Looking for attractive yields in the healthcare sector? This sector isn't known for high dividend yields - the current sector yield is ~1.5%.

However, these two closed-end funds, Tekla Healthcare Opportunities Fund (NYSE:THQ) and Gabelli Healthcare & Wellness Trust (NYSE:GRX), both offer attractive yields, and are trading at discounts to NAV.

Profiles

THQ - The Fund's objective is to seek current income and long-term capital appreciation through investing in companies engaged in the healthcare industry, including equity securities, debt securities and pooled investment vehicles. THQ IPO'd in 2014.

GRX - The trust will invest at least 80% of its assets, plus borrowings made for investment purposes, in equity securities such as common stock and preferred stock and income producing securities, such as fixed income debt securities and securities convertible into common stock, of domestic and foreign companies in the healthcare and wellness industries. The remaining 20% of its assets may be invested in other securities, including stocks, debt obligations and money market instruments, as well as certain derivative instruments in the healthcare and wellness industries or other industries.

GRX IPO'd in 2007.

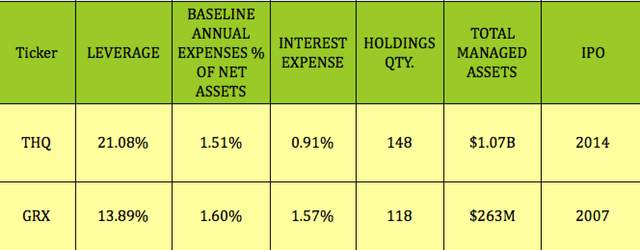

Both funds employ leverage to enhance their returns, with THQ levered at ~21%, and GRX at ~14%. THQ is a much larger fund, with ~4X the amount of assets that GRX has. It also has more holdings, at 148, vs. 118 for GRX. Their baseline expense ratios are similar, at 1.51% for THQ and 1.6% for GRX:

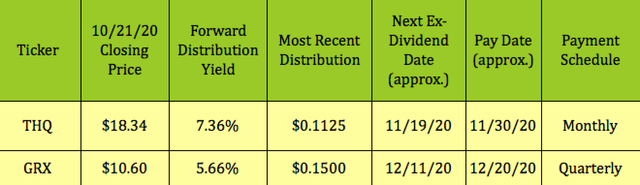

At $18.34, THQ yields 7.36%. It pays $.1125 on a monthly basis, and pays at the end of each month. It should go ex-dividend again ~11/19/20.

At $10.60, GRX yields 5.66%, and pays quarterly - it should go ex-dividend again on ~12/11/20, and pay on ~12/20/20. Management just raised the quarterly payout from $.14 to $.15.

THQ and GRX

Our Marketplace service, Hidden Dividend Stocks Plus, focuses on undercovered, undervalued income vehicles, and special high yield situations.

We scour the US and world markets to find solid income opportunities with dividend yields ranging from 5% to 10%-plus, backed by strong earnings.

We publish exclusive articles each week with investing ideas for the HDS+ site that you won't see anywhere else.

We offer a range of income vehicles, many of which are selling below their buyout and redemption values. Our latest buyout success story has a 39% total return.