cable television ("CATV") customers delaying capex decisions. Last year, the company also suffered from China trade dispute-related tariffs.

In response, management has taken some decisive action with the sale of its CATV production equipment and transfer of its CATV manufacturing operations from the company’s Beijing facility to electronics manufacturing services ("EMS") provider Hytera Communications ("Hytera"). While COVID-19 has delayed the move of the final transmitter line and other remaining operations to Hytera's Bangkok, Thailand facility, management now expects the transition to be completed by the end of December.

Last year, the company also bolstered its Aerospace and Defense division with the acquisition of Systron Donner Inertial Inc. ("SDI"), a manufacturer of quartz micro electro-mechanical systems ("QMEMS"):

This acquisition delivers immediate scale to our growing navigation systems product line and positions EMCORE as one of the largest independent inertial navigation providers in the industry. Merging EMCORE's existing navigation systems product line with SDI’s strong brand, technology and backlog, and program wins, instantly creates a stable, growing, and technically advanced business well-positioned to disrupt market norms.” said Jeff Rittichier, President and CEO of EMCORE. “SDI provides EMCORE with a scalable, chip-based platform for higher volume gyro applications, while delivering superior performance compared to its competitors.

While the purchase resulted in a $22.8 million cash outflow, EMCORE was able to recover $12.8 million in a subsequent sale and leaseback transaction of SDI's QMEMS manufacturing facility in Concord, California.

As a result, the Aerospace and Defense segment has become the company's largest revenue contributor in recent quarters.

Source: Company's Press Release and