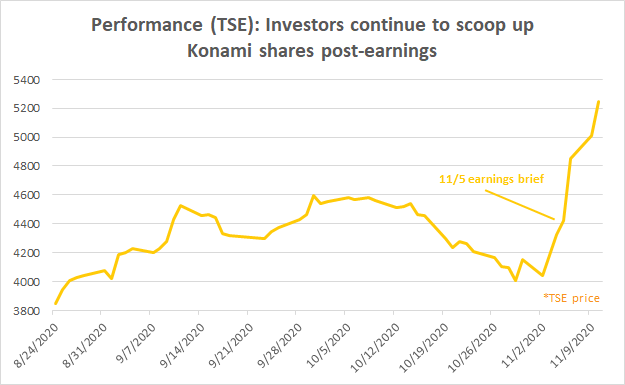

This past week, Konami (KNMCY) (OTCPK:KNAMF) released its Q2 earnings report and shares of the company experienced a wild rally I could only describe as unexpected. What I thought was a run-of-the-mill earnings report that had largely indicated Konami to be moving along trends already established seemed to actually be a red letter day for the company according to investors.

(Source: Raw data obtained from Yahoo Finance)

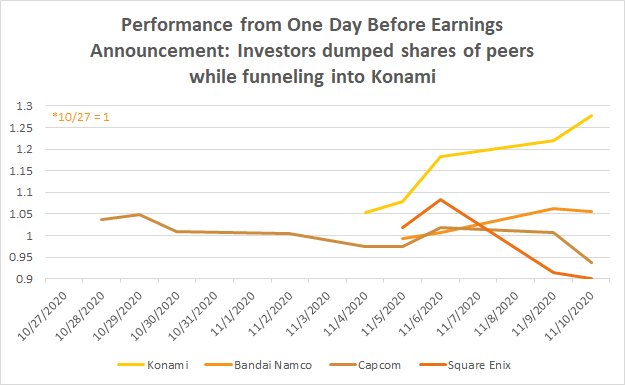

Not only did Konami's shares soar in their own right and relative to shares of peers, such as Bandai Namco (OTCPK:NCBDF) (OTCPK:NCBDY), Capcom (OTCPK:CCOEY) (OTCPK:CCOEF), and Square Enix (OTCPK:SQNXF) (OTCPK:SQNNY), which also announced earnings these past few weeks, but Konami's also outperformed by a large margin.

(Source: Raw data obtained from Yahoo Finance)

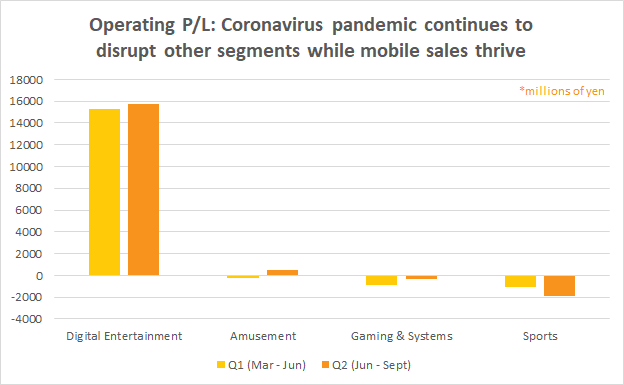

While Konami was able to point to record quarterly revenues in its mobile division as a significant achievement, not much else changed.

- Konami's other divisions, i.e. sports centers, arcades, etc., continued to suffer as a result of the coronavirus pandemic.

- With the exception of the announcement of new EDENS ZERO titles for mobile and console, the slate of games Konami had set to release was largely unchanged.

- And the business continued to be carried by the Digital Entertainment division which grew 31.8% from H1 last year, mostly by the record mobile revenues noted earlier.

So, what prompted investors to change their tune? Did investors just finally see the light on Konami come back?

Mobile revenue growth

Previously, I theorized that Konami would come to heavily rely on its mobile games business, e.g. its Yu-Gi-Oh! franchise titles and sports titles, especially amid the coronavirus pandemic. That remains largely true; despite some arcades and casinos experiencing a gradual pick-up in activity, capacity restraints and travel restrictions are still making business untenable, prompting even some, like competitor Sega Sammy (OTCPK:SGAMY) (OTCPK:SGAMF), to sell off their arcade business entirely.

