Looking for high yield opportunities in the natural gas midstream industry? Natural gas futures have risen 84% in the past quarter, and we may be headed for a colder winter this year, thanks to La Nina.

ONEOK Inc. (NYSE:OKE) engages in gathering, processing, storage, and transportation of natural gas in the United States. It operates through Natural Gas Gathering and Processing, Natural Gas Liquids, and Natural Gas Pipelines segments. The company owns natural gas gathering pipelines and processing plants in the Mid-Continent and Rocky Mountain regions. (OKE site)

Earnings:

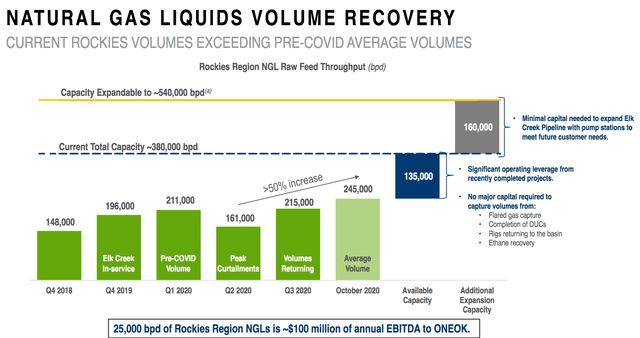

Q3 2020 saw a 34% increase in NGL volume for OKE, at 215K barrels/day, which was a bit higher than its pre COVID-19 level of 211K bpd. Management has recently completed several expansion projects, which have an additional 135 bpd potential, based upon drilled uncompleted wells, DUCs being completed, more rigs returning to activity, and flaring recapture:

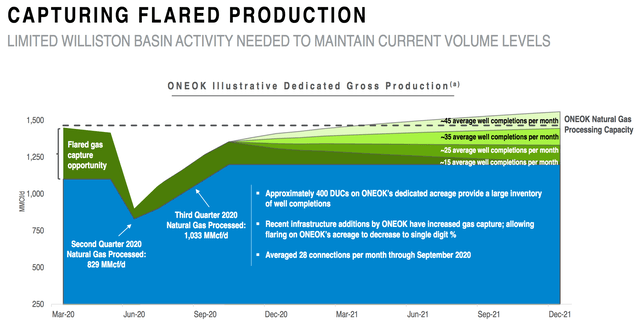

The technology has improved for recapturing more flared natgas, which will reduce the amount lost from flaring, and increase efficiencies:

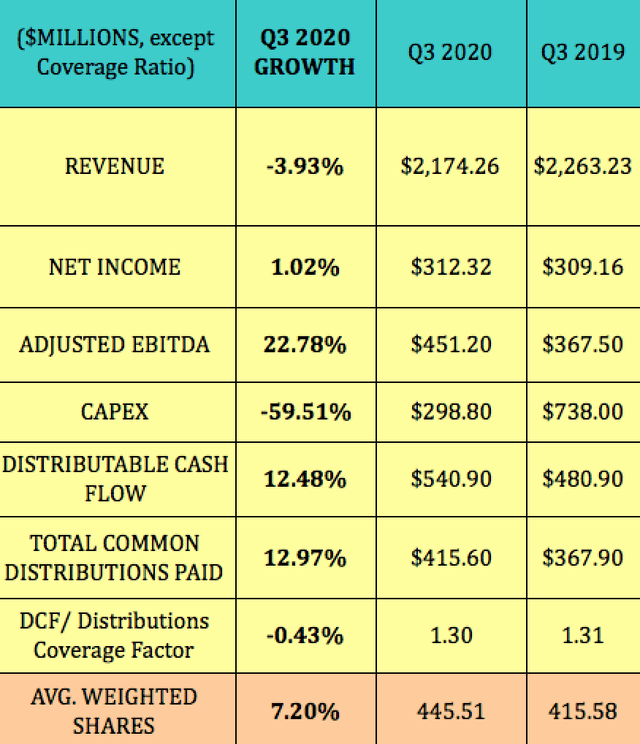

While revenue was down -3.93% in Q3 2020, EBITDA grew 22.78% in Q3 '20, DCF was up 12.48%, and net income rose 1%:

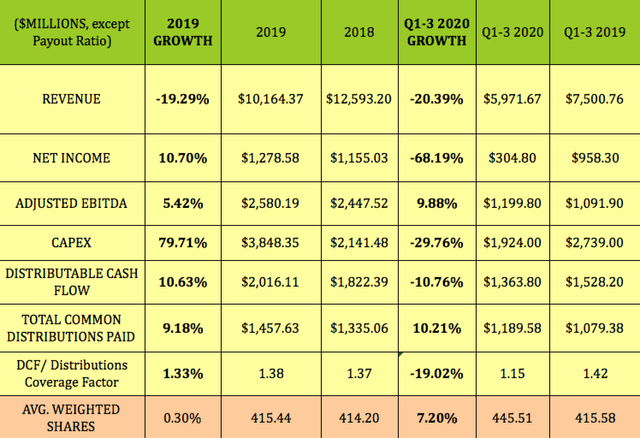

Those positive numbers stand in stark contrast to OKE's Q1-3 2020 figures, which, like most companies, were mostly down due to Q1-2 COVID-19 pressures. However, adjusted EBITDA did grow 9.88% in Q1-3 2020, better than the 5.42% growth seen in 2019.

Those positive numbers stand in stark contrast to OKE's Q1-3 2020 figures, which, like most companies, were mostly down due to Q1-2 COVID-19 pressures. However, adjusted EBITDA did grow 9.88% in Q1-3 2020, better than the 5.42% growth seen in 2019.

Like most midstream firms, OKE cut way back on capex in 2020, scaling it back by ~30%, vs. a major 79.7% push in 2019.

OKE's share count rose by 7.2% in Q2 2020 - in June it did a public offering of 26 million shares of its common stock at a price to the public of $32.00/share, which grossed ~$832.0 million.

OKE just went

Our Marketplace service, Hidden Dividend Stocks Plus, focuses on undercovered, undervalued income vehicles, and special high yield situations.

We scour the US and world markets to find solid income opportunities with dividend yields ranging from 5% to 10%-plus, backed by strong earnings.

We publish exclusive articles each week with investing ideas for the HDS+ site that you won't see anywhere else.

We offer a range of income vehicles, many of which are selling below their buyout and redemption values. Our latest buyout success story has a 39% total return.