At the time of writing, the ProShares VIX Short-Term Futures ETF (BATS:VIXY) is having its strongest day in a few weeks as the VIX has risen by over 15% on the back of a sliding stock market.

While we may continue to see some uplift in VIXY due to seasonal factors, I believe that this current rally will prove to be a great long-term selling opportunity. It is my belief that now is a strong time to sell the ETF for all but the shortest-term investors.

VIX Markets

To start this piece off, I’d like to frame up the recent movements in the VIX to get an idea as per where the index could likely travel over the coming weeks.

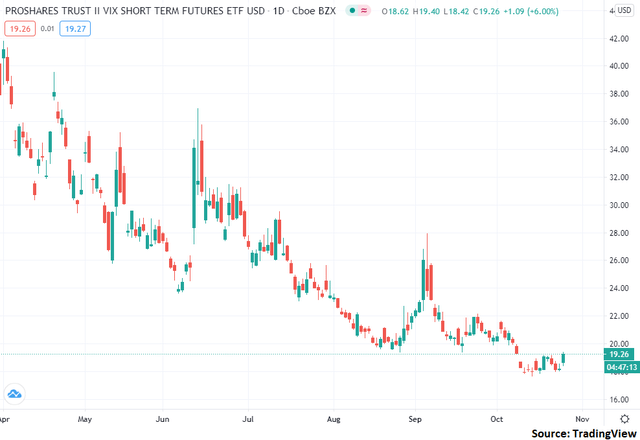

As you can see in the chart above, the VIX is currently pushing into the highest levels seen since early September. This rise in the VIX is associated with a clear decline in the S&P 500 as the market seems to have been caught off its feet by the rising virus count as well as stalling stimulus discussions.

It is times like these that investors may be tempted to jump on the growing momentum of the VIX through buying VIXY. I believe this would be the wrong move at this point because the numbers suggest that now is actually a strong selling opportunity.

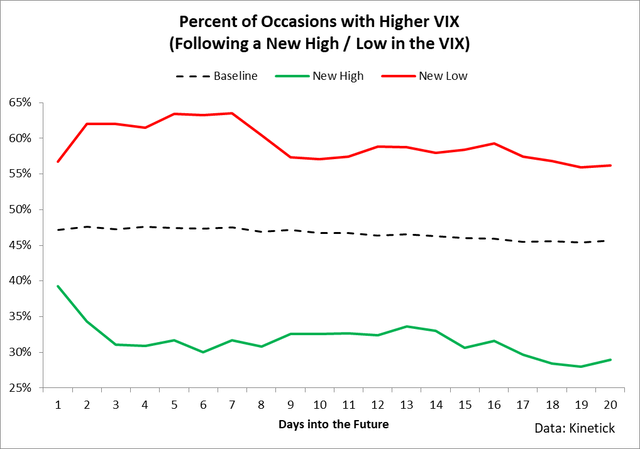

One study which clearly suggests that the VIX is likely going to decline in the coming days and weeks is the historic market tendencies showing the mean-reverting nature of VIX movements.

In this study, I have calculated the historic probability that the VIX is higher or lower a certain number of days into the future after the VIX hits a 1-month high or a 1-month low. For example, at the time of writing, the VIX is currently hitting a new 1-month