In the last post, I noted the strong backing for value investing for much of the last century, where a combination of investing success stories and numbers that back those stories allowed it to acquire its lead position among investment philosophies. In this post, I plan to look at the underbelly of value investing by first going back to the "good old days" for value investing, and probing the numbers more closely to see if even in those days, there were red lights that were being ignored. I will follow up by looking at the last decade (2010-2019), a period where value investing lost its sheen and even long-time value investors started questioning its standing, and then extend this discussion to 2020 as COVID has caused further damage. I will close by looking at the explanations for this lost decade, not so much as a post-mortem, but to get a measure of what value investors may need to do going forward.

The Dark Side of the Good Old Days

For value investors, nostalgic for the good old days, when the dominance of value investing was unquestioned, I think it is worth pointing out that the good old days were never that good, and that even in those days, there were legitimate questions about the payoff to value investing that remained unanswered or ignored.

Revisiting the Value Premium

For some value investors, the graph from my last post, showing that low price to book stocks have outperformed high price to book stocks by more than 5% a year, going back to 1927 in the US, is all the proof they need to conclude that value investing has won the investing game, but even that rosy history has warts that are worth examining. In the graph below, I look at the year-to-year movements in the value premium, i.e. the difference between the annual returns on the lowest and highest deciles of price to book ratios:

Source: Ken French |

While it is true that low price to book stocks earned higher annual returns than high price to book stocks over the entire time period, note that there is significant variation over time, and that the high price to book stocks delivered higher returns in 44 of the 93 years of data. In fact, one of the pitches that growth investors made, with some success, during the glory days of value investing was that you could still succeed as a growth investor, if you had the capacity to time the value/growth cycle. In particular, looking back at the data on value versus growth and correlating with other variables, there are two fundamentals that seem to be correlated with whether value or growth investing emerges the winner.

- The first is earnings growth, with growth investing beating value investing when earnings growth rates are low, perhaps because growth becomes a scarcer and a bigger driver of value.

- The other is the slope of the yield curve, i.e., the difference between short-term and long-term rates, with flatter and downward sloping yield curves associated with growth outperforming and upward sloping yield curves with value outperforming.

In short, the fact that value stocks, at least based upon the price to book proxy, delivered higher returns than growth stocks, again using that proxy, obscures the reality that there were periods of time even in the twentieth century, where the latter won out.

Payoff to Active Value Investing

Investing in low PE or low PBV stocks would not be considered true value investing by most of its adherents. In fact, most value investors would argue that the while you may start with these stocks, the real payoff to value investing comes in from the additional analysis that you do, whether it be in bringing in other quantitative screens (following up on Ben Graham) and qualitative ones (good management, moats). If we call this active value investing, the true test of value investing then becomes whether following value investing precepts and practices and picking stocks generates returns that exceed the returns on a value index fund created by investing in low price to book or low PE stocks. Defined thus, the evidence that value investing works has always been weaker than just looking at the top lines, though the strength of the evidence varies depending upon the strand of value investing examined.

- Screening for Value: Since Ben Graham provided the architecture for screening for cheap stocks, it should be no surprise that some of the early research looked at whether Graham's screens worked in delivering returns. Henry Oppenheimer examined the returns on stocks, picked using the Graham screens between 1970 and 1983 and found that they delivered average annual returns of 29.4% a year as opposed to 11.5% of the index. There are other studies that do come to the same conclusion, looking at screening over the period, but they all suffer from two fundamental problems. The first is that one of the value screens that invariably gets used is low PE and low PBV, and we already know that these stocks delivered significantly higher returns than the rest of the market for much of the last century, and it is unclear from these studies whether all of the additional screens (Graham has a dozen or more) add much to returns. The second is that the ultimate test of a philosophy is not in whether its strategies work on paper, but in whether the investors who use those strategies make money on actual portfolios. There is many a slip between the cup and the lip when it comes to converting paper strategies to practical ones, and finding investors who have consistently succeeded at beating the market using screening is difficult to do.

