Investment Thesis

American Tower (NYSE:AMT) is a leader in the telecommunications real estate market. As such, they are well positioned to benefit from certain growth drivers: edge computing, the build-out of 5G networks in advanced countries, and the continued build-out of 3G and 4G networks in developing countries. Due to these growth drivers and a history of steadily increasing dividend payments, I rate American Tower a modest buy at $230.

American Tower Overview

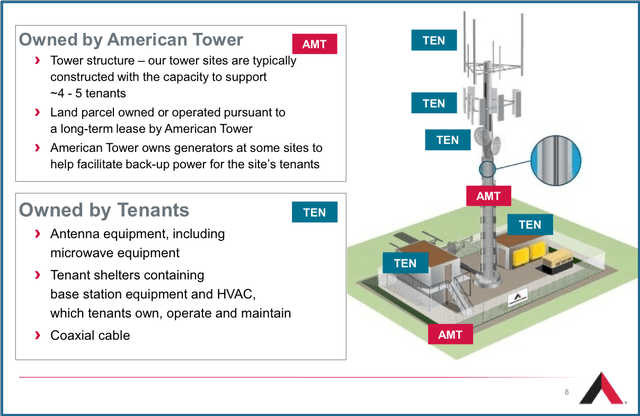

American Tower owns and operates telecommunications real estate on several different continents. In total, American Tower's property portfolio includes ~181,000 communications sites. The graphic below depicts a typical tower site.

Source: American Tower Presentations (Introduction To The Tower Industry)

American Tower generates revenue by leasing tower space to carriers, like AT&T (T) or Verizon (VZ). This allows carriers to install antenna equipment without needing to build towers themselves, which would be incredibly expensive. In this way, American Tower's expansive real estate network creates a barrier to entry.

But American Tower's business model also offers another advantage. Each cell tower typically supports 3-4 tenants. But operating expenses are largely unaffected by the number of tenants per tower. This means, with each additional tenant, the return on investment increases. With one tenant, ROI is roughly 3%, but with three tenants, ROI rises to roughly 24%. This represents a cost advantage, which reinforces the barrier to entry.

In the next few sections of this article, I will discuss three factors that should drive growth for American Tower over the next five years and beyond.

American Tower & 5G Networks

Implementation of 5G will require low, mid, and high-band spectrum to provide adequate coverage and capacity. These terms refer to the frequency of the radio waves that create cell networks. Low-band waves have a frequency of less than 1GHz, mid-band waves have a frequency of 1GHz - 6GHz, and