The reader is referred to a previous article regarding Global Self Storage (NASDAQ:SELF): "The Commendable Economic ROE Of Global Self Storage". As of, 6/30/2020, the NAV for SELF was estimated to be $7.16.

The NAV on 9/30/2020

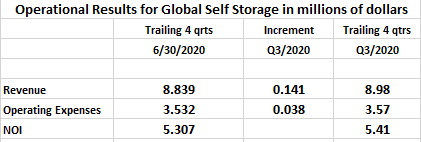

Following the same logic portrayed in the cited article above, please consider Exhibit One below.

Exhibit One

The first column provides the trailing four quarters for 6/30/2010, as registered in the article, while the increment column makes adjustments to arrive at the third column, the trailing four quarters as of 9/30/2020. The increment values are obtained from the latest Q3 report of SELF where we see a $141,000 increase in property-related revenues, along with a corresponding increase of $38,000 in operational costs. Of course, this implies an increase of $103,000 in trailing NOI during Q3.

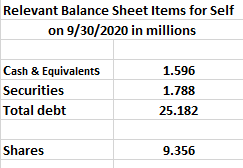

From the same information, we arrive at relevant balance sheet information at the end of Q3, as given by Exhibit Two.

Exhibit Two

A review of prevailing market conditions at the end of Q3 indicates that neither the basic term structure of interest rates changed appreciably, nor did the apparent spreads for the cap rates applicable to self-storage facilities with similar quality REIT characteristics. This is borne out by examining comparable asking-price cap rates for a sample of properties listed as of the two dates. So, a consistent market cap rate of 6% is reasonable.

With the 6% cap rate, the implied intrinsic market value of the properties (as they are being operated) will be 5.41/0.06 = $90.17 million. Adding back both the cash and securities while subtracting out the debt produces a net market value for SELF (NAV) of $68.37 million. Given the 9.356 million shares outstanding, we see a NAV of $7.31 per share on 9/30/2020.

For conservatism, restricted cash, accounts receivable and prepaid expenses are excluded from