Beware The Siren Song Of Income

One of the most popular articles on Seeking Alpha this past weekend had a simple but powerful premise: It's better to hold assets that produce income than to sell them off bit by bit to fund your retirement. Let me state upfront that I agree with that philosophy 100%. Judging by the 150 likes and 588 comments (mostly positive) in the 48 hours following publication, it is clear many readers agree as well.

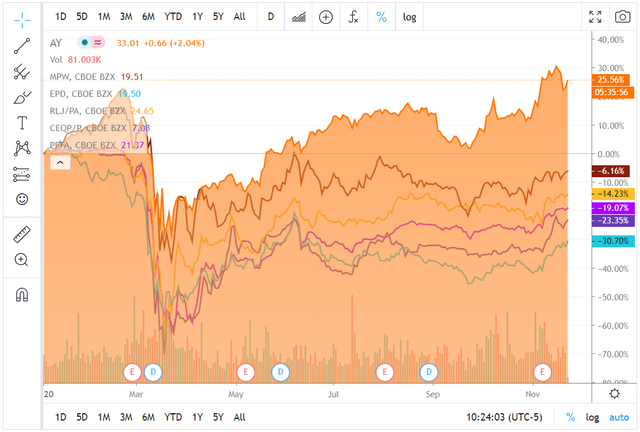

Where my thinking diverges from the author of the other article is in how to put this concept into practice. He presented a sample portfolio of just six securities - two preferred stocks, one preferred stock fund, two MLPs, and a REIT. With this portfolio, the author suggests the investor can "sit back and relax", collect an average yield of 8.1%, and not have to sell any principal to fund living expenses. I have no quibbles with the security selection. I even own one of the preferreds myself (RLJ.PA). I also own other preferreds, MLPs and a high-yielding closed-end fund. What I do have an issue with is the idea that these six securities can make up a complete or balanced portfolio. The preferreds have great yields, but zero chance of a distribution increase and minimal potential for capital appreciation. MLPs and REITs need to be selected carefully. Many cut their distributions during the pandemic, although the ones the author suggested did not. Also, while the income has been secure, can many investors really "sit back and relax" if five of the six securities' prices are down between 6% and 31% this year?

Source: Seeking Alpha Chart Page

High-yielding investments can have a place in everyone's portfolio, but adding some secular growth stocks can provide balance in a volatile year like 2020. They