(Source: Raw data obtained from Q2 earnings brief)

However, what I viewed as a possible detriment - that Konami's revenues were now so concentrated in one area that it had rendered the company's hard-fought efforts to diversify and ensure more stable cash flows void - investors apparently viewed as a positive.

| Six months ended Sept 30, 2019 | Six months ended Sept 30, 2020 | YoY Change (%) | |

| Revenue (¥ in billions) | 67.0 | 88.3 | +31.8% |

| Operating P/L (¥ in billions) | 18.7 | 30.9 | +65.2% |

| Margin | 28% | 35% | - |

Perhaps, related to the coronavirus tech-driven trades that have been the hallmark of the past year, investors view any perceived loss of diversification as insignificant to the prospects of higher margins and increased revenues in the Digital Entertainment division.

Debt now reflected in balance sheet

Back in August, I noted that tucked away in its Q1 earnings report was an addendum titled "Subsequent Events" that explained that the company had issued three unsecured bonds valued at ¥60 billion ($561 million) not included in balance sheet figures at the time. That is now finally reflected in this most recent report.

| As of March 31, 2020 | As of September 30, 2020 | |

| Non-current bonds and borrowings (¥ in millions) | 9,855 | 69,591 |

In fact, we can observe from the cash flow statement, Konami has likely already used some of the proceeds to pay off short-term borrowings.

| Financing activities (¥ in millions) | Six months ended Sept 30, 2019 | Six months ended Sept 30, 2020 |

| Proceeds from short-term borrowings | 5,429 | 5,364 |

| Repayments of short-term borrowings | (5,429) | (28,216) |

| Proceeds from issuance of bonds | - | 60,000 |

| Redemption of bonds | (5,000) | - |

| Principal payments of lease liabilities | (6,797) | (6,021) |

| Dividends paid | (8,848) | (935) |

| Other, net | (8) | (300) |

| Net cash provided by financing activities | (20,653) | 29,892 |

The net cash from this recent financing activity, in addition to operating cash flow from net income, has added to Konami's cash pile significantly, to the tune of about ¥43.8 billion over the past six months.

Is this why investors have warmed to Konami so readily? Are they betting Konami, having built this massive war chest, could tap this cash for future payouts, investments, etc. as I predicted in August? If so, that would imply investors did not read the fine print in Konami's previous filing - a concerning but nonetheless understandable assumption in the algorithm-driven trading age.

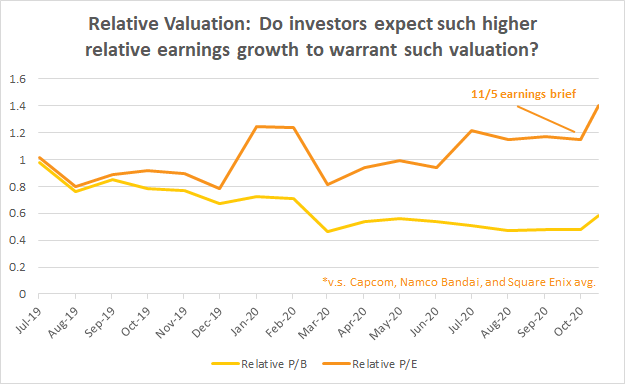

Still undervalued?

One last thing to re-examine is Konami's valuation after this massive rally. We can observe that Konami is still trading at a high relative P/E and low relative P/B, implying investors are really expecting Konami's future earnings growth to be able to outpace its peers.

(Source: Raw data obtained from YCharts)

Konami is also trading at an EV/EBITDA of around 11.5x, much more in line with peers whose median EV/EBITDA multiple was found to be around 14x; subsequently, its current price of around ¥5,000 is still shy of the ¥7,050 price target the EV/EBITDA implied in August.

The takeaway

Regardless of what caused the recent rally, the point is to look toward the future. Right now, it is clear that investors who may written off Konami in the past have been rebuked by Konami's performance.

But, in order for Konami's valuation to continue to be justified, the company will need to continue the revenue growth, maintain its current margins, and crucially figure out what to do about its failing arcades and sports centers. The ¥1 billion in leave allowance subsidies Konami received from the government doesn't even come close to covering the nearly ¥6 billion in coronavirus-related losses the company accrued in this quarter alone, mostly from its sports segment.

There has been much exuberance surrounding Pfizer's (PFE) recent advancements for a coronavirus vaccine that has contributed to large rotations back into travel and tourism sectors; however, it is impossible to model how and when capacity restraints and travel restrictions will be lifted and activity will genuinely pick back up. Investors need to consider that these segments will continue to be an albatross around Konami's neck for the foreseeable future, and the company will need to address investor concerns with more than just vague mission statements about how it hopes to continue to operate these facilities responsibly.