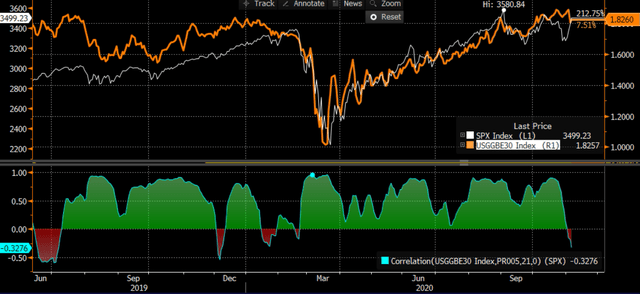

Over the past few days, we have seen U.S. stocks surge back to near all-time highs despite a dip in long-term breakeven inflation expectations, marking a near-term blip in the strong positive correlation in place since March. Our best guess is that investors appear to be expecting reduced prospects of fiscal stimulus under a Biden Presidency and a Republican Senate, depressing inflation expectations and bond yields, and more money printing from the Fed, lifting stocks.

30-Year Breakeven Inflation Expectations Vs SPX

Source: Bloomberg

This goldilocks reaction is unlikely to last and we think this provides an opportunity to sell U.S. stocks and position for rising inflation in the ProShares Inflation Expectations ETF (NYSEARCA:RINF). The RINF offers all the upside potential from increased money printing with fewer downside risks in the event of contracting U.S. equity valuations.

Near-Term Correlation To Remain Intact

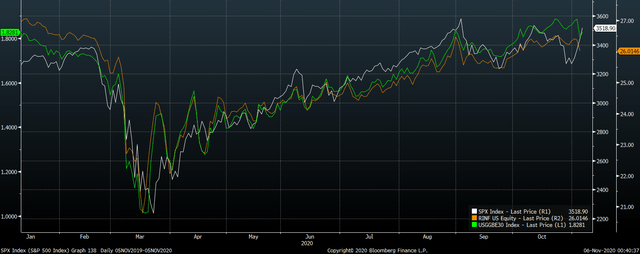

The RINF tracks an index with long exposure to 30-year U.S. TIPS and short exposure to 30-year U.S. Treasuries, gaining when yields on Treasuries increase relative to those on TIPS. The ETF therefore tracks investor expectations of long-term consumer price inflation. We first recommended the ETF back in April (see 'Inflation Expectations Are Way Underpriced') and since then it is up 15% having risen alongside stocks, albeit in much less volatile fashion.

RINF ETF Vs SPX

Source: Bloomberg

In the near term stocks are likely to remain positively correlated with inflation expectations. As the chart above shows, the RINF and breakeven inflation expectations have moved in lockstep with the SPX this year as both markets are being driven by similar dynamics. Expectations of higher inflation as a result of easing monetary and fiscal policy has helped to lift stocks, while rising optimism over the economy as seen through rising stock prices has helped to lift inflation expectations. Despite the decoupling of the