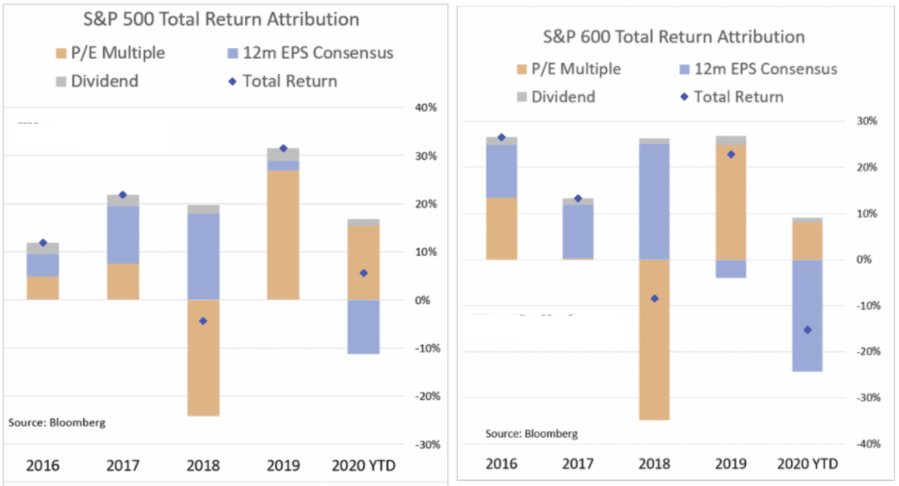

"The stock market is not the economy." Such has been the "Siren's Song" of investors over the last couple of years as valuation expansion has been the sole driver of the market's performance. However, given that corporations derive their revenue from economic activity, the "Buffett Indicator" suggests investors may be walking into a trap.

Read Part 1 For More On This Chart

Understanding The Buffett Indicator

Many investors are quick to dismiss any measure of "valuation." The reasoning is if there is not an immediate correlation, the indicator is wrong. As I discussed previously in "Shiller's CAPE - Is It Just B.S."

The problem is that valuation models are not, and were never meant to be, 'market timing indicators.' The vast majority of analysts assume that if a measure of valuation (P/E, P/S, P/B, etc.) reaches some specific level it means that:

- The market is about to crash, and;

- Investors should be in 100% cash.

Such is incorrect. Valuation measures are simply just that - a measure of current valuation. More, importantly, when valuations are excessive, it is a better measure of 'investor psychology' and a manifestation of the 'greater fool theory.'"

What valuations do provide is a reasonable estimate of long-term investment returns. It is logical that if you overpay for a stream of future cash flows today, your future return will be low.

"Price is what you pay. Value is what you get." - Warren Buffett

Such is what the Buffett Indicator tells us as it measures "Market Capitalization" to "GDP." To understand the relative importance of the measure, we must understand the economic cycle.

The premise is that in an economy driven roughly 70% by consumption, individuals must produce to have a paycheck to consume. That consumption is where corporations derive their revenues and ultimately profits