Introduction

Even though Delek US Holdings (NYSE:DK) initially fought to sustain its dividends, the company was still ultimately forced to completely suspend them recently - a risk that was covered in my previous article. Following this painful outcome for shareholders, this article provides an updated analysis that takes a look at the company's prospects to reinstate its dividends going forwards.

Executive Summary and Ratings

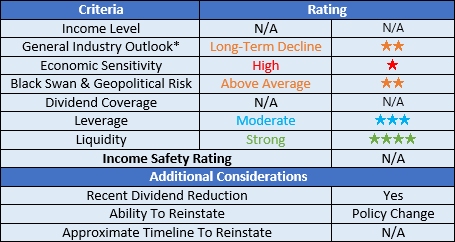

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that was assessed. This Google Document provides a list of all my equivalent ratings, as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

(Image Source: Author)

*There are significant short and medium-term uncertainties for the broader oil and gas industry. However, in the long term, they will certainly face a decline as the world moves away from fossil fuels.

Detailed Analysis

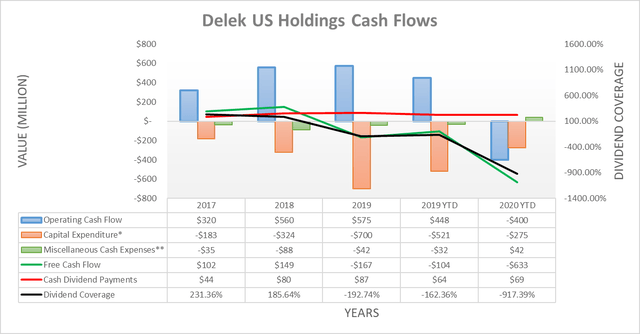

(Image Source: Author)

Instead of simply assessing dividend coverage through earnings per share, I prefer to utilize free cash flow, since it provides the toughest criteria and best captures the true impact to the company's financial position. The extent that these two results differ will depend upon the company in question and often comes down to the spread between the depreciation and amortization to capital expenditure.

When reviewing Delek US Holdings' cash flow performance, the signs of a dividend in distress were clearly evident, with its operating cash flow falling deep into the negative territory, thanks to the broad-based COVID-19 economic downturn. Using debt to fund dividend payments due to high capital expenditure is already risky in its own rights, but when it stems from negative operating cash flow, well, that is toxic and simply cannot last very long, despite the optimism