There is a plethora of articles and videos attacking value investing, discussing whether it is dead, detrimental, whether people like Buffett should change their strategies and embrace the new ways of investing? There is one certainty with such content; as Warren Buffett is a declared value investor, if you attack value investing you are sure to get a lot of attention and clicks.

But there are 2 key things most of these articles omit that are crucial for understanding and even just discussing value investing:

- Properly defining value investing is key to understanding it - many fail to grasp what value investing really is.

(it is not just price to book or price to earnings)

- Consequently, the key question, when you understand what is value investing, is whether value investing is something for you or not?

(value investing is what it is, it is a different strategy compared to most other, so it can't be dead; it can be for you, or it isn't for you - it is as simple as that)

This article will define value investing, focusing on the principles used by the best value investors over the past decades, from Buffett to Klarman and even Lynch (all about earnings), to give you the inputs you need to answer the most important question, which is not whether value investing is dead, but whether value investing is something for you?

Value investing definition

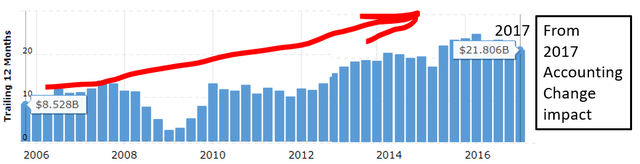

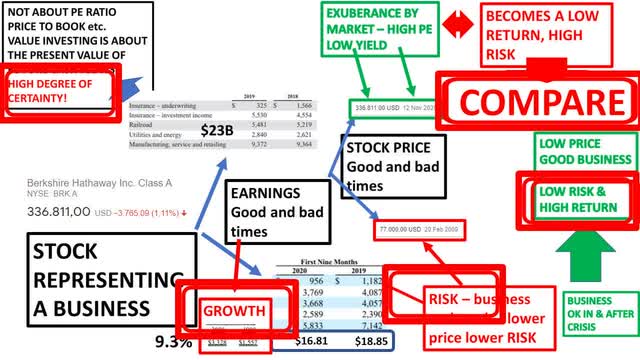

Before discussing value investing, one must first define what value investing really is. There is this constant comparison between value and growth. Here is something of a surprise then: Buffett's Berkshire Hathaway (BRK.A) (BRK.B) grew earnings at 9.3% on a yearly basis over the last 20 years putting it into the top end of growth stocks.

Berkshire's net income from 2006 to 2017 (before the accounting change impact) - Source: Macrotrends

Thus, growth is an essential part of value investing, and I believe all those pundits attacking value investing simply don't understand the essence of value investing.

I've written a book about value investing where I summarized all the key ideas from the great value investors and I came out with 10 key value investing factors. I hope this will give you an indication of what value investing really is, and most importantly, whether it is something for you or not. That is the most important question to answer.

Key value investing factors by Sven Carlin - Source: Sven Carlin

The key value investing factors and beliefs in my opinion are:

1) A value investor is first and foremost a business owner.

2) Business earnings are the driver of investing returns.

3) Growth is an essential component of value.

4) Value investors look for the best growth, best earnings but always consider the margin of safety.

5) The margin of safety can be found in a low stock price compared to intrinsic value based on conservative business and economic estimations.

6) Business risk is to be avoided and patience is required to buy low risk businesses at a fair price.

7) Unlike most other investing philosophies, value investors look for low risk to achieve high returns. By focusing on minimizing the downside, what is left is only upside.

8) Intrinsic value is key - it is calculated by looking at what is the present value to you personally, of all the future cash flows a business will likely deliver from today to judgement day.

9) The lower the stock price is, below your intrinsic value calculation alongside a margin of safety with conservative calculations, the lower is the risk of investing. Consequently, as the stock price increases, the risk becomes higher.

10) Bottom line, it is all about comparing and finding the lowest risk, highest return opportunities for your portfolio that will lead you towards your financial goals with the highest possible level of certainty.

I think the above summarizes what Warren Buffett does and what Berkshire Hathaway is as an investment vehicle.

Is value investing dead?

I agree that if you look at price to book values, price to earnings ratios, or any other commonly regarded fixed value investing metric, then value investing is certainly dead.

But by looking at it that way, value investing has been dead since the early 1960s, since the net net, buying below net cash, Benjamin Graham investing style opportunities have slowly and surely disappeared as information became more and more available to large audiences.

Is value investing, in the modern form, something for you?

Whether value investing is dead or alive doesn't really matter. It might matter only to those superficial investors and content writers that look for clicks by trying to look smart through focusing on a few metrics that certainly don't work anymore as it was the case in the 1930s, for example.

As we discussed above, value investing is a mix of concepts. The key question you have to answer is whether value investing is something for you or not?

Value investing will always be regarded as a second-grade investing philosophy because within every period, there will always be something better than value investing, something that will make value investing look bad. Over the last 10 years, tech stocks made value investing look bad, during the 2000s highly leveraged real estate deals were the way to go, in the 1990s it was again internet stocks, LBOs in the 1980s, the nifty-fifty in the 1960s etc. The success of such trends makes it very attractive to follow them, but those invested in internet stocks in the 1990s know how such hot stocks carry also a high degree of risk. Risk is something value investing is on the opposite side of.

No matter what the hot trend at the moment is, by focusing on earnings, cash flows, margins of safety, risk, you'll do good over time and that is the key of value investing.

It is unlikely you will outperform the hot trend in the short to medium term due to the higher risk, and consequently higher reward hot stocks carry, but the key of value investing is that:

You'll do good for yourself over the long-term and mostly likely reach your realistic financial goals. That is what value investing is all about. Is it something for you?