Investment Thesis

Skyworks Solutions (NASDAQ:SWKS) currently trades at a valuation of Price/Earnings 30.57 and has an Enterprise Value of 23.53 billion. There are some people that think Skyworks Solutions is overvalued at current valuations and believe the stock price could stagnate in future years like it has for the past five years. However, I think those investors are wrong and Skyworks Solutions is a buy at current prices.

Stock Price

(Source: Yahoo Finance)

Among the reasons that the stock price has stagnated the last five years is that innovation in a 4G world has declined over the last several years and mobile device sales have turned flat. Even Skyworks Solutions' biggest customer, Apple (NASDAQ: AAPL), seems to have had iPhone sales peak around 2018 or so. Recently, there was news of Apple seeing a big disappointment in iPhone 12 sales, however, there are some people that are also predicting that 5G will be the revolution that ignites a "super cycle" in iPhone sales. Since Apple makes up approximately 50% of Skyworks sales, what is good for Apple is also good for Skyworks.

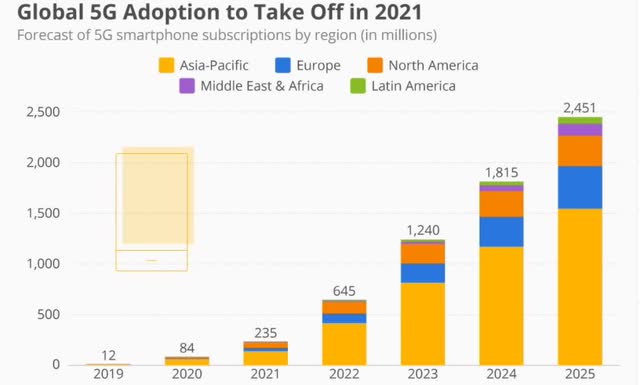

(Source: Statista)

Despite the onset of the pandemic at the beginning of the year, there is a growing belief backed by research that cheaper and more available smartphones are set to drive a 5G adoption surge, with China and Korea leading the way. The recent addition of the Apple 5G phone should now also accelerate 5G growth within the USA.

Notably, the world's leading smartphone manufacturer has just now released its entire lineup of new 5G devices, a key catalyst underpinning our growth thesis. Although we are only in the early innings, 5G has arrived, ushering in a new and expansive set of opportunities.

(Source: CEO Liam Griffin, Q4 2020 Earnings Call Transcript)

5G also enables a broad