- Contrarian Value: The early evidence on contrarian investing came from looking at loser stocks, i.e., stocks that have gone down the most over a prior period, and chronicling the returns you would earn if you bought these stocks. One of the earliest studies, from the mid 1980s, presented this eye-catching graph, backing up the thesis that loser stocks are investment winners:

Source: DeBondt and Thaler, |

Loser stocks, defined as the stocks that have gone down the most in the last year, deliver almost 45% more in returns than winner stocks, defined as stocks that have gone up the most in the last year. Before you jump out and start buying loser stocks, research in subsequent years pointed to two flaws. The first was that many of the loser stocks in the study traded at less than a dollar, and once transactions costs were factored in, the payoff to buying these stocks shrunk significantly. The second came in a different study, which made a case for buying winner stocks with this graph:

Source: Jegadeesh and Titman |

Note that winner stocks continue to win, in both time periods examined, in the first twelve months after the portfolios are created, though those excess returns fade in the months thereafter. Put simply, if you invest in loser stocks and lose your nerve or your faith, and sell too soon, your loser stock strategy will not pay off.

Activist Value: Of all of the different strands of value investing, the one that seems to offer the most promise is activist investing since it is a club that only those with substantial resources can join, with the promise of bringing change to companies. The early results looked promising, as activist hedge funds seemed to offer a greater chance of beating the market than other investing approaches:

| Source: Brav (2008) |

In the 1995-2007 time period, activist value investors outstripped both hedge funds and the S&P 500, delivering super-sized returns. Those numbers though are starting to come under strain, as activist investing has widened its search and perhaps lost its focus in the last decade:

Source: CFA Institute |

In the last decade, the bloom has come off the activist investing rose, as returns from it have dropped off to the point that activist investors, at least in the aggregate, are underperforming the market. The only saving grace is that activist investing is a skewed game, where the winners win really big, and many of the losers drop out.

Indexed Value: Many value investors will blanch at the idea of letting indexed value investors into this group, but there can be no denying the fact that funds have flowed into tilted index funds, with many of the tilts reflecting historical value factors (low price to book, small cap, low volatility). The sales pitch for these funds is more often that you can not only get a higher return, because of your factor tilts, but also a bigger bang (return) for your risk (standard deviation) rather than a higher return per se (higher ratios of returns to standard deviation). The jury is still out, and my personal view is that titled index funds are an oxymoron, and that these funds should be categorized as minimalist value funds, where you try to minimize your activity so as to lower your costs.

The most telling statistics on the failure of value investing come from looking at the performance of mutual fund managers who claim to be its adherents. While the earliest studies of mutual funds looked at them as a group, and concluded that they collectively underperformed the market, later studies have looked at mutual funds, grouped by category (small cap vs. large cap, value vs. growth) to see if fund managers in any of these groupings performed better than managers in other groupings. None of these studies have found any evidence that value fund managers are more likely to beat their index counterparts than their growth fund counterparts. It is telling that value investors, when asked to defend their capacity to add value to investing, almost never reference that research, partly because there is little that they can point to as supportive evidence, but instead fall back on Warren Buffett, as their justification for value investing. As I noted in my last post, there is no doubt about Buffett's success over the decades, but as the man turned ninety this year, it is worth asking whether the continued use of his name is more a sign of weakness in value investing rather than of strength.

