Investment Review: Corning Incorporated

Corning Incorporated (NYSE:GLW) offers poor prospects for share price growth. Increases in indebtedness to fund share repurchases has been ineffective for growing EPS, and has weakened the balance sheet. The headline "Core" earnings and EPS are illusory from a point of view of income available to pay dividends and fund share repurchases. Corning may benefit from increased revenue for some of its businesses supplying products related to the ongoing COVID-19 pandemic. This is considered unlikely to bridge the gap between the realistically calculated net income, available for distribution to shareholders, and the dividend payment. Increased borrowings are likely to be continued to be required for partial funding of the dividend. I set out below the detailed case in support of these opinions.

Looking for share market mispricing of stocks

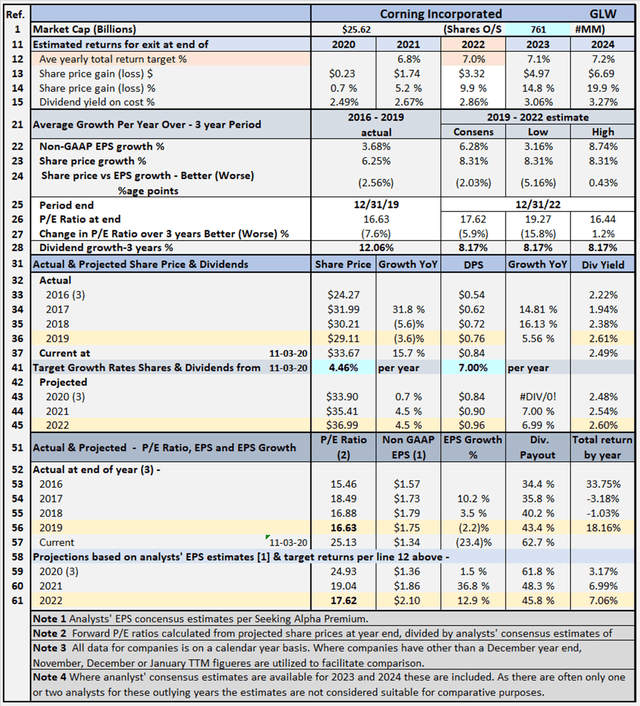

What I'm primarily looking for here are instances of share market mispricing of stocks due to distortions to many of the usual statistics used for screening stocks for buy/hold/sell decisions. The usual metrics do not work when the "E" in P/E is distorted by the impact of COVID-19. And, if the P/E ratio is suspect, so too then is the PEG ratio similarly affected. I believe the answer is to start with data at the end of 2019, early 2020, pre COVID-19 and compare to projections out to end of 2022, when hopefully the impacts of COVID-19 will have largely dissipated. Summarized in Tables 1, 2, and 3 below are the results of compiling and analyzing the data on this basis.

Table 1 Detailed Financial History And Projections

Table 1 documents historical data from 2016 to 2019, including share prices, P/E ratios, EPS and DPS, and EPS and DPS growth rates. The table also includes estimates out to 2022 for share prices, P/E ratios, EPS and DPS and EPS and DPS growth rates (note estimates

Dividend Growth Income+ Club - Register today for your Free Trial.

Click Triple Treat Offer (1) Your Free 2 Week Trial; (2) 20% Discount New Members; (3) Bespoke reviews for tickers of interest to subscribers.