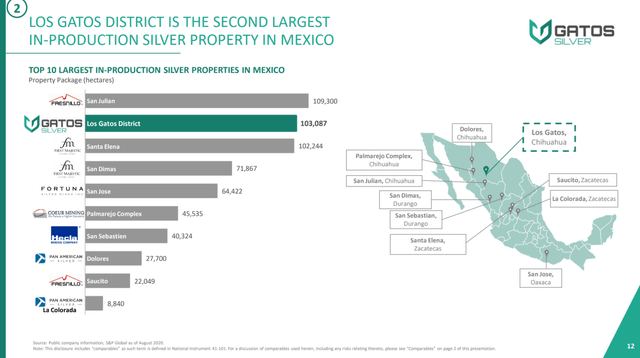

Gatos Silver Inc (NYSE:GATO) recently launched its IPO raising a total of $172.5 million at an offering price of $7.00 per share. The company with a current market cap of $405 million operates a mining facility and ore processing site in the Chihuahua region of Mexico. Its property with 103k hectares is recognized as the second-largest producing silver district in Mexico with a high ore grade and significant exploration potential.

With production already started and expected to ramp up going forward, the annual silver output growth through 2022 is expected to be among the highest in a peer group of major silver miners. We see Gatos Silver as an exciting new player among pure-play silver mining stocks, well-positioned to benefit from rising silver prices with overall solid fundamentals.

(Source: Company IR)

GATO Background

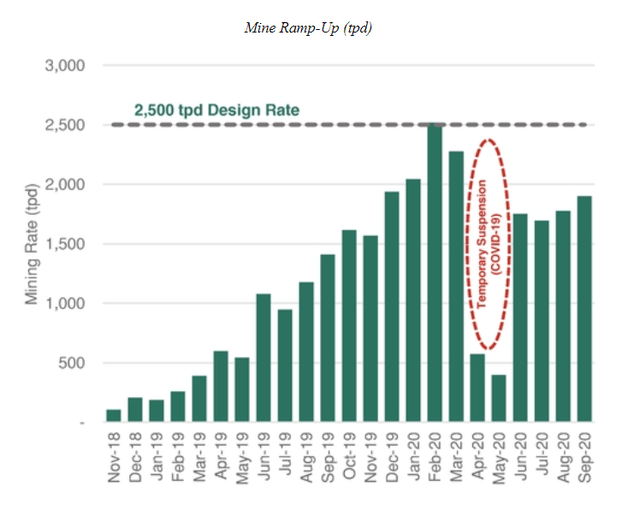

Gatos Silver is incorporated in the United States currently operating the 'Cerro Los Gatos Mine' with production having started in September 2019 capable of processing upwards of 2,500 tons per day "tpd." While the company reached that level of output in February of this year, the COVID-19 pandemic and temporary suspension of activities given government restrictions limited production in recent months. Nevertheless, the company expects to ramp back up to the design rate by Q1 2021.

(Source: S1 Filing)

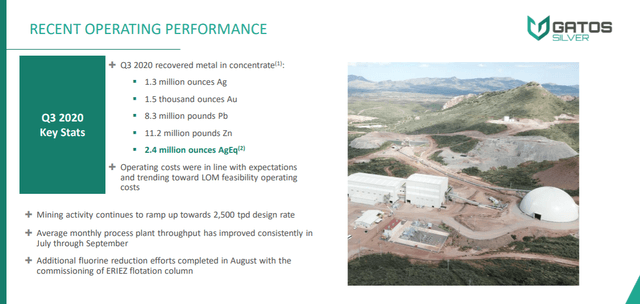

Favorably, the project is engineered to eventually expand capacity to 3,000 tpd and has already proven to generate strong recovery rates. Data for Q3 shows 164,510 tons were mined and 172,229 tons were processed with recovery average grades of 269 grams per ton for silver, 0.43 g/t gold, 2.51% lead, and 4.00% zinc. Overall, the entire operation recovered approximately 1.3 million ounces of silver, 1.5 thousand ounces of gold, 8.3 million pounds of lead, and 11.2 million pounds of zinc in the last quarter.

(Source: Company IR)

To

Add some conviction to your trading! We sort through +4,000 ETFs/CEFs along with +16,000 U.S. stocks/ADRs to find the best trade ideas. Click here for a two-week free trial and explore our content at the Conviction Dossier.