Quick Take

Atea Pharmaceuticals (NASDAQ:AVIR) has filed to raise $253 million in an IPO of its common stock, according to an S-1 registration statement.

The company is a clinical stage biopharma developing therapeutics for virus-borne diseases such as Covid-19 and others.

AVIR has produced positive safety trial results but the IPO appears excessively valued, so I'll pass on the IPO.

Company & Technology

Boston, Massachusetts-based Atea was founded to develop treatments for virus-borne diseases such as Hepatitis C, Dengue and more recently Covid-19.

Management is headed by founder, president, CEO and Chairman Jean-Pierre Sommadossi, Ph.D., who was previously co-founder at Idenix Pharmaceuticals.

Below is a brief overview video of Hepatitis C:

Source: Johns Hopkins Medicine

The firm's lead candidate, AT-527, is being developed for the treatment of the Covid-19 virus, SARS-CoV-2.

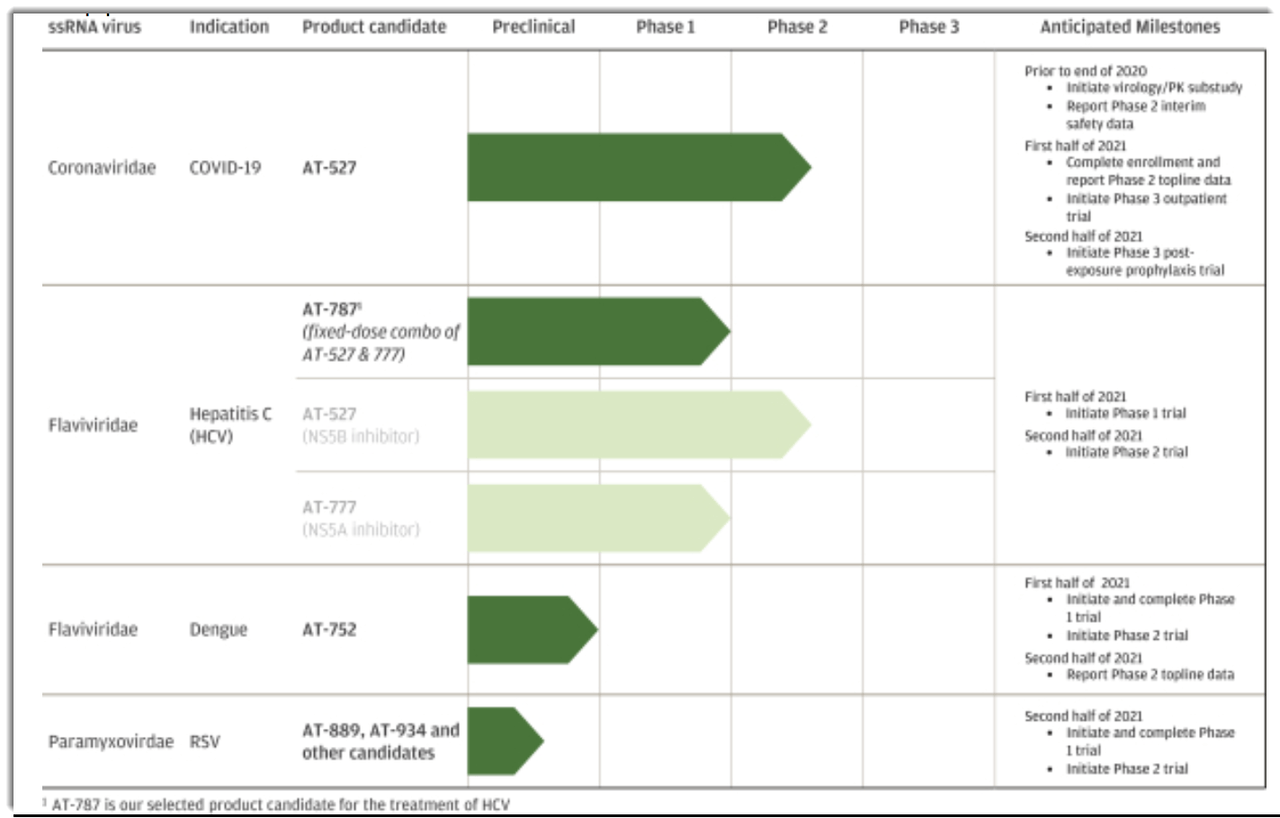

Management expects to report Phase 2 interim safety data by the end of 2020 and initiate Phase 3 outpatient trial by 1H 2021.

Below is the current status of the company’s drug development pipeline:

Source: Company S-1 Filing

Investors in the firm have invested at least $69 million and include JPM Partners, Morningside Investments, Cormorant and Bain Capital Life Science Investors.

Market & Competition

The global market for a successful Covid-19 treatment is difficult to quantify, but is likely to be well above $20 billion per year, as diagnostics and detection kits markets are $17 billion and $4.6 billion each, respectively.

Key elements driving this expected growth are continued expansion of the number of persons infected by the virus across the globe.

Also, there are several parts to the treatment market, including:

Antiviral medicine

Plasma therapy

Immunotherapy

Life support

Others

Major competitive vendors that provide or are developing Covid-19 treatments include:

Gilead Sciences (GILD)

Fujifilm Pharma

Ridgeback Biotherapeutics

Regeneron Pharmaceuticals (REGN)

Eli Lilly (LLY)

Others

Financial Status

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis. Get started with a free trial!