Housing stocks have been a bright spot in 2020, with most US builders' stocks outperforming the market. Some marquee names, such as D.R. Horton (DHI), are up over 40%, while the iShares Home Construction ETF (ITB) is up over 26%.

That's the good news. The bad news for income investors is that homebuilder stocks generally don't offer attractive dividend yields. The top 5 market cap names in the industry yield anywhere from 0% to 1.3%.

If you're looking for a backdoor higher yield alternative, you may want to consider CatchMark Timber Trust (CTT). It's a REIT which "seeks to deliver consistent and growing per share cash flow from disciplined acquisitions and superior management of prime timberlands located in high demand U.S. mill markets."

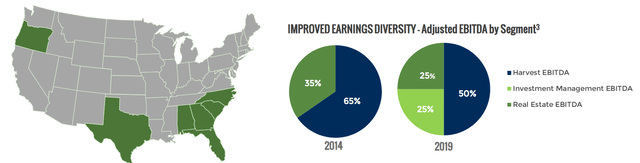

CTT owns timberlands in Texas, Oregon, and several southeastern states. Its biggest acreage is in Texas, where it owns a 22% interest in the Triple T JV that has over 1M acres. Management has diversified the company's earnings, via adding an investment management segment to its Harvest and Real Estate operations:

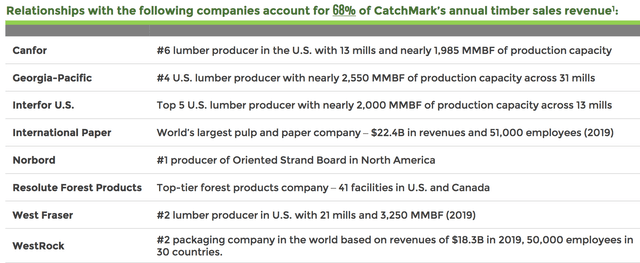

CTT's top customers include several major lumber companies and paper/packaging firms, comprising 68% of annual timber sales revenue:

Dividends:

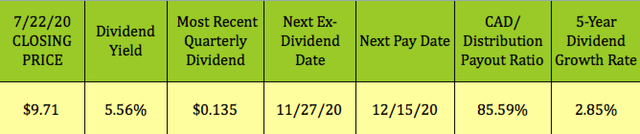

Although CTT's yield may not be as high as many of the high dividend stocks we've covered in our recent articles, it does have an attractive 5.55% dividend yield.

CTT goes ex-dividend in a Feb/May/Aug/Nov. schedule. Its next ex-dividend date is 11/27/20, with a pay date of 12/15/20. Management has maintained the quarterly payout at $.135 since Q2 2016, hence the low 2.85% dividend growth rate.

CTT's Cash Available for Distribution, CAD, payout ratio has averaged 85.59% over the past four quarters, which is higher than its 2014-2019 average of 76%. Management's chart points out that this is a more conservative payout ratio than CTT's main competitors.

CTT's Cash Available for Distribution, CAD, payout ratio has averaged 85.59% over the past four quarters, which is higher than its 2014-2019 average of 76%. Management's chart points out that this is a more conservative payout ratio than CTT's main competitors.

Our Marketplace service, Hidden Dividend Stocks Plus, focuses on undercovered, undervalued income vehicles, and special high yield situations.

We scour the US and world markets to find solid income opportunities with dividend yields ranging from 5% to 10%-plus, backed by strong earnings.

We publish exclusive articles each week with investing ideas for the HDS+ site that you won't see anywhere else.

We offer a range of income vehicles, many of which are selling below their buyout and redemption values. Our latest buyout success story has a 39% total return.