When NXP Semiconductors (NASDAQ:NXPI) pre-announced its quarterly results on Oct. 8, investors knew the actual results would beat estimates. Automotive markets are on a positive inflection point. Previously, investors who bet earlier this year that the pandemic from the coronavirus would hurt the automotive market missed out on NXPI’s uptrend.

![]()

The semiconductor posted strong revenue growth above its midpoint guidance, especially in automotive and mobile. As demand continues to increase, the stock could trade at new highs in the coming months.

Why is NXPI stock a buy after returning 43% since this publication?

Strong Business

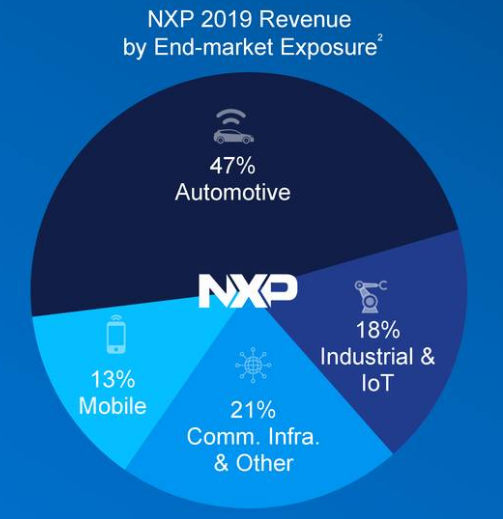

Automotive accounted for 47% of NXP’s revenue in 2019, while at 13%, mobile was the least:

Source: NXP Q3 Earnings Call Presentation

In mobile, the company launched new products for specific customers, ahead of their new platform launches. This lifted NXP’s total revenue to $2.27 billion, a solid $267 million above the midpoint of its original guidance range. Mobile revenue grew by 5% year on year to $337 million but up 32% sequentially. Importantly, it did not benefit from any shipment ban associated with Huawei.

Samsung (OTCPK:SSNLF) will adopt NXP’s secure ultra-wideband and mobile wallet on the Galaxy Fold and Note 20 Ultra. So, if Samsung offers this to other models in the future, revenue from the Mobile division will accelerate. The addressable market expands for these connectivity solutions in industrial end markets. Investors should expect this portfolio to perform well in 2021.

Above: NXPI stock is up a decent 15% but still trailed Qualcomm in 2020.

IoT Segment Strength

NXP forecast Industrial and IoT growing in the low 20% range. On the conference call, CEO Kurt Sievers said, “if you speak about industrial IoT, I think we are seeing this year already an amazingly strong year in industrial IoT, which is also a function of China because we have

Please [+]Follow me for coverage on deeply-discounted stocks. Click on the "Follow" button beside my name and check "real-time." Now join DIY investing today.