Wandering in the wilderness? Value Investing in the last decade

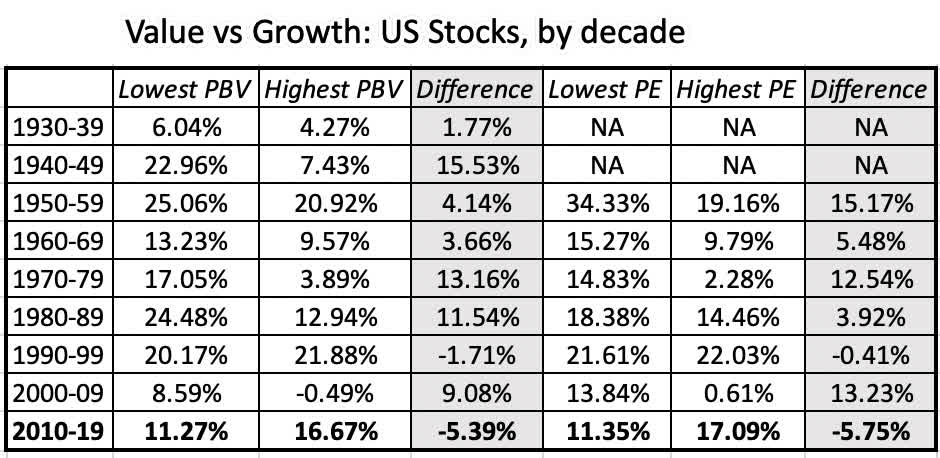

Looking at my analysis of value investing over the last century, you can accuse me of perhaps nitpicking an overall record of success, but the last decade has, in my view, tested value investing in ways that we have never seen before. To see how much of an outlier this period (2010-2019) has been, take a look at the returns to low and high PBV stocks by decade:

|

Source: Ken French |

While it is true that the dot-com boom allowed growth stocks to beat out value stocks in the 1990s, the difference was small and bunched up in the last few years of that decade. In the 2010-2019 time period, in the battle between value and growth, it was no contest with growth winning by a substantial amount and in seven of the ten years.

To make things worse, active value investors, at least those that run mutual funds, found ways to underperform even these badly performing indices. Rather than use risk and return models or academic research to back up this proposition, and open up the debate about portfolio theories, I will draw on a much more simplistic but perhaps more effective comparison. One of S&P's most informative measures is SPIVA, where S&P compares the returns of fund managers in different groupings to indices that reflect that grouping (value index for value funds, growth index for growth funds, etc.) and reports on the percentage of managers in each grouping that beat the index. Listed below are the SPIVA measures for 2005-2019 for value managers in all different market cap classes (large, mid-sized, small):

Risk Adjusted SPIVA Scorecard (2019) |

Put simply, most value fund managers have had trouble beating the value indices, net of fees. Even gross of fees, the percentages of fund managers beating their indices stays well above 50%.

Even legendary value investors lost their mojo during the decade, and even Warren Buffett's stock picking delivered average returns. He abandoned long-standing practices, such as using book value as a basis for estimating intrinsic value and never doing buybacks, for good and bad reasons. The best indicator of how the market has also lowered the value it attaches to his stock picking is in a number that has the Buffett imprimatur, the ratio of price to book at Berkshire (BRK.A) (BRK.B) in the last few years:

Since Berkshire's assets are primarily in publicly-traded companies, and these investments have been marked to market for all of this period, one way to look at a portion of the premium that investors are paying over book value is to consider it to be the stock picker premium. Since some of the premium can also be explained by its presence in the insurance business, I compared the price to book for Berkshire to that of general insurance companies listed and traded in the United States. At the start of 2010, Berkshire traded at a price to book ratio of 1.54, well above the US insurance company industry average of 1.10. Ten years later, at the start of 2020, the price to book ratio for Berkshire had dropped to 1.27, below the average of 1.47 for US insurance companies. The loss of the Buffett premium may seem puzzling to those who track news stories about the man since he is still not only treated as an investing deity, but also viewed as the person behind every Berkshire Hathaway decision, from its investment in Apple (AAPL) in 2017 to its more recent one in the Snowflake (SNOW) IPO. My reading is that markets are less sentimental and more realistic in assessing both the quality of his investments (that he is now closer to the average investor than he has ever been) and the fact that at his age, it is unlikely that he is the lead decision-maker at Berkshire anymore.

The COVID shock

For much of the decade, value investors argued that their underperformance was a passing phase, driven by the success of growth and momentum and aided and abetted by the Fed, and that is value investing would come back with a vengeance in a crisis. The viral shock delivered by the coronavirus early this year seemed to offer an opportunity for value investing, with its emphasis on safety and earnings, to shine.

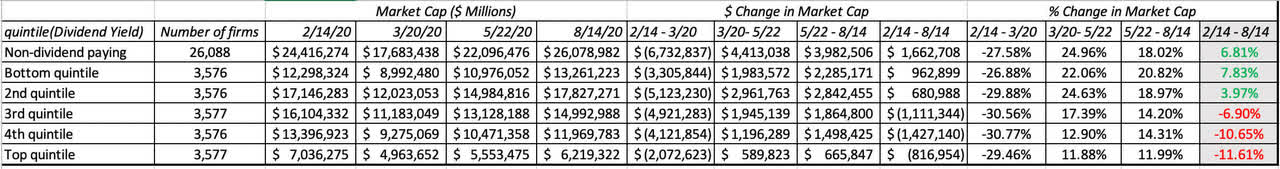

In the first few weeks, there were some in the value investing camp who argued that following old-time value-investing precepts and investing in stocks with low PE and price to book ratios and high dividends would help buffer investors from downside risk. While the logic may have been appealing, the results have not, as can be seen in this table, where I look at stocks classified based upon their PE ratios and price to book ratios on February 14, 2020 (at the start of the crisis), and examining the changes in the aggregate market capitalization in the six months following:

