The four hardest-hit sectors in March when COVID-19 roiled markets were Energy, Consumer Discretionary, Financials, and Industrials. These four sectors are generally considered the most cyclically sensitive sectors within the S&P 500. It makes sense why their valuations plummeted when economic activity was by decree or, as a result of consumer behavior, severely curtailed. Many of the industrials faced particularly difficult problems as demand collapsed, or its future at least became far more opaque. They had to cut operating leverage and costs very significantly to be able to survive. We think these companies will be well-positioned to achieve pre-crisis earnings before they meet pre-crisis revenue and will thus beat consensus estimates.

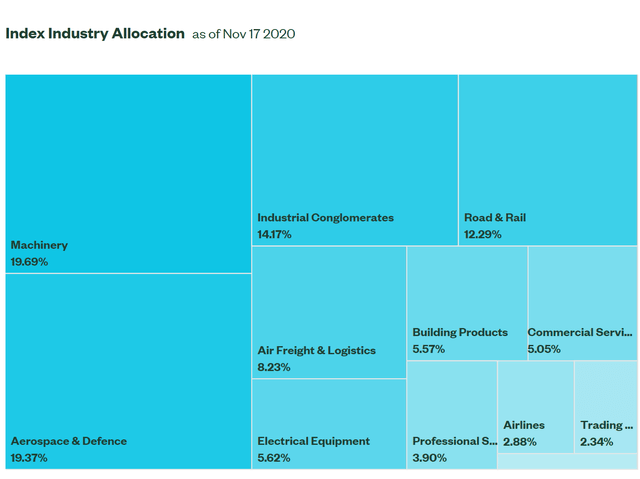

Source: SSGA.com

Industrials To Benefit From Vaccine Distribution

Many investors may get the wrong idea when they think of the Industrial Sector. While some stalwart members of the old-world economy are present in this index, there are also a lot of very dynamic companies who will likely benefit from the distribution of the vaccine. You have airlines, rails, and other industrial firms whose capabilities will be necessary to implement the massive logistical challenge of effective distribution. Particularly since the Pfizer (PFE) vaccine at least will be required to be stored at extremely low temperatures and is thus very energy-intensive. The fact is you aren't going to Apple (AAPL) or Google (GOOG) (GOOGL) to try to get these vaccines distributed to billions of people; you're going to UPS (UPS), GE (GE), United Airlines (UAL), and CSX (CSX).

Source: Fundstrat

How Has XLI Been Doing Lately? What Is It Comprised Of?

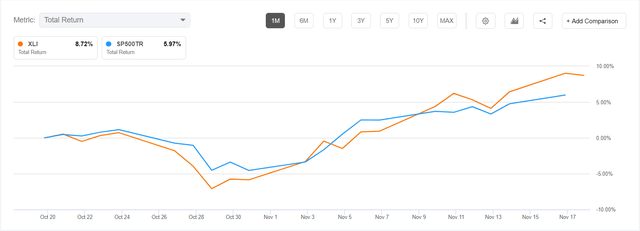

Source: Seeking Alpha

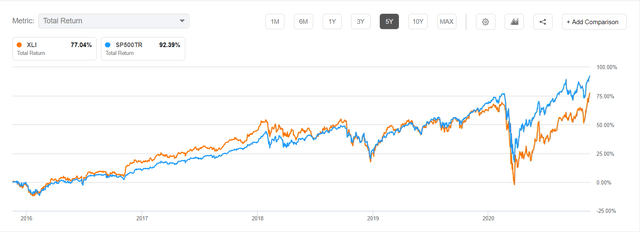

As you can see, the momentum is changing based on 10 years of underperformance for Industrial Select Sector SPDR ETF (NYSEARCA:XLI). Over the one month and six-month time periods, you can see XLI has outperformed. We think