It's been a rough couple of months for the junior gold sector (GDXJ) with the price of gold (GLD) correcting, but several names continue to sport triple-digit year-to-date returns even after the drop. One of these names is Tudor Gold (OTCPK:TDRRF), a gold junior that's busy exploring its Treaty Creek Project in the Golden Triangle of British Columbia. Over the past year, the company has released several 500-meter plus intercepts of low-grade gold and looks to be defining a significant gold system at its Goldstorm Zone. However, with Tudor's market cap now sitting above US$360 million pre-resource, the valuation has become an issue. All figures are in US Dollars unless otherwise noted.

(Source: Company Presentation)

(Source: Company Presentation)

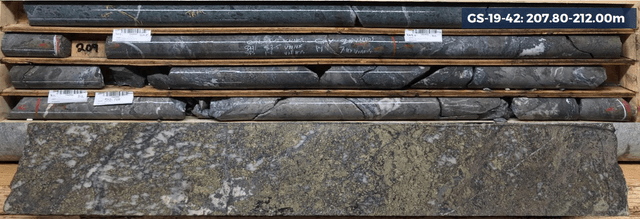

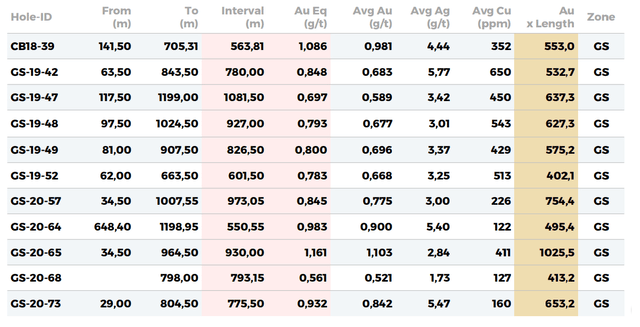

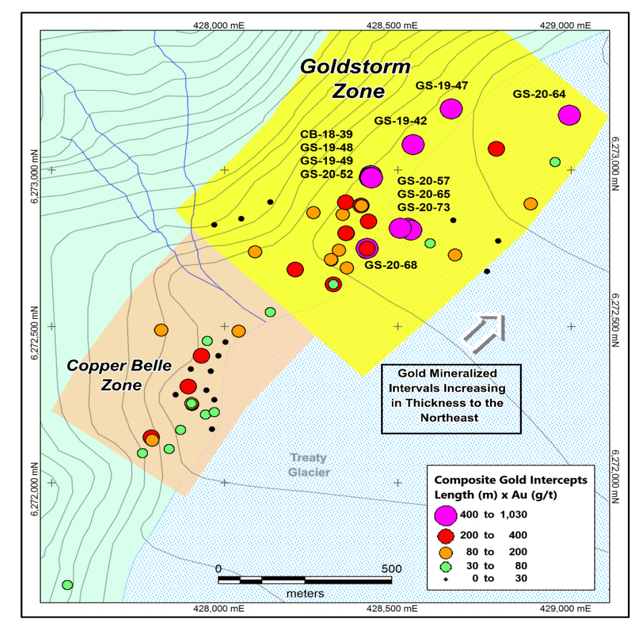

Tudor Gold has had an exciting drill season at its Treaty Creek Project in the Golden Triangle and has now outlined a mineralized area with a strike length of over 1 kilometer that's up to 600 meters wide at Goldstorm. Meanwhile, the Copper Belle Zone at Treaty Creek to the southwest of Goldstorm has been extended to a strike length of up to 650 meters, with the total strike length of the two deposits coming in at nearly 1.5 kilometers. Most recently, Tudor intersected 1,152 meters of 0.74 grams per tonne gold equivalent, which was the longest mineralized intercept drilled to date in GS-20-75, and this hole continues to show a pattern of 500-meter plus intercepts that are coming in at a grade of over 0.80 gram per tonne gold-equivalent on average. Typically, holes that can intersect even 300 meters of mineralization are quite rare, so the drilling is undoubtedly quite impressive. We can take a look at some of the results below:

(Source: Company Presentation)

(Source: Company Presentation) (Source: Company Presentation)

(Source: Company Presentation)

As the above table shows, the lowest-grade hole of these highlight intercepts is 0.56 grams per tonne gold