The numbers speak for themselves. Low PE and low PBV stocks have lost value during this crisis, just as high PE and PBV stocks have gained in value. Breaking companies down based upon dividend yields, and looking at market capitalization changes yields the following:

The results are perverse, at least from a value investing perspective, since the stocks that have done best in this crisis are non-dividend paying, high-PE stocks, and the stocks that have done worst during the crisis have been high-dividend-paying, low-PE stock.

The Explanations

The attempt to explain what happened to value investing in the last decade (and during COVID) is not just about explaining the past, since the rationale you provide will inform whether you will continue to adhere to old-time value-investing rules, modify them to reflect new realities or abandon them in search of new ones. In particular, there are four explanations that I have heard from value investors for what were wrong during the last decade, and I will list them in their order of consequence for value investing practices, from most benign to most consequential.

-

This is a passing phase!

Diagnosis: Even in its glory days, during the last century, there were extended periods (like the 1990s) when low PE and low PBV stocks underperformed, relative to high PE and high PBV stocks. Once those periods passed, they regained their rightful place at the top of the investing heap. The last decade was one of those aberrations, and as with previous aberrations, it too shall pass!

Prescription: Be patient. With time, value investing will deliver superior returns.

-

The Fed did it!

Diagnosis: Starting with the 2008 crisis and stretching into the last decade, central banks around the world have become much more active players in markets. With quantitative easing, the Fed and other central banks have contributed not only to keeping interest rates lower (than they should be, given fundamentals) but also provided protection for risk taking at the expense of conservative investing.

Prescription: Central banks cannot keep interest rates low in perpetuity, and even they do not have the resource to bail out risk takers forever. Eventually, the process will blow up, causing currencies to lose value, government budgets to implode and inflation and interest rates to rise. When that happens, value investors will find themselves less hurt than other investors.

-

The Investment World has become flatter!

Diagnosis: When Ben Graham listed his screens for finding good investments in 1949, running those screens required data and tools that most investors did not have access to, or the endurance to run. All of the data came from poring over annual reports, often using very different accounting standards, the ratios had to be computed with slide rules or on paper, and the sorting of companies was done by hand. Even into the 1980s, access to data and powerful analytical tools was restricted to professional money managers and thus remained a competitive advantage. As data has become easier to get, accounting more standardized and analytical tools more accessible, there is very little competitive advantage to computing ratios (PE, PBV, debt ratio etc.) from financial statements and running screens to find cheap stocks.

Prescription: To find a competitive edge, value investors have to become creative in finding new screens that are either qualitative or go beyond the financial statements or in finding new ways of processing publicly accessible data to find undervalued stocks.

-

The global economy has changed!

Diagnosis: At the risk of sounding cliched, the shift in economic power to more globalized companies, built on technology and immense user platforms, has made many old time value investing nostrums useless.

Prescription: Value investing has to adapt to the new economy, with less of a balance sheet focus and more flexibility in how you assess value. Put simply, investors may have to leave their preferred habitat (mature companies with physical assets bases) in the corporate life cycle to find value.

From listening to value investors across the spectrum, there does not seem to be a consensus yet on what ails it, but the evolution in thinking has been clear. As the years of underperformance have stretched on, there are fewer value investors who believe that this is a passing phase and that all that is needed is patience. There are many value investors who still blame the Fed (and other central banks) for their underperformance, and while I agree with them that central banks have sometimes overreached and skewed markets, I also think that this belief has become a convenient excuse for not looking at the very real problems at the heart of value investing. Especially after the COVID experience, there are at least some value investors who are willing to consider the possibility that it is time to change the way we practice value investing. In my next post, I will look at some of these changes.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.