The funds from operations of EastGroup Properties, Inc. (NYSE: NYSE:EGP), an industrial real estate investment trust, continued to grow in the third quarter of 2020 because of the pandemic-driven e-commerce boom. The REIT reported funds from operations of $1.36 per share in the third quarter, up from $1.28 per share in the corresponding period last year. I’m expecting revenue growth to slow down next year because some of the gains in e-commerce will get eroded as the pandemic slowly becomes manageable. Further, new players will likely continue to enter the market because industrial real estate is far more lucrative than office or lodging real estate in the current environment. As a result, I’m expecting revenue growth to slow down to 6% in 2021, compared to average growth of 9% from 2016 to 2019. EGP is currently offering a low dividend yield of 2.2%, which makes the REIT unattractive; hence, I’m adopting a neutral rating on EGP.

Leasing Volume Likely to Lose Some Steam in the Second Half of 2021

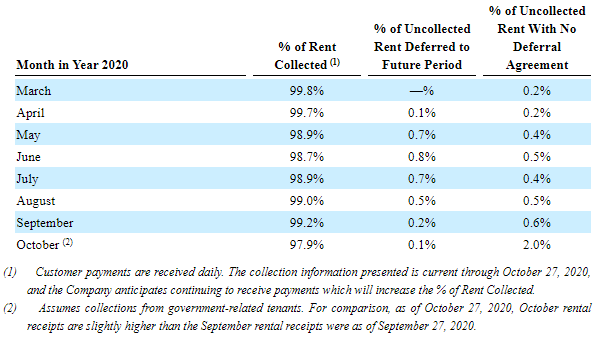

EGP’s revenue continued to grow in the third quarter as deferrals declined and rent collection improved. The management mentioned in the third quarter’s conference call that rent relief requests have largely subsided. The following table from the third quarter’s 10-Q filing shows the decline in deferrals since the start of the pandemic.

The revenue growth was driven by a boost in e-commerce and last-mile delivery trends amid the pandemic, as mentioned in the conference call. Due to the recent surge in COVID-19 cases, I’m expecting e-commerce business to remain elevated in the coming months before most of the population gets immunized to the pandemic. In fact, Adobe Analytics forecasts that online sales this November and December will jump by 33% year-over-year to $189 billion. Moreover, EGP is working on several new land sites and a