Aberdeen Global Premier Properties Fund (NYSE:AWP) has not had a pleasant 2020. The real estate fund has lagged both the Vanguard Real Estate ETF (VNQ) and the Vanguard Global Ex-U.S. Real Estate ETF (VNQI).

The lag has also been rather substantial and hardly something that we can just sweep under the carpet. We look at what has gone wrong and whether the fund can catch up its benchmarks in 2021.

The Fund

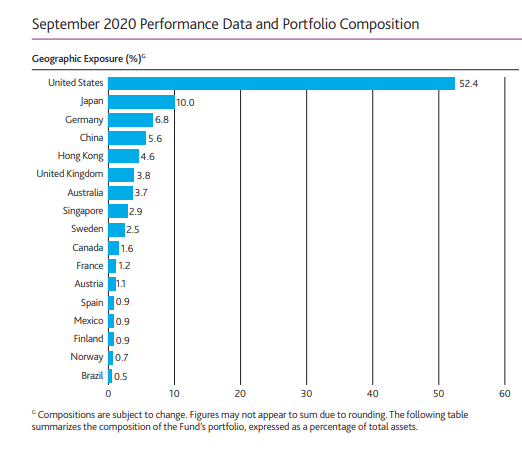

AWP aims to exploit global real estate through value investing. The fund has split ownership of its assets about equally between the US and outside the US. The bulk of overseas involvement is in developed countries, but it does hold some REITs across the developing markets as well.

Source: AWP Quarterly Report

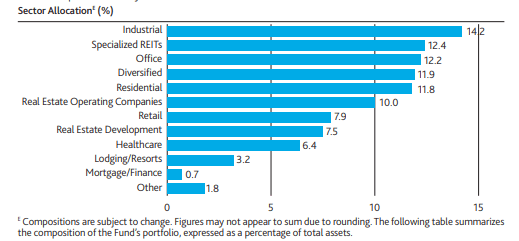

AWP invests across the spectrum of REITs and currently has its highest concentration in the industrial space.

Source: AWP Quarterly Report

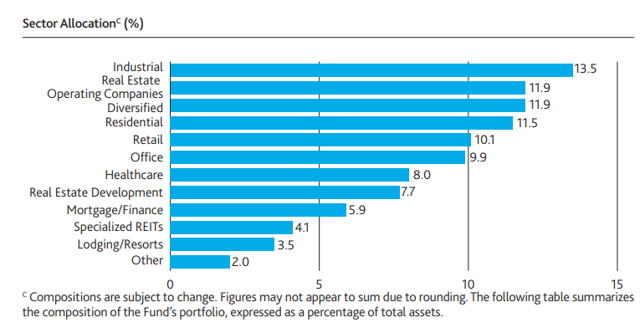

AWP has been actively managing its portfolio and we can see that by examining its portfolio composition over time. For example, this older sector allocation screenshot (from 2019) shows that it had weighed Mortgage REITs rather heavily previously.

Source: AWP Quarterly Report From 2019

Currently AWP has industrial REITs at the highest weightage. Some of this is through choice and some of it has likely come via industrial and distribution assets outperforming retail and office spaces. AWP also has positions in real estate operating and development companies. These are ones that are not bound by REIT rules and typically they pay very little in the way of dividends. Some of these have been more impacted by COVID-19 as they usually tend to have less predictable income to start with.

Top Holdings

AWP owns a very large number of real estate companies and the full list can be found over here. Note the list is from

Are you looking for Real Yields which reduce portfolio volatility and outperform in bear markets?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Cash Secured Put and Covered Call Portfolios are designed to reduce volatility while generating 7-9% yields. We focus on being the house and take the opposite side of the gambler.

Learn more about our method & why it might be right for your portfolio. We are offering the next 20 subscribers a 20% discount to try our method risk-free!