The resource problem

We're all inured to the idea that resources are becoming scarcer and so should be rising in price. It's obvious, we've used the easy stuff and so the minerals we want to use in the future will come from lower grade deposits and thus necessarily we'll have to pay higher prices for them.

This is compounded when we think about newly fashionable resources like lithium - or the neodymium and dysprosium for magnets to take another current obsession.

The thing is this isn't actually how it works out. Natural resources tend to get cheaper over time, not more expensive. Something is wrong with that world view that tells us things should be getting more scarce. There was that Ehrlich Simon bet and it was Julian Simon, betting that metals prices would fall, who won.

The reason for this is that extraction technology changes over time.

Thus we need to divide junior miners into two different classes, or groups. Those that are just a new entrant into an already extant and mature market. Say, a small gold miner. Their exploitation of a new deposit isn't - except at the very margin - going to change the global price of gold. We can thus evaluate the company on the basis of how much is there in them thar hills and how efficient will they be at extracting it?

Then there are those caught up in the excitement of a new market. Yes, we've got to look at their proficiency, their ability to finance and so on. But we're now exposed also to the excitement of that new market. This being something that all too many only look at the upside of and don't consider the downside.

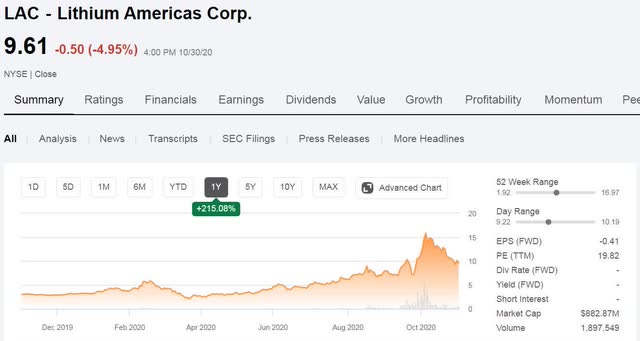

Lithium Americas Corporation (NYSE:LAC)

(Lithium Americas share price from Seeking Alpha)

(Lithium Americas share price from Seeking Alpha)

There's