As you have probably read in various REIT-related articles here on Seeking Alpha and likely already know, cell-towers have been one of the least affected and most resilient real estate areas during the ongoing pandemic. One of our favorite stocks in the sector is Crown Castle (NYSE:CCI), which we have previously classified as a must-have company for dividend-growth investors.

A few days ago, the company reported its Q3 results, posting another quarter of satisfactory performance, reaffirming our bullish thesis. Despite robust earnings and management's raised guidance, shares have remained relatively flat lately while slightly dipping post-earnings. As a result, we believe that Crown Castle remains a compelling buy for dividend growth investors, offering satisfactory returns over the medium-term.

Source: Google Finance

Discussing earnings

Benefiting from uninterrupted tower rental revenues, cell-tower companies, including Crown Castle, have been able to generate consistent cash flows, with little to no correlation to the adverse effects of COVID-19. The company's recent quarter further displayed this case, recording rental revenue growth of 4%, to $1.34 billion. The increase comprised about 9.1% from new leasing activity and contractually locked escalations, while suffering only around 3.6% from tenant non-renewals, lifting the figure to an all-time quarterly high.

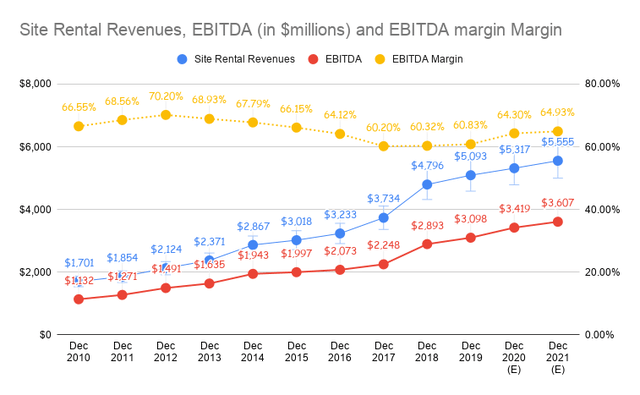

Due to enjoying a relatively more predictable outlook than the rest o of its sector, management is confident enough to guide FY2021. The current and next financial year's Rental revenues are expected to be $5.3 billion and $5.5 billion, respectively, as we have illustrated in the graph below.

The company's EBITDA margin is also expected to expand, likely due to increased average tenant per tower, kicking in economies of scale. As a result, management has projected up to FY2021's FFO/share of $6.70, implying a double-digit growth in the short term. This is particularly exciting since this growth rate beats management's very own

The company's EBITDA margin is also expected to expand, likely due to increased average tenant per tower, kicking in economies of scale. As a result, management has projected up to FY2021's FFO/share of $6.70, implying a double-digit growth in the short term. This is particularly exciting since this growth rate beats management's very own

Wheel of FORTUNE is a one-stop-shop, covering all asset-classes (common stocks, preferred shares, bonds, options, commodities, ETFs, and CEFs), across all sectors/industries, through single trading-ideas and model-managed portfolios.

The extremely-wide scope of the service allows us to cater all types (of investors) and (investment) needs/goals, making WoF a true one-service-fits-all.

Our offering includes, but isn't excluded to, the following:

- Weekly macro coverage of the markets.

- Trading Alerts. We generate >250 suggestions a year, every year!

- Trading Alerts Directory, where all trades are monitored.

- Funds Macro Portfolio, comprised of up-to-25 funds.